As the tax filing season approaches, individuals who have taken coronavirus-related distributions from their retirement accounts may need to file Form 8915-F with the IRS. This form is used to report the tax implications of these distributions and to claim any tax relief that may be available. If you're using TurboTax to prepare your tax return, you'll be happy to know that filing Form 8915-F is a relatively straightforward process. In this article, we'll walk you through the 5 easy steps to file Form 8915-F with TurboTax.

What is Form 8915-F?

Before we dive into the steps, let's take a brief look at what Form 8915-F is and why you might need to file it. Form 8915-F is a tax form used to report qualified 2020 disaster retirement plan distributions and repayments. If you took a coronavirus-related distribution from your retirement account in 2020, you'll need to file this form to report the distribution and claim any tax relief that may be available.

Step 1: Gather Your Information

Before you start filing Form 8915-F with TurboTax, make sure you have all the necessary information. You'll need to gather the following documents:

- Your 1099-R forms, which show the amount of the coronavirus-related distribution

- Your W-2 forms, which show your income for the year

- Your tax return from the previous year, if applicable

- Any repayment records, if you've repaid some or all of the distribution

Step 2: Log In to Your TurboTax Account

Once you have all the necessary information, log in to your TurboTax account. If you don't have an account, you can create one easily. Make sure you have the correct version of TurboTax, as Form 8915-F is only available in TurboTax Deluxe, Premier, and Self-Employed.

Step 3: Select the Correct Form

After logging in, select the "Start a New Return" option. TurboTax will guide you through a series of questions to determine which forms you need to file. Make sure to select the option for Form 8915-F.

Step 4: Enter Your Information

Once you've selected the correct form, TurboTax will prompt you to enter your information. You'll need to enter the following details:

- The amount of the coronavirus-related distribution

- The date of the distribution

- Any repayment amounts

- Any interest or penalties owed

TurboTax will guide you through each step, making it easy to enter your information.

Step 5: Review and Submit Your Return

After you've entered all the necessary information, review your return carefully. Make sure everything is accurate and complete. If you're satisfied with your return, submit it to the IRS.

What to Expect After Submitting Your Return

After submitting your return, you can expect to receive a confirmation from the IRS. If you're eligible for a refund, you can expect to receive it within a few weeks. If you owe taxes, you'll receive a bill from the IRS.

Frequently Asked Questions

Do I need to file Form 8915-F if I took a coronavirus-related distribution in 2020?

+Yes, if you took a coronavirus-related distribution from your retirement account in 2020, you'll need to file Form 8915-F to report the distribution and claim any tax relief that may be available.

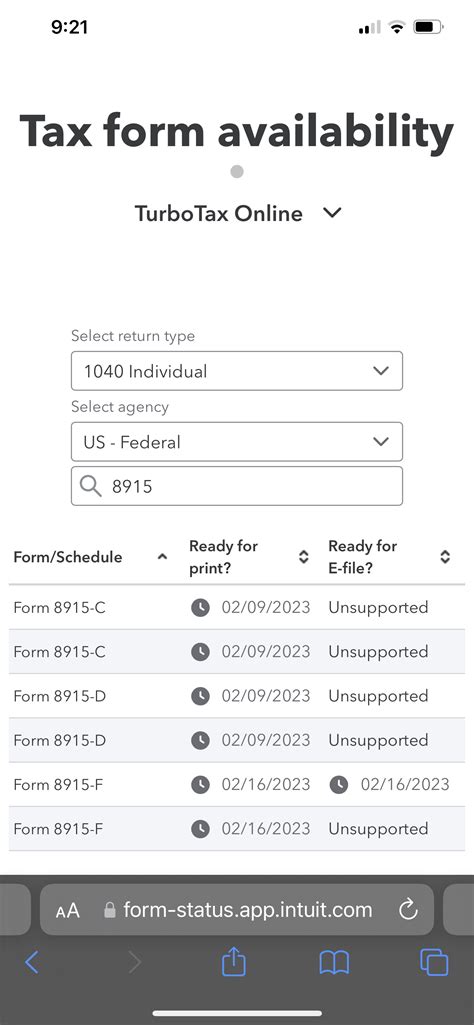

Can I file Form 8915-F electronically with TurboTax?

+Yes, you can file Form 8915-F electronically with TurboTax. In fact, e-filing is the recommended method, as it's faster and more accurate than paper filing.

What if I need help filing Form 8915-F with TurboTax?

+If you need help filing Form 8915-F with TurboTax, you can contact TurboTax support for assistance. They offer a range of support options, including phone, email, and live chat.

We hope this article has been helpful in guiding you through the process of filing Form 8915-F with TurboTax. Remember to take your time and ensure that all the information is accurate and complete. If you have any questions or need further assistance, don't hesitate to contact TurboTax support.