Tax season can be a daunting time for many students and families, especially when it comes to navigating the complex world of tax forms and credits. One of the most important forms for students to fill out is Form 8863, also known as the Education Credits (American Opportunity and Lifetime Learning Credits) form. This form allows eligible students to claim education credits, which can significantly reduce their tax liability.

In this article, we will break down the essential steps to fill out Form 8863, providing you with a clear understanding of the process and the information you need to provide.

Understanding Form 8863

Before we dive into the steps, let's quickly review what Form 8863 is and why it's important. Form 8863 is used to claim two types of education credits: the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC). These credits can help offset the costs of higher education expenses, such as tuition and fees.

The AOTC is a refundable credit worth up to $2,500 per eligible student, while the LLC is a non-refundable credit worth up to $2,000 per tax return. To qualify for these credits, students must meet specific eligibility requirements, such as being enrolled in a degree program and having a valid Form 1098-T.

Step 1: Gather Required Documents

Before filling out Form 8863, you'll need to gather several important documents. These include:

- Form 1098-T, which shows the amount of qualified tuition and related expenses paid to an eligible educational institution

- Form 1099-INT, which shows interest earned on savings accounts and other investments

- A copy of your transcript or enrollment verification

- Records of any scholarships, grants, or other forms of financial aid

Step 2: Determine Eligibility

To qualify for the education credits, you must meet specific eligibility requirements. These include:

- Being enrolled in a degree program at an eligible educational institution

- Having a valid Form 1098-T

- Not being claimed as a dependent on someone else's tax return

- Not having been convicted of a felony

You'll also need to determine which credit you're eligible for: the AOTC or the LLC. The AOTC is generally more beneficial, but it has stricter eligibility requirements.

Step 3: Calculate Qualified Education Expenses

To calculate your qualified education expenses, you'll need to add up the amounts shown on Form 1098-T. This includes:

- Tuition and fees

- Course materials and equipment

- Other related expenses

You'll also need to subtract any scholarships, grants, or other forms of financial aid from your total expenses.

Step 4: Complete Form 8863

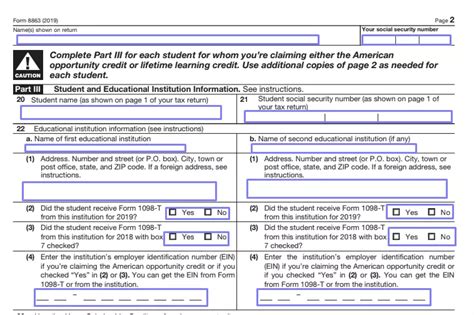

Now it's time to fill out Form 8863. You'll need to provide information about your student status, the educational institution you attended, and your qualified education expenses.

The form is divided into several parts, including:

- Part I: Student's Information

- Part II: Educational Institution's Information

- Part III: Qualified Education Expenses

- Part IV: Credits

Make sure to read the instructions carefully and fill out each section accurately.

Step 5: Attach Form 8863 to Your Tax Return

Once you've completed Form 8863, attach it to your tax return (Form 1040 or Form 1040A). Make sure to sign and date the form, and keep a copy for your records.

Tips and Reminders:

- Make sure to file Form 8863 by the tax filing deadline to avoid penalties and interest.

- If you're eligible for the AOTC, you may be able to claim a refund even if you don't owe taxes.

- Keep accurate records of your qualified education expenses and Form 1098-T, as you may need to provide these documents if you're audited.

By following these essential steps, you can successfully fill out Form 8863 and claim the education credits you're eligible for.

What is Form 8863 used for?

+Form 8863 is used to claim education credits, including the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC).

What documents do I need to fill out Form 8863?

+You'll need Form 1098-T, Form 1099-INT, a copy of your transcript or enrollment verification, and records of any scholarships, grants, or other forms of financial aid.

How do I determine which credit I'm eligible for?

+You'll need to review the eligibility requirements for the AOTC and LLC, including being enrolled in a degree program, having a valid Form 1098-T, and not being claimed as a dependent on someone else's tax return.

We hope this article has provided you with a clear understanding of how to fill out Form 8863 and claim the education credits you're eligible for. If you have any further questions or concerns, please don't hesitate to reach out.