The state of New Jersey requires its residents to file a state income tax return each year, and the most common form used for this purpose is the NJ-1040. This form is used to report an individual's income, claim deductions and credits, and calculate the amount of state income tax owed or refund due. In this comprehensive guide, we will walk you through the process of filling out the NJ-1040 form, including the different sections, required documents, and deadlines.

Understanding the NJ-1040 Form

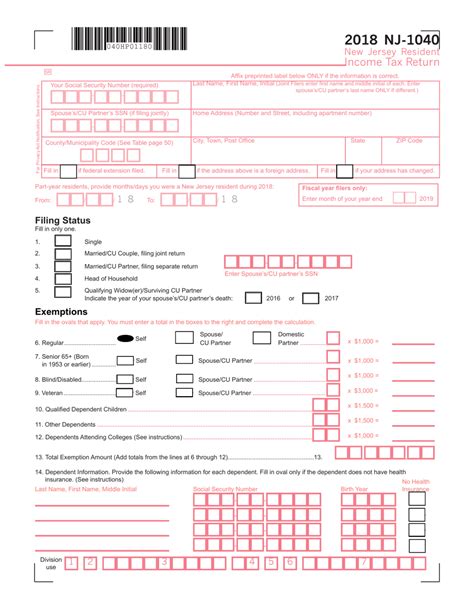

The NJ-1040 form is a self-reporting form that requires individuals to provide detailed information about their income, deductions, and credits. The form is divided into several sections, each with its own set of instructions and requirements. The main sections of the NJ-1040 form include:

- Identification and Residency Information

- Income

- Deductions and Exemptions

- Credits

- Tax Computation

- Payments and Refunds

Who Needs to File an NJ-1040 Form?

Not everyone who lives in New Jersey is required to file an NJ-1040 form. The following individuals are required to file a state income tax return:

- Residents with gross income exceeding $10,000 ($20,000 for joint filers)

- Residents with net profits from self-employment exceeding $3,000

- Residents who received a distribution from a pension or retirement plan

- Residents who have New Jersey income tax withheld

Gathering Required Documents

Before starting to fill out the NJ-1040 form, it's essential to gather all the required documents. These include:

- W-2 forms from employers

- 1099 forms for self-employment income, dividends, and interest

- Forms 1098 for mortgage interest and property taxes

- Charitable donation receipts

- Medical expense receipts

- Business expense records

Filing Status and Residency

The NJ-1040 form requires individuals to indicate their filing status and residency status. The filing status options include single, married filing jointly, married filing separately, head of household, and qualifying widow(er). The residency status options include full-year resident, part-year resident, and non-resident.

Income Reporting

The NJ-1040 form requires individuals to report all their income from various sources, including:

- Wages and salaries

- Self-employment income

- Dividends and interest

- Capital gains and losses

- Rental income

Deductions and Exemptions

The NJ-1040 form allows individuals to claim various deductions and exemptions, including:

- Standard deduction

- Itemized deductions (e.g., mortgage interest, property taxes, charitable donations)

- Personal exemptions

- Dependent exemptions

Credits

The NJ-1040 form also allows individuals to claim various credits, including:

- Earned Income Tax Credit (EITC)

- Child Tax Credit

- Education Credits

- Retirement Savings Contributions Credit

Tax Computation

The NJ-1040 form requires individuals to calculate their state income tax liability using the tax computation section. This section involves calculating the total tax liability, subtracting credits and deductions, and determining the amount of tax owed or refund due.

Payments and Refunds

The NJ-1040 form requires individuals to indicate whether they are making a payment or claiming a refund. If a payment is due, individuals can make an online payment or send a check with the return. If a refund is due, individuals can choose to receive a direct deposit or a paper check.

Deadline for Filing

The deadline for filing the NJ-1040 form is typically April 15th of each year. However, if the 15th falls on a weekend or holiday, the deadline is extended to the next business day. Individuals who need an extension can file Form NJ-630 to request a six-month extension.

Electronic Filing

The state of New Jersey encourages individuals to file their NJ-1040 form electronically. Electronic filing is faster, more accurate, and more convenient than paper filing. Individuals can use the New Jersey Division of Taxation's website to file their return electronically.

Conclusion

Filing the NJ-1040 form can be a complex process, but with this guide, individuals should be able to navigate the process with ease. Remember to gather all required documents, report all income, claim deductions and credits, and calculate tax liability accurately. If you need help or have questions, consider consulting a tax professional or contacting the New Jersey Division of Taxation.

Additional Resources

For more information on the NJ-1040 form and New Jersey state income tax, visit the New Jersey Division of Taxation's website. You can also contact their customer service department for assistance with filing your return.

What's Next?

If you found this guide helpful, please share it with others who may need assistance with filing their NJ-1040 form. Don't forget to comment below with any questions or concerns you may have. We'll do our best to respond promptly.

What is the deadline for filing the NJ-1040 form?

+The deadline for filing the NJ-1040 form is typically April 15th of each year. However, if the 15th falls on a weekend or holiday, the deadline is extended to the next business day.

Can I file my NJ-1040 form electronically?

+Yes, the state of New Jersey encourages individuals to file their NJ-1040 form electronically. Electronic filing is faster, more accurate, and more convenient than paper filing.

What documents do I need to file my NJ-1040 form?

+You will need to gather all required documents, including W-2 forms, 1099 forms, Forms 1098, charitable donation receipts, medical expense receipts, and business expense records.