As a taxpayer, it's essential to stay on top of your tax obligations, especially if you're involved in foreign transactions. One crucial form that might be relevant to your situation is the Form 8858 Schedule M. In this article, we'll delve into the details of this form, exploring its purpose, requirements, and the benefits of accurate completion.

What is Form 8858 Schedule M?

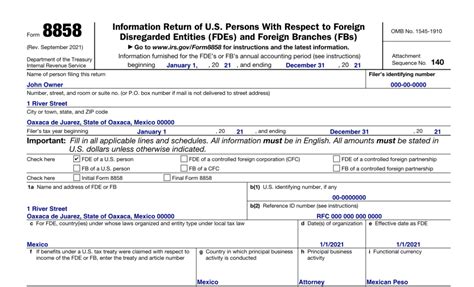

Form 8858 Schedule M is a part of the Form 8858, also known as the Information Return of U.S. Persons with Respect to Foreign Disregarded Entities (FDEs) and Foreign Branches (FBs). The schedule is used to report transactions between a U.S. person and a foreign disregarded entity or foreign branch. These transactions can include purchases, sales, or other exchanges of goods or services.

Who Needs to File Form 8858 Schedule M?

U.S. persons, including individuals, corporations, and partnerships, may need to file Form 8858 Schedule M if they have a foreign disregarded entity or foreign branch. This includes situations where:

- A U.S. person owns a foreign disregarded entity or foreign branch.

- A U.S. person has a transaction with a foreign disregarded entity or foreign branch.

What Information is Required on Form 8858 Schedule M?

Form 8858 Schedule M requires detailed information about the transactions between the U.S. person and the foreign disregarded entity or foreign branch. This includes:

- The name, address, and employer identification number (EIN) of the U.S. person.

- The name, address, and EIN of the foreign disregarded entity or foreign branch.

- A description of the transactions, including the type of goods or services exchanged.

- The value of the transactions in U.S. dollars.

Benefits of Accurate Completion

Accurate completion of Form 8858 Schedule M is crucial for several reasons:

- Compliance with tax laws: Filing Form 8858 Schedule M helps ensure compliance with U.S. tax laws, reducing the risk of penalties and fines.

- Transparency: The form provides transparency into transactions between U.S. persons and foreign disregarded entities or foreign branches, helping to prevent tax evasion and money laundering.

- Record-keeping: Completing the form helps maintain accurate records of transactions, making it easier to track and report income.

How to Complete Form 8858 Schedule M

To complete Form 8858 Schedule M, follow these steps:

- Gather necessary information: Collect the required information, including the names, addresses, and EINs of the U.S. person and the foreign disregarded entity or foreign branch.

- Identify transactions: Determine which transactions need to be reported on the form.

- Complete the form: Fill out the form accurately, using the information gathered in steps 1 and 2.

- Review and sign: Review the form carefully, and sign it to certify its accuracy.

Common Mistakes to Avoid

When completing Form 8858 Schedule M, avoid these common mistakes:

- Inaccurate or incomplete information

- Failure to report all required transactions

- Incorrect calculations or valuations

- Late filing or failure to file

Penalties for Non-Compliance

Failure to file Form 8858 Schedule M or providing inaccurate information can result in penalties, including:

- Fines: Up to $10,000 per failure to file

- Interest: On unpaid taxes and penalties

- Criminal prosecution: In severe cases, non-compliance can lead to criminal charges

Seek Professional Help

Given the complexity of Form 8858 Schedule M and the potential penalties for non-compliance, it's essential to seek professional help from a qualified tax expert. They can guide you through the process, ensuring accurate completion and minimizing the risk of errors.

Conclusion

Form 8858 Schedule M is a critical component of tax compliance for U.S. persons involved in foreign transactions. By understanding the requirements, benefits, and potential penalties, you can ensure accurate completion and minimize the risk of errors. If you're unsure about any aspect of the form, don't hesitate to seek professional help.

We hope this article has provided valuable insights into Form 8858 Schedule M. If you have any further questions or concerns, please feel free to comment below. Share this article with others who may benefit from this information, and don't forget to follow us for more informative content.

Who needs to file Form 8858 Schedule M?

+U.S. persons, including individuals, corporations, and partnerships, may need to file Form 8858 Schedule M if they have a foreign disregarded entity or foreign branch.

What information is required on Form 8858 Schedule M?

+The form requires detailed information about the transactions between the U.S. person and the foreign disregarded entity or foreign branch, including the names, addresses, and EINs of the parties involved, as well as a description of the transactions and their value in U.S. dollars.

What are the penalties for non-compliance?

+Failure to file Form 8858 Schedule M or providing inaccurate information can result in penalties, including fines of up to $10,000 per failure to file, interest on unpaid taxes and penalties, and potential criminal prosecution.