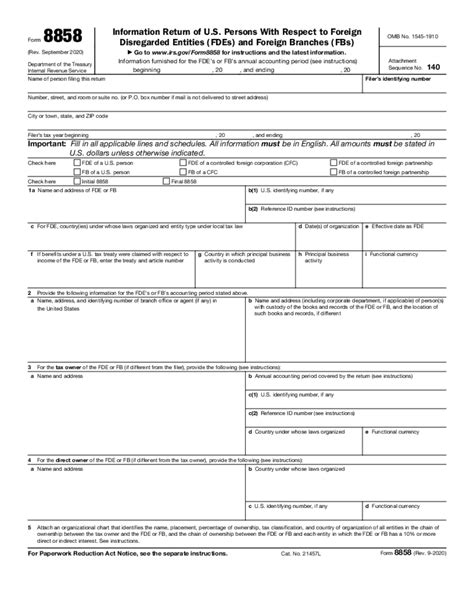

As a US taxpayer with foreign investments or business interests, you may be required to file Form 8858, also known as the Information Return of U.S. Persons with Respect to Foreign Disregarded Entities (FDEs) and Foreign Base Company (FBC) Income. This form is used to report certain foreign business activities and income, and to calculate any potential tax liabilities.

Why File Form 8858?

The IRS requires US taxpayers to file Form 8858 if they have an interest in a foreign disregarded entity (FDE) or foreign base company (FBC). FDEs are foreign entities that are disregarded for US tax purposes, meaning they are not treated as separate entities from their owners. FBCs, on the other hand, are foreign corporations that are treated as controlled foreign corporations (CFCs) under US tax law.

Failure to file Form 8858 can result in significant penalties and fines. The IRS may impose a penalty of up to $10,000 for each year the form is not filed, plus interest and any applicable additional penalties.

Who Needs to File Form 8858?

The following US taxpayers are required to file Form 8858:

- US citizens or residents who have an interest in a foreign disregarded entity (FDE)

- US citizens or residents who are shareholders of a foreign base company (FBC)

- US citizens or residents who have control over a foreign corporation that is treated as a CFC

- US corporations that have an interest in a foreign disregarded entity (FDE)

- US corporations that are shareholders of a foreign base company (FBC)

What Constitutes an Interest in a Foreign Disregarded Entity?

An interest in a foreign disregarded entity includes:

- Ownership of at least 10% of the entity's assets or profits

- Control over the entity's operations or management

- Any other interest in the entity that is treated as a disregarded entity for US tax purposes

What Constitutes a Foreign Base Company?

A foreign base company is a foreign corporation that is treated as a CFC under US tax law. This includes:

- Foreign corporations that are controlled by US shareholders

- Foreign corporations that are treated as CFCs under Section 957(a) of the Internal Revenue Code

How to File Form 8858

To file Form 8858, follow these steps:

- Obtain the necessary forms and schedules: You will need to complete Form 8858, as well as any required schedules, such as Schedule M, which reports the income and expenses of the foreign disregarded entity.

- Gather required information: You will need to gather information about the foreign disregarded entity, including its name, address, and taxpayer identification number, as well as information about its income and expenses.

- Complete Form 8858: Follow the instructions for completing Form 8858, which include reporting the income and expenses of the foreign disregarded entity, as well as any other required information.

- File the form with the IRS: File Form 8858 with the IRS by the required deadline, which is typically the 15th day of the 4th month after the end of the tax year.

- Attach required schedules: Attach any required schedules, such as Schedule M, to Form 8858.

Penalties for Failure to File Form 8858

Failure to file Form 8858 can result in significant penalties and fines. The IRS may impose a penalty of up to $10,000 for each year the form is not filed, plus interest and any applicable additional penalties.

Conclusion

In conclusion, filing Form 8858 is a critical requirement for US taxpayers with foreign investments or business interests. Failure to file the form can result in significant penalties and fines. By following the steps outlined above, you can ensure that you are in compliance with the IRS requirements and avoid any potential penalties.

Additional Resources

For additional information and resources on filing Form 8858, including instructions, forms, and schedules, visit the IRS website at irs.gov.

We hope this article has been helpful in providing guidance on filing Form 8858. If you have any questions or need further assistance, please don't hesitate to comment below or reach out to a qualified tax professional.

What is Form 8858?

+Form 8858 is the Information Return of U.S. Persons with Respect to Foreign Disregarded Entities (FDEs) and Foreign Base Company (FBC) Income. It is used to report certain foreign business activities and income, and to calculate any potential tax liabilities.

Who needs to file Form 8858?

+US taxpayers who have an interest in a foreign disregarded entity (FDE) or foreign base company (FBC) are required to file Form 8858. This includes US citizens or residents who have control over a foreign corporation that is treated as a CFC.

What is the penalty for failure to file Form 8858?

+The IRS may impose a penalty of up to $10,000 for each year the form is not filed, plus interest and any applicable additional penalties.