The IRS Form 4506-C is a crucial document for individuals and businesses seeking to verify their income and employment history with the Internal Revenue Service (IRS). In this comprehensive guide, we will delve into the world of Form 4506-C, exploring its purpose, benefits, and step-by-step instructions for completing and submitting it.

What is IRS Form 4506-C?

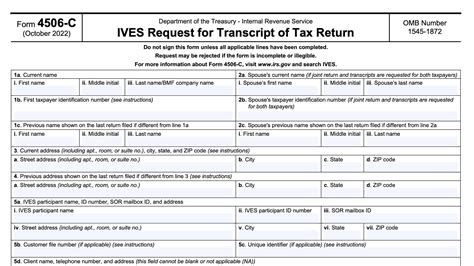

IRS Form 4506-C, also known as the IVES Request for Transcript of Tax Return, is a form used to request a transcript of tax return information from the IRS. This form is typically used by lenders, creditors, and other authorized third parties to verify an individual's or business's income and employment history.

Purpose of Form 4506-C

The primary purpose of Form 4506-C is to provide a secure and efficient way for authorized third parties to obtain tax return transcripts from the IRS. This form is designed to help lenders and creditors verify the income and employment history of individuals and businesses, which is essential for making informed lending decisions.

Benefits of Using Form 4506-C

There are several benefits to using Form 4506-C, including:

- Secure and Efficient: Form 4506-C provides a secure and efficient way for authorized third parties to obtain tax return transcripts from the IRS.

- Accurate Verification: The form helps lenders and creditors verify the income and employment history of individuals and businesses, reducing the risk of errors or misrepresentation.

- Compliance with Regulations: Using Form 4506-C helps lenders and creditors comply with regulatory requirements, such as the Fair Credit Reporting Act (FCRA).

Who Can Use Form 4506-C?

Form 4506-C can be used by the following individuals and entities:

- Lenders: Banks, credit unions, and other financial institutions can use Form 4506-C to verify the income and employment history of borrowers.

- Creditors: Credit card companies, collection agencies, and other creditors can use the form to verify the income and employment history of debtors.

- Employers: Employers can use Form 4506-C to verify the employment history of job applicants or current employees.

- Government Agencies: Government agencies, such as the Social Security Administration, can use the form to verify the income and employment history of individuals applying for benefits.

How to Complete Form 4506-C

To complete Form 4506-C, follow these steps:

- Download the Form: Download Form 4506-C from the IRS website or obtain a copy from the IRS.

- Complete the Form: Complete the form by providing the required information, including the individual's or business's name, Social Security number or Employer Identification Number (EIN), and the tax year(s) for which the transcript is being requested.

- Sign the Form: Sign the form as the authorized representative of the individual or business.

- Submit the Form: Submit the completed form to the IRS by mail or fax.

Where to Submit Form 4506-C

Form 4506-C can be submitted to the IRS by mail or fax. The mailing address and fax number are as follows:

- Mailing Address: Internal Revenue Service, 1111 Constitution Ave NW, Washington, DC 20224

- Fax Number: (855) 214-2223

Processing Time for Form 4506-C

The processing time for Form 4506-C typically takes 10-15 business days from the date the IRS receives the completed form.

Common Errors to Avoid When Completing Form 4506-C

To avoid delays or rejection of Form 4506-C, make sure to avoid the following common errors:

- Inaccurate or incomplete information: Ensure that all information provided is accurate and complete.

- Missing signature: Make sure to sign the form as the authorized representative of the individual or business.

- Incorrect tax year: Ensure that the correct tax year(s) is/are requested.

Conclusion

IRS Form 4506-C is an essential document for verifying income and employment history with the IRS. By understanding the purpose, benefits, and step-by-step instructions for completing and submitting the form, individuals and businesses can ensure a smooth and efficient process. Remember to avoid common errors and submit the form correctly to avoid delays or rejection.

What is the purpose of Form 4506-C?

+The primary purpose of Form 4506-C is to provide a secure and efficient way for authorized third parties to obtain tax return transcripts from the IRS.

Who can use Form 4506-C?

+Lenders, creditors, employers, and government agencies can use Form 4506-C to verify the income and employment history of individuals and businesses.

How long does it take to process Form 4506-C?

+The processing time for Form 4506-C typically takes 10-15 business days from the date the IRS receives the completed form.

We hope this comprehensive guide has helped you understand the importance of IRS Form 4506-C and how to complete and submit it correctly. If you have any further questions or concerns, please don't hesitate to reach out to us.