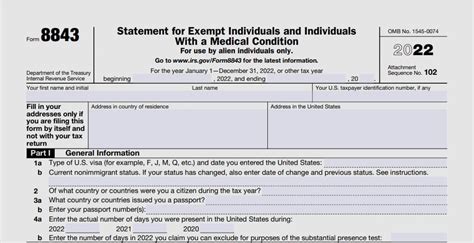

As a non-resident alien in the United States, you're likely familiar with the complexities of navigating the U.S. tax system. One crucial form that can be particularly daunting is Form 8843, also known as the Statement for Exempt Individuals and Individuals with a Medical Condition. In this article, we'll break down the 7 essential steps to master Form 8843, ensuring you're well-equipped to handle this critical tax requirement.

Understanding the Purpose of Form 8843

Form 8843 is a critical tax document for non-resident aliens, including students, scholars, and individuals with a medical condition. The primary purpose of this form is to:

- Certify your exempt individual status

- Report your exemption from the substantial presence test

- Claim an exemption from counting days present in the United States for tax purposes

Who Needs to File Form 8843?

You'll need to file Form 8843 if you're a non-resident alien who meets one of the following conditions:

- You're a student or scholar with an F, J, M, or Q visa

- You're an individual with a medical condition

- You're a teacher or trainee with a J visa

- You're a cultural exchange visitor with a Q visa

Step 1: Determine Your Eligibility

Before diving into the form, it's essential to determine whether you're eligible to file Form 8843. Review the conditions mentioned above and assess your individual situation. If you're unsure, consult with a tax professional or seek guidance from the IRS.

Step 2: Gather Required Documents

To accurately complete Form 8843, you'll need to gather specific documents, including:

- Your passport

- Visa documentation (F, J, M, or Q visa)

- I-20 or DS-2019 form (for students and scholars)

- Proof of medical condition (if applicable)

- Records of your U.S. arrival and departure dates

Why Are These Documents Important?

These documents are crucial in establishing your eligibility for exempt individual status and supporting your claim for an exemption from the substantial presence test.

Step 3: Understand the Substantial Presence Test

The substantial presence test is a critical component of Form 8843. To meet this test, you must be present in the United States for at least 183 days in the current year or 31 days in the current year and 183 days in the aggregate over the prior 3 years.

How Does the Substantial Presence Test Affect Me?

If you fail the substantial presence test, you'll be considered a resident alien for tax purposes, which can significantly impact your tax obligations.

Step 4: Complete Form 8843

With your documents in hand, you're ready to complete Form 8843. Be sure to:

- Fill out the form accurately and completely

- Report your U.S. arrival and departure dates

- Claim your exemption from the substantial presence test

- Sign and date the form

Common Mistakes to Avoid

When completing Form 8843, be mindful of common mistakes, such as:

- Failing to report all U.S. presence days

- Incorrectly calculating the substantial presence test

- Not signing or dating the form

Step 5: Attach Supporting Documentation

In addition to Form 8843, you'll need to attach supporting documentation, including:

- A copy of your visa documentation

- A copy of your I-20 or DS-2019 form (if applicable)

- Proof of your medical condition (if applicable)

Why Is Supporting Documentation Important?

Supporting documentation is essential in establishing your eligibility for exempt individual status and supporting your claim for an exemption from the substantial presence test.

Step 6: File Form 8843 with the IRS

Once you've completed Form 8843 and attached the required supporting documentation, you're ready to file with the IRS. You can file by mail or electronically through the IRS e-file system.

What's the Deadline for Filing Form 8843?

The deadline for filing Form 8843 is typically April 15th of each year. However, if you're filing an extension, you may have until October 15th.

Step 7: Maintain Accurate Records

After filing Form 8843, it's essential to maintain accurate records, including:

- A copy of your completed Form 8843

- Supporting documentation

- Records of your U.S. presence days

Why Is Record-Keeping Important?

Maintaining accurate records will help you:

- Support your exempt individual status

- Track your U.S. presence days

- Ensure compliance with IRS regulations

By following these 7 essential steps, you'll be well-equipped to master Form 8843 and navigate the complexities of the U.S. tax system as a non-resident alien.

We hope this article has been informative and helpful. If you have any questions or concerns, please don't hesitate to comment below or share this article with others who may benefit from this information.

What is the purpose of Form 8843?

+Form 8843 is used to certify exempt individual status and report exemption from the substantial presence test.

Who needs to file Form 8843?

+Non-resident aliens, including students, scholars, and individuals with a medical condition, need to file Form 8843.

What is the substantial presence test?

+The substantial presence test is a critical component of Form 8843, requiring you to be present in the United States for at least 183 days in the current year or 31 days in the current year and 183 days in the aggregate over the prior 3 years.