Filing taxes can be a daunting task, especially when dealing with complex forms like the Form 8814. As a parent, you want to ensure that you're taking advantage of the Child Tax Credit, but navigating the paperwork can be overwhelming. That's where TurboTax comes in – a trusted tax preparation software that guides you through the process with ease. In this article, we'll provide you with 5 valuable tips for filing Form 8814 with TurboTax, making the process smoother and less stressful.

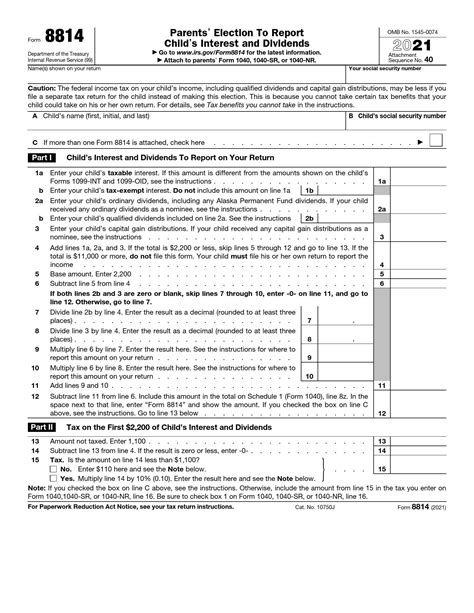

Understanding Form 8814: Parents' Election to Report Child's Interest and Dividends

Form 8814 is used by parents to report their child's interest and dividends on their tax return. This form allows parents to elect to include their child's income on their tax return, which can help reduce the child's tax liability. By reporting the child's income on the parent's tax return, parents can avoid the need for the child to file a separate tax return.

Tip 1: Gather Required Documents and Information

Before starting the filing process, make sure you have all the necessary documents and information. You'll need:

- Your child's Social Security number or Individual Taxpayer Identification Number (ITIN)

- The child's interest and dividend statements (Forms 1099-INT and 1099-DIV)

- Your tax return information, including your filing status and taxable income

Having these documents ready will help you navigate the TurboTax process more efficiently.

Reporting Child's Interest and Dividends: A Step-by-Step Guide

Reporting your child's interest and dividends on Form 8814 involves several steps. Here's a step-by-step guide to help you through the process:

- Step 1: Enter your child's Social Security number or ITIN in the required field.

- Step 2: Report the child's interest and dividend income on the corresponding lines.

- Step 3: Calculate the tax on the child's income using the tax tables or the Tax Computation Worksheet.

- Step 4: Complete the Parents' Election to Report Child's Interest and Dividends section.

- Step 5: Sign and date the form.

Tip 2: Use TurboTax's Guided Interview Process

TurboTax's guided interview process makes it easy to file Form 8814. The software will ask you a series of questions to determine if you're eligible to file the form and will guide you through the reporting process. Make sure to answer the questions accurately, and TurboTax will handle the calculations and form preparation.

Tip 3: Take Advantage of the Child Tax Credit

The Child Tax Credit is a valuable tax credit that can help reduce your tax liability. By reporting your child's interest and dividends on Form 8814, you may be eligible for the Child Tax Credit. TurboTax will help you determine if you qualify for the credit and will guide you through the process of claiming it.

Common Errors to Avoid When Filing Form 8814

When filing Form 8814, it's essential to avoid common errors that can delay your tax refund or trigger an audit. Here are some mistakes to watch out for:

- Incorrect Social Security number or ITIN: Make sure to enter your child's Social Security number or ITIN correctly to avoid delays or errors.

- Inaccurate reporting of interest and dividends: Double-check the interest and dividend statements to ensure accurate reporting.

- Failure to sign and date the form: Don't forget to sign and date the form, as this can delay processing.

Tip 4: E-File Your Tax Return with TurboTax

E-filing your tax return with TurboTax is a convenient and secure way to submit your tax return. The software will guide you through the e-filing process, ensuring that your return is accurate and complete. Plus, you'll receive your tax refund faster when you e-file.

Tip 5: Seek Help When Needed

If you're unsure about any part of the filing process, don't hesitate to seek help. TurboTax offers live support from tax experts who can answer your questions and provide guidance. You can also visit the TurboTax website for resources and FAQs.

By following these 5 tips, you'll be well on your way to filing Form 8814 with TurboTax with confidence. Remember to gather required documents, use the guided interview process, take advantage of the Child Tax Credit, avoid common errors, and seek help when needed.

We hope this article has provided you with valuable insights and tips for filing Form 8814 with TurboTax. If you have any questions or comments, please don't hesitate to share them below.

What is Form 8814 used for?

+Form 8814 is used by parents to report their child's interest and dividends on their tax return.

What documents do I need to file Form 8814?

+You'll need your child's Social Security number or ITIN, the child's interest and dividend statements (Forms 1099-INT and 1099-DIV), and your tax return information.

Can I e-file my tax return with TurboTax?

+Yes, you can e-file your tax return with TurboTax, which is a convenient and secure way to submit your tax return.