The POS-010 form is a crucial document used in various business operations, particularly in the context of accounting, tax compliance, and financial management. Its significance cannot be overstated, as it plays a vital role in ensuring the accuracy and transparency of business transactions. In this article, we will delve into the top 5 uses of the POS-010 form in business operations, highlighting its importance and applications.

Understanding the POS-010 Form

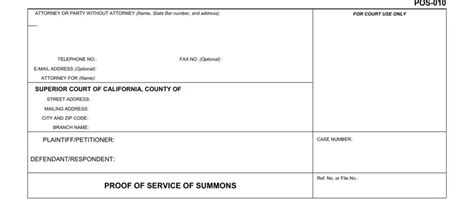

Before we dive into the uses of the POS-010 form, it's essential to understand what it is and its purpose. The POS-010 form is a standard document used to record and report Point of Sale (POS) transactions. It's typically used by businesses to track sales, calculate taxes, and maintain accurate financial records. The form contains essential information such as the date, time, and details of the transaction, including the amount, tax rate, and payment method.

1. Sales Tracking and Reporting

One of the primary uses of the POS-010 form is to track and report sales transactions. Businesses use this form to record every sale, including the date, time, and amount of the transaction. This information is essential for generating sales reports, which help business owners understand their revenue streams, identify trends, and make informed decisions.

By using the POS-010 form, businesses can ensure accuracy and consistency in their sales tracking and reporting. This form helps to eliminate errors and discrepancies, providing a clear picture of sales performance.

2. Tax Compliance

The POS-010 form is also used for tax compliance purposes. Businesses use this form to calculate and report taxes on sales transactions. The form includes fields for tax rates, tax amounts, and payment methods, making it easier to calculate and report taxes accurately.

By using the POS-010 form, businesses can ensure compliance with tax regulations and avoid penalties or fines. This form helps to streamline the tax reporting process, reducing the risk of errors and discrepancies.

3. Financial Management

The POS-010 form is an essential tool for financial management. Businesses use this form to maintain accurate financial records, including sales data, tax information, and payment details.

By using the POS-010 form, businesses can ensure that their financial records are accurate, complete, and up-to-date. This form helps to streamline financial management, reducing the risk of errors and discrepancies.

4. Inventory Management

The POS-010 form can also be used for inventory management purposes. Businesses can use this form to track sales and inventory levels, helping to identify trends and patterns.

By using the POS-010 form, businesses can ensure that their inventory levels are accurate and up-to-date. This form helps to streamline inventory management, reducing the risk of stockouts or overstocking.

5. Auditing and Accounting

Finally, the POS-010 form is used for auditing and accounting purposes. Businesses use this form to provide a clear and accurate record of sales transactions, tax information, and payment details.

By using the POS-010 form, businesses can ensure that their financial records are accurate and complete, reducing the risk of errors or discrepancies. This form helps to streamline the auditing and accounting process, making it easier to identify and address any issues or discrepancies.

In conclusion, the POS-010 form is a vital document used in various business operations. Its uses range from sales tracking and reporting to tax compliance, financial management, inventory management, and auditing and accounting.

By using the POS-010 form, businesses can ensure accuracy, transparency, and compliance in their financial records. This form helps to streamline business operations, reducing the risk of errors and discrepancies.

We hope this article has provided valuable insights into the top 5 uses of the POS-010 form in business operations. If you have any questions or comments, please feel free to share them below.

What is the purpose of the POS-010 form?

+The POS-010 form is used to record and report Point of Sale (POS) transactions, including sales data, tax information, and payment details.

Why is the POS-010 form important for business operations?

+The POS-010 form is essential for ensuring accuracy, transparency, and compliance in financial records. It helps to streamline business operations, reducing the risk of errors and discrepancies.

Can the POS-010 form be used for inventory management?

+Yes, the POS-010 form can be used for inventory management purposes. It helps to track sales and inventory levels, identifying trends and patterns.