The tax season is here, and many taxpayers are busy gathering their documents and filing their tax returns. One of the most important forms for real estate investors and rental property owners is Form 8582, also known as the "Passive Activity Loss Limitations" form. In this article, we will discuss how to fill out Form 8582 with TurboTax, one of the most popular tax preparation software.

Why is Form 8582 important?

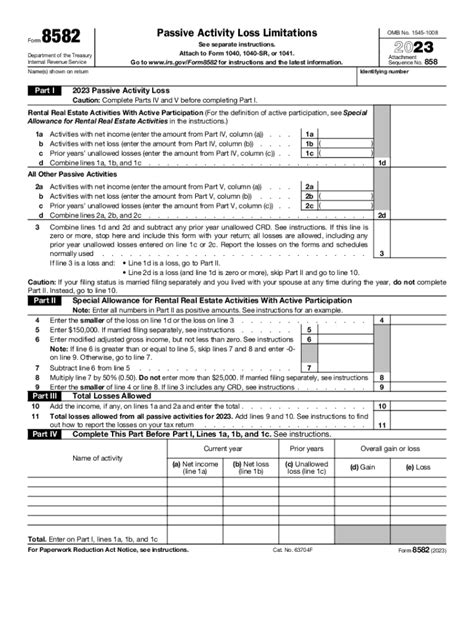

Form 8582 is used to report the income and expenses from rental properties and other passive activities. The form helps taxpayers to calculate the passive activity loss (PAL) limitation, which is the maximum amount of losses that can be deducted from passive activities in a given tax year. This form is crucial for real estate investors and rental property owners who want to claim losses on their tax return.

Gathering necessary documents

Before filling out Form 8582, it's essential to gather all the necessary documents, including:

- Rental income statements

- Expense records, such as mortgage interest, property taxes, and maintenance costs

- Depreciation schedules

- Any other relevant documentation

Using TurboTax to fill out Form 8582

TurboTax is a popular tax preparation software that can help make filling out Form 8582 easier and more accurate. Here are the steps to follow:

Step 1: Accessing Form 8582 in TurboTax

To access Form 8582 in TurboTax, follow these steps:

- Log in to your TurboTax account and select the tax return you want to work on.

- Click on the "Rental Income and Expenses" section.

- Select "Rental Properties" and then click on "Add a Rental Property."

- Follow the prompts to enter your rental property information.

Step 2: Reporting Rental Income

To report rental income on Form 8582, follow these steps:

- In the "Rental Income" section, enter the total rental income from your property.

- Enter any other income related to the property, such as interest income or dividends.

Step 3: Reporting Rental Expenses

To report rental expenses on Form 8582, follow these steps:

- In the "Rental Expenses" section, enter the total rental expenses for the year.

- Enter any other expenses related to the property, such as mortgage interest, property taxes, and maintenance costs.

Step 4: Calculating Depreciation

To calculate depreciation on Form 8582, follow these steps:

- In the "Depreciation" section, enter the total depreciation for the year.

- Enter any other depreciation-related information, such as the property's cost basis and useful life.

Step 5: Reviewing and Submitting Form 8582

Once you've completed Form 8582, review it carefully to ensure accuracy. Then, submit it with your tax return.

Tips and Reminders

Here are some tips and reminders to keep in mind when filling out Form 8582 with TurboTax:

- Make sure to keep accurate records of your rental income and expenses.

- Consult with a tax professional if you're unsure about any aspect of Form 8582.

- Review your form carefully before submitting it to ensure accuracy.

Get Started with TurboTax

If you're ready to fill out Form 8582 with TurboTax, get started today. With its user-friendly interface and expert guidance, TurboTax can help make tax preparation easier and less stressful.

What's Next?

Once you've completed Form 8582, you can move on to other sections of your tax return. Remember to review your return carefully before submitting it to the IRS.

Final Thoughts

Filling out Form 8582 with TurboTax can be a straightforward process if you have the right guidance. By following these steps and tips, you can ensure accuracy and compliance with tax laws. Don't hesitate to reach out to a tax professional if you have any questions or concerns.

Share Your Thoughts

Have you used TurboTax to fill out Form 8582? Share your experiences and tips in the comments below. We'd love to hear from you!

FAQ Section:

What is Form 8582 used for?

+Form 8582 is used to report the income and expenses from rental properties and other passive activities.

Why is it important to keep accurate records of rental income and expenses?

+Keeping accurate records of rental income and expenses is essential to ensure accuracy on Form 8582 and to avoid any potential tax penalties.

Can I use TurboTax to fill out Form 8582 if I'm not a real estate investor?

+No, Form 8582 is specifically designed for real estate investors and rental property owners. If you're not a real estate investor, you may not need to fill out this form.