As a taxpayer, it's essential to stay informed about the various forms and documents required for filing taxes. One such form that's crucial for partnerships is Form 8453-Pe. In this article, we'll delve into the world of Form 8453-Pe and explore its significance, purpose, and benefits. Whether you're a tax professional or a partnership representative, understanding this form is vital for ensuring accurate and timely tax filings.

Tax compliance is a complex process, and partnerships must navigate a multitude of forms and regulations. Form 8453-Pe is a critical component of this process, and its importance cannot be overstated. By understanding the essential facts about Form 8453-Pe, partnerships can avoid potential pitfalls and ensure seamless tax filings.

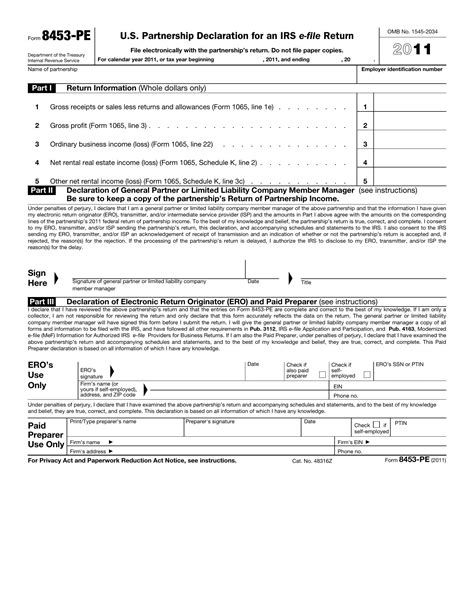

What is Form 8453-Pe?

Form 8453-Pe is an IRS form used by partnerships to file their annual return electronically. The form is designed to facilitate the electronic filing of Form 1065, the U.S. Return of Partnership Income. By using Form 8453-Pe, partnerships can expedite the filing process, reduce errors, and ensure timely submission of their tax returns.

Benefits of Using Form 8453-Pe

Using Form 8453-Pe offers several benefits for partnerships, including:

- Faster processing: Electronic filing through Form 8453-Pe enables faster processing of tax returns, reducing the likelihood of delays and errors.

- Improved accuracy: The form's built-in checks and balances help minimize errors, ensuring that partnerships submit accurate and complete tax returns.

- Enhanced security: Form 8453-Pe provides a secure way to transmit sensitive tax information, protecting partnerships from potential data breaches.

- Reduced paperwork: By filing electronically, partnerships can reduce the amount of paperwork required, making it easier to manage tax-related documents.

Who Needs to File Form 8453-Pe?

Form 8453-Pe is required for all partnerships that file their annual return electronically. This includes:

- General partnerships

- Limited partnerships

- Limited liability partnerships (LLPs)

- Limited liability limited partnerships (LLLPs)

How to File Form 8453-Pe

To file Form 8453-Pe, partnerships must follow these steps:

- Prepare Form 1065: Complete and review Form 1065, ensuring all required information is accurate and complete.

- Obtain an Electronic Filing Identification Number (EFIN): Partnerships must obtain an EFIN from the IRS to file Form 8453-Pe electronically.

- Submit Form 8453-Pe: Use approved tax software to submit Form 8453-Pe, attaching the completed Form 1065 and supporting documents.

- Receive confirmation: The IRS will provide a confirmation receipt upon successful submission of Form 8453-Pe.

Common Errors to Avoid When Filing Form 8453-Pe

When filing Form 8453-Pe, partnerships should be aware of common errors that can delay or reject their tax returns. These include:

- Incomplete or inaccurate information

- Failure to attach required supporting documents

- Incorrect EFIN or PIN

- Insufficient payment or payment made after the deadline

Penalties for Late or Inaccurate Filings

Partnerships that fail to file Form 8453-Pe accurately or on time may face penalties, including:

- Late filing fees

- Interest on unpaid taxes

- Accuracy-related penalties

It's essential for partnerships to prioritize timely and accurate filings to avoid these penalties and ensure compliance with tax regulations.

Best Practices for Filing Form 8453-Pe

To ensure a smooth filing process, partnerships should follow these best practices:

- Review and update tax software regularly

- Verify EFIN and PIN accuracy

- Double-check Form 1065 for completeness and accuracy

- Attach all required supporting documents

- File Form 8453-Pe well before the deadline

By following these best practices, partnerships can minimize errors, reduce the risk of penalties, and ensure timely tax filings.

As a partnership representative, understanding Form 8453-Pe is crucial for ensuring accurate and timely tax filings. By recognizing the importance of this form, avoiding common errors, and following best practices, partnerships can navigate the complex world of tax compliance with confidence.

We hope this article has provided valuable insights into the world of Form 8453-Pe. Share your thoughts and experiences with filing this form in the comments below. Don't forget to share this article with your colleagues and peers to help spread awareness about the importance of accurate and timely tax filings.

What is the purpose of Form 8453-Pe?

+Form 8453-Pe is used by partnerships to file their annual return electronically.

Who needs to file Form 8453-Pe?

+All partnerships that file their annual return electronically must use Form 8453-Pe.

What are the benefits of using Form 8453-Pe?

+Using Form 8453-Pe offers faster processing, improved accuracy, enhanced security, and reduced paperwork.