As a resident of Kentucky, understanding how to file your state income tax return is crucial to avoid any penalties or fines. The Kentucky Form 740 is the standard form used for filing individual income tax returns, and it can seem overwhelming, especially for first-time filers. However, with the right guidance, you can navigate the process with ease. In this article, we will break down the steps involved in filing Kentucky Form 740, highlighting the essential information you need to know.

Understanding the Kentucky Form 740

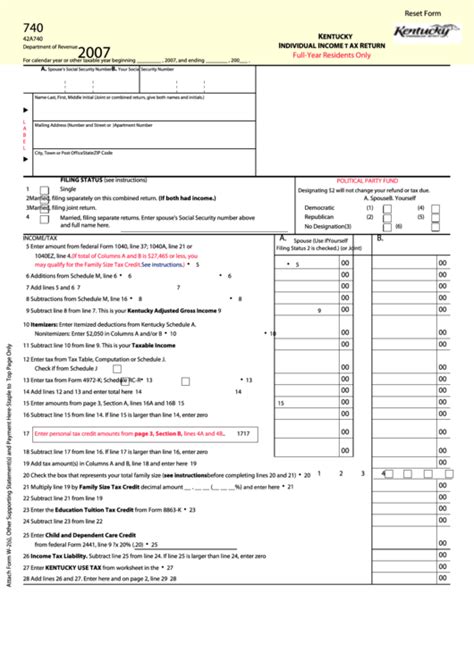

The Kentucky Form 740 is used to report your income, claim deductions and credits, and calculate your tax liability. The form is divided into several sections, each requiring specific information. To ensure accuracy, it's essential to gather all necessary documents and information before starting the filing process.

Gathering Required Documents

Before you begin filing your Kentucky Form 740, make sure you have the following documents:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your spouse's Social Security number or ITIN (if filing jointly)

- W-2 forms from all employers

- 1099 forms for freelance work, self-employment, or other income

- Interest statements from banks and investments (1099-INT)

- Dividend statements (1099-DIV)

- Capital gains statements (Schedule D)

- Charitable donation receipts

- Medical expense receipts

- Mortgage interest statements (1098)

Filing Status and Residency

When filing your Kentucky Form 740, you must choose a filing status, which determines your tax rates and deductions. The available filing statuses are:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Additionally, you must indicate your residency status:

- Resident: You lived in Kentucky for the entire tax year.

- Non-resident: You did not live in Kentucky for the entire tax year.

- Part-year resident: You lived in Kentucky for part of the tax year.

Deductions and Credits

Kentucky allows various deductions and credits to reduce your tax liability. Some of the most common include:

- Standard deduction

- Itemized deductions (Schedule A)

- Earned Income Tax Credit (EITC)

- Child Tax Credit

- Education credits

- Charitable donations

Completing the Kentucky Form 740

Now that you have gathered all necessary documents and information, it's time to complete the Kentucky Form 740. Follow these steps:

- Fill in your personal information, including your name, address, and Social Security number.

- Choose your filing status and indicate your residency status.

- Report your income from all sources, including W-2 and 1099 forms.

- Claim deductions and credits, as applicable.

- Calculate your tax liability using the provided tax tables or schedules.

- Sign and date the form.

E-Filing and Payment Options

You can e-file your Kentucky Form 740 through the Kentucky Department of Revenue's website or through a tax preparation software. If you owe taxes, you can pay online, by phone, or by mail. The payment options include:

- Electronic check or debit card

- Credit card

- Check or money order

Avoiding Penalties and Fines

To avoid penalties and fines, make sure to:

- File your Kentucky Form 740 by the deadline (April 15th)

- Pay any owed taxes by the deadline

- Report all income and claim only eligible deductions and credits

- Keep accurate records and documentation

Amending Your Return

If you need to make changes to your Kentucky Form 740 after filing, you can amend your return using Form 740-X. You can also use this form to claim a refund or report additional income.

Conclusion

Filing your Kentucky Form 740 doesn't have to be a daunting task. By gathering all necessary documents, understanding the filing process, and avoiding common mistakes, you can ensure a smooth and accurate filing experience. If you're unsure about any part of the process, consider consulting a tax professional or seeking guidance from the Kentucky Department of Revenue.

We hope this article has provided you with a comprehensive guide to filing your Kentucky Form 740. If you have any questions or comments, please feel free to share them below.

What is the deadline for filing Kentucky Form 740?

+The deadline for filing Kentucky Form 740 is April 15th.

Can I e-file my Kentucky Form 740?

+Yes, you can e-file your Kentucky Form 740 through the Kentucky Department of Revenue's website or through a tax preparation software.

What are the payment options for owed taxes?

+The payment options for owed taxes include electronic check or debit card, credit card, and check or money order.