The Ohio IT-4 exemption certificate is a crucial document for employers and employees in the state of Ohio. It is used to claim exemption from Ohio state income tax withholding on wages earned by employees. In this article, we will delve into the Ohio IT-4 exemption certificate requirements, its importance, and the steps to obtain and complete the certificate.

What is the Ohio IT-4 Exemption Certificate?

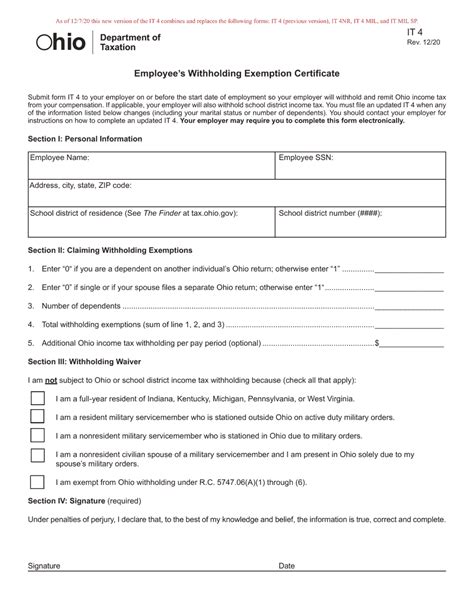

The Ohio IT-4 exemption certificate is a form that employees complete to claim exemption from Ohio state income tax withholding on their wages. This certificate is required by the Ohio Department of Taxation and must be completed and submitted to the employer by the employee.

Why is the Ohio IT-4 Exemption Certificate Important?

The Ohio IT-4 exemption certificate is essential for several reasons:

- It allows employees to claim exemption from Ohio state income tax withholding on their wages.

- It ensures that employers are in compliance with Ohio state tax laws and regulations.

- It helps to prevent over-withholding of taxes, which can result in a significant refund for the employee at tax time.

Ohio IT-4 Exemption Certificate Requirements

To be eligible for an Ohio IT-4 exemption certificate, employees must meet certain requirements. These requirements include:

- The employee must be a resident of Ohio.

- The employee must have no Ohio income tax liability for the previous tax year.

- The employee must not expect to have any Ohio income tax liability for the current tax year.

Steps to Obtain and Complete the Ohio IT-4 Exemption Certificate

To obtain and complete the Ohio IT-4 exemption certificate, employees can follow these steps:

- Download the Form: The Ohio IT-4 exemption certificate form can be downloaded from the Ohio Department of Taxation website.

- Complete the Form: Employees must complete the form in its entirety, providing all required information.

- Sign and Date the Form: Employees must sign and date the form.

- Submit the Form: Employees must submit the completed form to their employer.

Employer Responsibilities

Employers have certain responsibilities when it comes to the Ohio IT-4 exemption certificate. These responsibilities include:

- Maintaining Records: Employers must maintain records of all Ohio IT-4 exemption certificates submitted by employees.

- Withholding Taxes: Employers must withhold Ohio state income taxes from employee wages unless an Ohio IT-4 exemption certificate is on file.

- Submitting Certificates: Employers must submit the Ohio IT-4 exemption certificates to the Ohio Department of Taxation, if required.

Frequently Asked Questions

Q: Who is eligible for an Ohio IT-4 exemption certificate? A: Employees who are residents of Ohio, have no Ohio income tax liability for the previous tax year, and do not expect to have any Ohio income tax liability for the current tax year.

Q: How do I obtain an Ohio IT-4 exemption certificate? A: The Ohio IT-4 exemption certificate form can be downloaded from the Ohio Department of Taxation website.

Q: What are the consequences of not completing the Ohio IT-4 exemption certificate? A: Failure to complete the Ohio IT-4 exemption certificate can result in over-withholding of taxes, which can lead to a significant refund for the employee at tax time.

Q: Can I submit the Ohio IT-4 exemption certificate electronically? A: Yes, the Ohio IT-4 exemption certificate can be submitted electronically to the employer.

What is the deadline for submitting the Ohio IT-4 exemption certificate?

+The deadline for submitting the Ohio IT-4 exemption certificate is December 1st of each year.

Can I claim exemption from Ohio state income tax withholding if I am not a resident of Ohio?

+No, only residents of Ohio are eligible to claim exemption from Ohio state income tax withholding.

How long is the Ohio IT-4 exemption certificate valid?

+The Ohio IT-4 exemption certificate is valid for one year from the date of submission.

By understanding the Ohio IT-4 exemption certificate requirements and following the steps outlined above, employees and employers can ensure compliance with Ohio state tax laws and regulations.