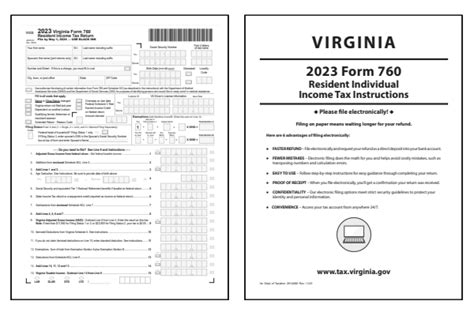

The Virginia Form 760 is a vital document for residents of the Commonwealth of Virginia, serving as the state's individual income tax return form. Completing this form accurately and thoroughly is essential for ensuring timely and error-free filing. In this comprehensive guide, we will walk you through the step-by-step process of filling out the Virginia Form 760, exploring the various sections, and providing helpful tips along the way.

Understanding the Importance of Accurate Filing

Accurate and timely filing of your Virginia Form 760 is crucial for several reasons. Not only does it help you avoid penalties and interest, but it also ensures that you receive any refunds due to you as quickly as possible. Moreover, accurate filing helps the state maintain accurate records, which in turn facilitates better public services and infrastructure development.

Gathering Necessary Documents and Information

Before diving into the form, gather all necessary documents and information to ensure a smooth filing process. These may include:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your spouse's Social Security number or ITIN (if filing jointly)

- W-2 forms from your employer(s)

- 1099 forms for freelance work, self-employment, or other income

- Interest statements from banks and investments

- Dividend statements

- Charitable donation receipts

- Medical expense receipts

Section 1: Filing Status and Personal Information

The first section of the Virginia Form 760 requires you to provide your filing status and personal information.

Virginia Form 760 Instructions for Filing Status

- Single: Check this box if you are unmarried or considered unmarried for tax purposes.

- Married filing jointly: Check this box if you are married and filing a joint return with your spouse.

- Married filing separately: Check this box if you are married but filing a separate return from your spouse.

- Head of household: Check this box if you are unmarried and have dependents.

- Qualifying widow(er): Check this box if you are a widow(er) with dependents and meet specific requirements.

Personal Information

- Provide your name, Social Security number, and date of birth.

- If filing jointly, provide your spouse's name, Social Security number, and date of birth.

Section 2: Income

This section requires you to report your income from various sources.

Virginia Form 760 Instructions for Income

- Wages, salaries, and tips: Report your income from W-2 forms.

- Interest and dividends: Report interest from banks, investments, and dividend statements.

- Capital gains and losses: Report gains and losses from the sale of assets.

- Business income and expenses: Report income and expenses from self-employment, freelance work, or business ventures.

Section 3: Adjustments to Income

This section allows you to report adjustments to your income, such as deductions and exemptions.

Virginia Form 760 Instructions for Adjustments to Income

- Student loan interest deduction: Claim a deduction for interest paid on student loans.

- Alimony paid: Claim a deduction for alimony paid to a former spouse.

- Charitable contributions: Claim a deduction for charitable donations.

Section 4: Credits

This section requires you to report any credits you are eligible for.

Virginia Form 760 Instructions for Credits

- Earned Income Tax Credit (EITC): Claim a credit for low-to-moderate income working individuals and families.

- Child tax credit: Claim a credit for qualifying children.

- Education credits: Claim a credit for education expenses.

Section 5: Payments and Refund

This section requires you to report any payments made and calculate your refund.

Virginia Form 760 Instructions for Payments and Refund

- Payments: Report any payments made towards your tax bill.

- Refund: Calculate your refund based on your tax liability and payments made.

Conclusion: Final Steps and Filing

Congratulations! You have completed the Virginia Form 760. Review your form carefully for accuracy and completeness. Make sure to sign and date the form, and attach any required supporting documentation.

FAQs

What is the deadline for filing the Virginia Form 760?

+The deadline for filing the Virginia Form 760 is typically May 1st, but it may vary depending on your specific situation. Check the Virginia Department of Taxation website for the most up-to-date information.

Can I file the Virginia Form 760 electronically?

+Yes, you can file the Virginia Form 760 electronically through the Virginia Department of Taxation's website or through a tax preparation software. Electronic filing is generally faster and more accurate than paper filing.

What if I need help completing the Virginia Form 760?

+If you need help completing the Virginia Form 760, you can contact the Virginia Department of Taxation or consult with a tax professional. You can also find resources and guides on the Virginia Department of Taxation's website.

We hope this comprehensive guide has helped you navigate the Virginia Form 760. Remember to review and follow the instructions carefully to ensure accurate and timely filing. If you have any questions or concerns, don't hesitate to reach out to the Virginia Department of Taxation or a tax professional for assistance.