The IRS Form 720 is a crucial document for businesses to report and pay their excise taxes. However, filling out this form can be a daunting task, especially for those who are new to the process. In this article, we will provide you with 5 ways to fill out Form 720 with ease, ensuring that you meet your tax obligations without any hassle.

Understanding Form 720 and Its Requirements

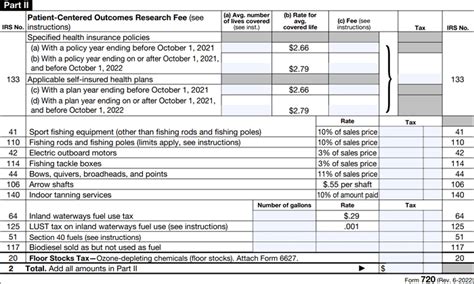

Before we dive into the 5 ways to fill out Form 720, it's essential to understand what this form is and what it requires. Form 720 is a quarterly federal excise tax return used to report and pay excise taxes on certain goods and services, such as fuel, tobacco, and indoor tanning services. The form requires businesses to report their excise tax liability and make payments to the IRS.

Who Needs to File Form 720?

Not all businesses need to file Form 720. Only those who have a federal excise tax liability are required to file this form. Some common examples of businesses that need to file Form 720 include:

- Gas stations and fuel distributors

- Tobacco manufacturers and distributors

- Indoor tanning service providers

- Telephone and teletypewriter services

5 Ways to Fill Out Form 720 with Ease

Now that we understand what Form 720 is and who needs to file it, let's move on to the 5 ways to fill out this form with ease.

1. Use IRS-Approved Software

The IRS offers a list of approved software providers that can help you prepare and file Form 720. These software programs are designed to guide you through the filing process, ensuring that you report and pay your excise taxes correctly. Some popular IRS-approved software providers include TurboTax, H&R Block, and TaxAct.

2. Consult the IRS Instructions

The IRS provides detailed instructions for filling out Form 720. These instructions can be found on the IRS website and are designed to help you understand the filing process and requirements. By consulting the IRS instructions, you can ensure that you complete the form accurately and avoid any errors.

3. Use the IRS Online Filing System

The IRS offers an online filing system that allows you to prepare and file Form 720 electronically. This system is free and can be accessed through the IRS website. By using the online filing system, you can avoid paperwork and ensure that your form is received by the IRS promptly.

4. Seek Professional Help

If you're unsure about how to fill out Form 720 or need help with the filing process, consider seeking professional help from a tax accountant or attorney. These professionals have experience with tax laws and can guide you through the filing process, ensuring that you meet your tax obligations.

5. File Electronically with an Authorized IRS e-File Provider

The IRS has authorized several e-file providers to help businesses file Form 720 electronically. These providers can guide you through the filing process and ensure that your form is received by the IRS promptly. Some popular authorized IRS e-file providers include Drake Software and CCH Small Firm Services.

Benefits of Filing Form 720 Electronically

Filing Form 720 electronically offers several benefits, including:

- Faster processing times

- Reduced errors

- Increased accuracy

- Electronic payment options

- Reduced paperwork

Common Mistakes to Avoid When Filing Form 720

When filing Form 720, it's essential to avoid common mistakes that can delay processing or result in penalties. Some common mistakes to avoid include:

- Inaccurate or incomplete information

- Failure to report excise tax liability

- Late filing or payment

- Incorrect payment amounts

- Failure to keep accurate records

Conclusion: Simplify Your Form 720 Filing Process

Filing Form 720 doesn't have to be a daunting task. By using the 5 ways outlined in this article, you can simplify your filing process and ensure that you meet your tax obligations without any hassle. Remember to use IRS-approved software, consult the IRS instructions, use the IRS online filing system, seek professional help, and file electronically with an authorized IRS e-file provider.

We hope this article has provided you with valuable insights and tips to make your Form 720 filing process easier. If you have any questions or comments, please feel free to share them below.

What is Form 720 used for?

+Form 720 is a quarterly federal excise tax return used to report and pay excise taxes on certain goods and services, such as fuel, tobacco, and indoor tanning services.

Who needs to file Form 720?

+Only businesses with a federal excise tax liability need to file Form 720. Common examples include gas stations, tobacco manufacturers, and indoor tanning service providers.

How can I file Form 720 electronically?

+You can file Form 720 electronically using the IRS online filing system or through an authorized IRS e-file provider.