If you've made significant gifts to family members or friends, you may be required to file a gift tax return with the IRS. The Form 709 is used to report these gifts and calculate any gift tax owed. In this article, we'll provide a step-by-step guide to help you navigate the Form 709 instructions and ensure you're in compliance with the IRS.

Understanding the Importance of Gift Tax Reporting

Gift tax is a federal tax levied on the transfer of property or assets from one individual to another without receiving full consideration in return. While gifts are often made with the best of intentions, they can have significant tax implications. Failing to report gifts or underreporting their value can result in penalties, fines, and even interest on unpaid taxes. By understanding the Form 709 instructions, you can avoid these consequences and ensure you're meeting your gift tax obligations.

Who Needs to File Form 709?

You'll need to file Form 709 if you've made gifts exceeding the annual gift tax exclusion amount ($16,000 in 2022). This includes gifts of cash, securities, real estate, or other assets. You'll also need to file if you've made gifts to non-citizens or non-resident aliens. Additionally, if you've split gifts with your spouse or made gifts to minors or trusts, you may be required to file Form 709.

Form 709 Instructions: A Step-By-Step Guide

Step 1: Gather Required Information

Before starting the Form 709, you'll need to gather certain information, including:

- Your name, address, and Social Security number

- The recipient's name, address, and Social Security number (if applicable)

- A description of the gifted property, including its value and date of transfer

- Any gift tax previously paid or applied to the current year's gift

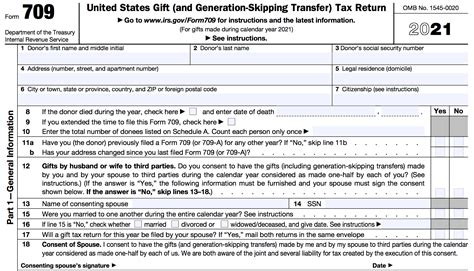

Step 2: Complete Part 1: Identification of Donor

In Part 1, you'll provide your identifying information, including your name, address, and Social Security number. If you're filing a joint return with your spouse, you'll also provide their information.

Step 3: Complete Part 2: Gifts

In Part 2, you'll report each gift made during the tax year. You'll need to provide a description of the gifted property, its value, and the date of transfer. You may need to complete multiple pages if you've made multiple gifts.

Step 4: Complete Part 3: Computation of Taxable Gifts

In Part 3, you'll calculate the total value of gifts made during the tax year. You'll subtract the annual gift tax exclusion amount ($16,000 in 2022) from the total value of gifts. If the result is greater than zero, you'll need to complete the rest of the form.

Step 5: Complete Part 4: Gift Tax Computation

In Part 4, you'll calculate the gift tax owed on the taxable gifts. You'll use the gift tax rate schedule to determine the tax owed.

Step 6: Complete Part 5: Application of Gift Tax Credit

If you've paid gift tax in previous years, you may be able to apply a gift tax credit to reduce your current year's tax liability.

Step 7: Complete Part 6: Signature

Finally, you'll sign the Form 709, certifying that the information provided is accurate and complete.

Gift Tax Exclusions and Deductions

There are several gift tax exclusions and deductions you can claim to reduce your tax liability. These include:

- Annual Gift Tax Exclusion: You can exclude gifts up to $16,000 in 2022 per recipient.

- Charitable Deduction: You can deduct gifts made to qualified charitable organizations.

- Medical Expense Deduction: You can deduct gifts made to pay medical expenses on behalf of another individual.

Penalties for Failing to File Form 709

If you fail to file Form 709 or underreport gifts, you may be subject to penalties, fines, and interest on unpaid taxes. The IRS may impose a penalty of up to 47.6% of the unpaid tax.

Conclusion

In conclusion, the Form 709 is an essential tax form for individuals who've made significant gifts to others. By following the step-by-step guide provided in this article, you can ensure you're meeting your gift tax obligations and avoiding potential penalties. Remember to gather all required information, complete each part of the form accurately, and claim any applicable exclusions and deductions.

Share Your Thoughts

Have you ever filed a gift tax return? What challenges did you face, and how did you overcome them? Share your experiences and tips in the comments below.

Additional Resources

For more information on gift tax and the Form 709, visit the IRS website or consult with a tax professional.

FAQs

What is the annual gift tax exclusion amount?

+The annual gift tax exclusion amount is $16,000 in 2022.

Do I need to file Form 709 if I've made gifts to non-citizens or non-resident aliens?

+Yes, you'll need to file Form 709 if you've made gifts to non-citizens or non-resident aliens.

What are the penalties for failing to file Form 709?

+The IRS may impose a penalty of up to 47.6% of the unpaid tax.