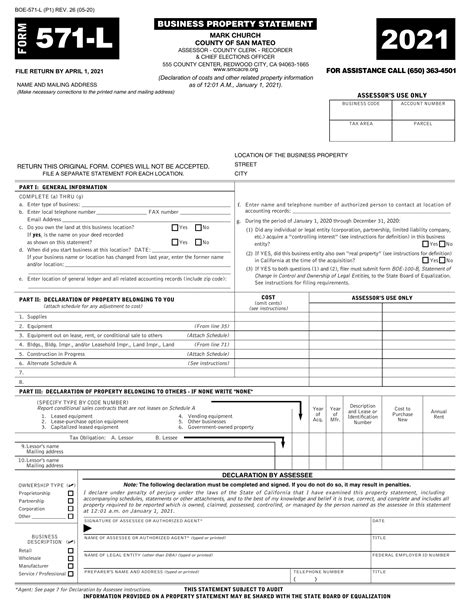

Completing tax forms can be a daunting task, especially for those who are new to the process. Form 571-L, also known as the Business Entity Report, is a crucial document that California-based businesses must submit to the California Secretary of State's office. Failure to do so can result in penalties, fines, and even the suspension of your business. In this article, we will provide you with a step-by-step guide on how to complete Form 571-L successfully, ensuring that you avoid any potential pitfalls and keep your business in good standing.

The Importance of Form 571-L

Form 571-L is a biennial report that must be filed by all California-based business entities, including corporations, limited liability companies (LLCs), and limited partnerships. The report provides the California Secretary of State's office with updated information about your business, including its name, address, and management structure.

What You Need to Know Before Filing Form 571-L

Before you start filling out Form 571-L, there are a few things you need to know:

- Filing Period: The filing period for Form 571-L is every two years, during the month of the anniversary of your business's formation or registration in California.

- Filing Fee: The filing fee for Form 571-L is $25, which must be paid by check or money order.

- Required Information: You will need to provide updated information about your business, including its name, address, and management structure.

5 Ways to Complete Form 571-L Successfully

Here are five ways to complete Form 571-L successfully:

1. Gather All Required Information

Before you start filling out Form 571-L, make sure you have all the required information. This includes:

- Business Name and Address: Your business's name and address must be accurate and up-to-date.

- Management Structure: You must provide information about your business's management structure, including the names and addresses of your officers, directors, or managers.

- Business Activity: You must describe your business's primary activity or purpose.

2. Choose the Correct Form

There are different versions of Form 571-L, depending on the type of business entity you have. Make sure you choose the correct form for your business.

3. Fill Out the Form Accurately

Fill out the form accurately and completely. Make sure you sign and date the form, and that you include all required information.

4. Attach Required Documents

You may need to attach additional documents to Form 571-L, such as a statement of information or a certificate of good standing.

5. File the Form on Time

Make sure you file Form 571-L on time, during the designated filing period. Late filings can result in penalties and fines.

Common Mistakes to Avoid

Here are some common mistakes to avoid when filling out Form 571-L:

- Incomplete or Inaccurate Information: Make sure you provide complete and accurate information about your business.

- Late Filing: Make sure you file Form 571-L on time, during the designated filing period.

- Incorrect Form: Make sure you choose the correct form for your business entity type.

Conclusion

Completing Form 571-L is a crucial step in maintaining your business's good standing in California. By following the steps outlined in this article, you can ensure that you complete the form successfully and avoid any potential pitfalls. Remember to gather all required information, choose the correct form, fill out the form accurately, attach required documents, and file the form on time.

What is Form 571-L?

+Form 571-L is a biennial report that must be filed by all California-based business entities, including corporations, limited liability companies (LLCs), and limited partnerships.

What is the filing fee for Form 571-L?

+The filing fee for Form 571-L is $25, which must be paid by check or money order.

What happens if I don't file Form 571-L on time?

+If you don't file Form 571-L on time, you may be subject to penalties and fines, and your business may be suspended or forfeited.