The state of California requires all businesses to file a property statement annually, detailing their business personal property. This guide will walk you through the process of filling out California Form 571-L, also known as the Business Property Statement.

Why is Filing a Business Property Statement Important?

Filing a business property statement is crucial for businesses in California, as it helps the county assessor's office determine the value of taxable business personal property. This, in turn, affects the amount of property taxes owed by the business. Failure to file a business property statement can result in penalties and fines.

Benefits of Filing a Business Property Statement

• Ensures accurate property tax assessment • Helps businesses avoid penalties and fines • Allows businesses to take advantage of exemptions and deductions • Provides a record of business assets and property

Who Needs to File a Business Property Statement?

All businesses in California are required to file a business property statement, except for those that are exempt. Exemptions include:

• Businesses with no taxable property • Businesses that have already filed a statement with the county assessor's office • Certain non-profit organizations

What Types of Businesses Need to File?

• Sole proprietorships • Partnerships • Limited liability companies (LLCs) • Corporations • Any business with taxable personal property

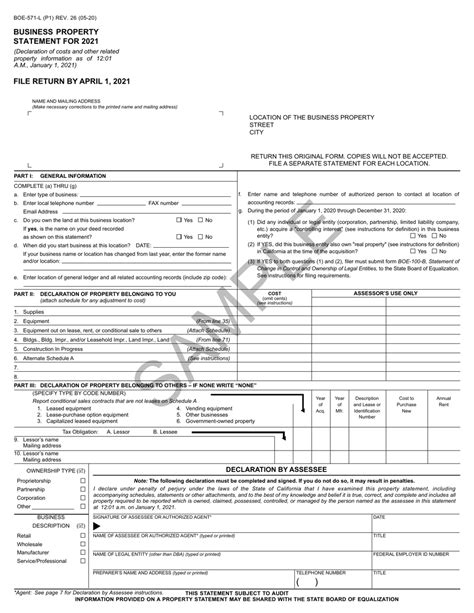

What Information is Required for the Business Property Statement?

To complete California Form 571-L, businesses will need to provide the following information:

• Business name and address • Business owner's name and address • Description of business activities • List of business personal property, including: • Equipment • Machinery • Furniture • Fixtures • Computers and software • Vehicles • Other business assets • Acquisition date and cost of each item • Depreciation and disposal information

Additional Requirements

• Businesses with multiple locations must file a separate statement for each location • Businesses with leased equipment must report the equipment's original cost and acquisition date

How to Complete California Form 571-L

To complete California Form 571-L, follow these steps:

- Gather all necessary information and documentation

- Complete the form online or by mail

- Attach supporting documentation, such as: • Depreciation schedules • Invoices • Receipts

- Sign and date the form

- Submit the form to the county assessor's office by the filing deadline

Important Deadlines and Penalties

• The filing deadline is typically April 1st of each year • Late filing penalties can range from 10% to 50% of the tax owed • Failure to file can result in a penalty of up to $100 or more

FAQs

What is the purpose of the Business Property Statement?

+The Business Property Statement is used to determine the value of taxable business personal property for property tax purposes.

Who is exempt from filing a Business Property Statement?

+Certain non-profit organizations and businesses with no taxable property are exempt from filing a Business Property Statement.

What happens if I fail to file a Business Property Statement?

+Failure to file a Business Property Statement can result in penalties and fines, including a penalty of up to $100 or more.

We hope this guide has provided you with a comprehensive understanding of the California Form 571-L Business Property Statement. By following the steps outlined above and providing accurate information, you can ensure that your business is in compliance with state regulations and avoid any potential penalties. If you have any further questions or concerns, please don't hesitate to reach out to your local county assessor's office or a qualified tax professional.