The Form 5471 Schedule G-1 is a crucial component of the U.S. tax return for corporations that have foreign subsidiaries or interests. This schedule is used to report the income of foreign corporations, and it's essential for taxpayers to understand its requirements and significance.

In today's globalized economy, it's common for U.S. corporations to have operations or investments in foreign countries. However, this can create complex tax obligations, particularly when it comes to reporting foreign corporation income. The Form 5471 Schedule G-1 is designed to help taxpayers navigate these complexities and ensure compliance with U.S. tax laws.

To understand the importance of the Form 5471 Schedule G-1, let's explore its purpose and requirements in more detail.

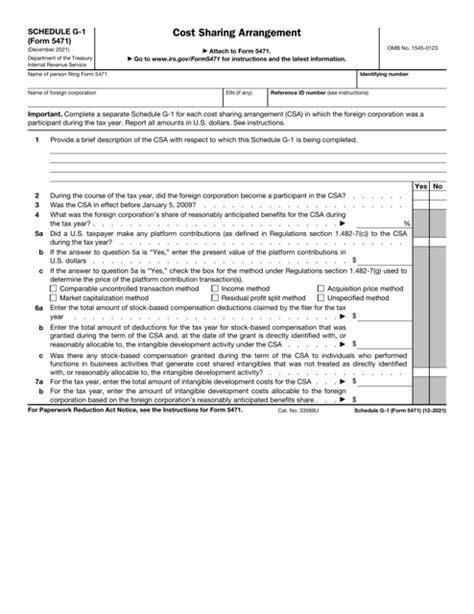

What is the Form 5471 Schedule G-1?

The Form 5471 Schedule G-1 is a supplementary schedule to the Form 5471, which is used by U.S. corporations to report their foreign corporation income. The schedule is specifically designed to report the income of controlled foreign corporations (CFCs), which are foreign corporations that are more than 50% owned by U.S. shareholders.

The Form 5471 Schedule G-1 requires taxpayers to report the gross income, deductions, and credits of the CFC, as well as the income earned by the CFC that is subject to U.S. taxation. This information is crucial for the IRS to determine the taxpayer's U.S. tax liability and to ensure compliance with U.S. tax laws.

Who Must File the Form 5471 Schedule G-1?

The Form 5471 Schedule G-1 must be filed by U.S. corporations that have a direct or indirect interest in a CFC. This includes:

- U.S. corporations that own more than 50% of the total voting power or value of the CFC

- U.S. corporations that have a direct or indirect interest in a CFC that is subject to U.S. taxation

- U.S. corporations that have a CFC that has income that is subject to U.S. taxation

It's essential to note that the Form 5471 Schedule G-1 must be filed annually, and it's due on the same date as the taxpayer's U.S. tax return.

What Information Must be Reported on the Form 5471 Schedule G-1?

The Form 5471 Schedule G-1 requires taxpayers to report the following information:

- Gross income of the CFC

- Deductions and credits of the CFC

- Income earned by the CFC that is subject to U.S. taxation

- Information about the CFC's country of incorporation and residence

- Information about the CFC's business activities and operations

The schedule also requires taxpayers to provide additional information, such as:

- The CFC's name, address, and taxpayer identification number

- The CFC's accounting period and method of accounting

- The CFC's gross income and deductions by category

How to Complete the Form 5471 Schedule G-1

To complete the Form 5471 Schedule G-1, taxpayers must follow these steps:

- Gather all necessary information about the CFC, including its financial statements and tax returns.

- Complete the schedule in accordance with the IRS instructions.

- Attach the schedule to the Form 5471 and submit it with the taxpayer's U.S. tax return.

It's essential to ensure that the schedule is accurate and complete, as the IRS may impose penalties for incomplete or inaccurate reporting.

Benefits of Accurate Reporting on the Form 5471 Schedule G-1

Accurate reporting on the Form 5471 Schedule G-1 is crucial for taxpayers to avoid penalties and ensure compliance with U.S. tax laws. Some benefits of accurate reporting include:

- Avoidance of penalties and fines

- Reduced risk of audit and examination

- Improved compliance with U.S. tax laws

- Enhanced credibility with the IRS

In addition, accurate reporting can also help taxpayers to:

- Claim foreign tax credits and deductions

- Reduce their U.S. tax liability

- Improve their overall tax position

Common Mistakes to Avoid on the Form 5471 Schedule G-1

Common mistakes to avoid on the Form 5471 Schedule G-1 include:

- Inaccurate or incomplete reporting of CFC income

- Failure to report CFC income subject to U.S. taxation

- Inadequate documentation and support for CFC income

- Failure to attach the schedule to the Form 5471

To avoid these mistakes, taxpayers should ensure that they:

- Gather all necessary information about the CFC

- Follow the IRS instructions carefully

- Review the schedule for accuracy and completeness

Conclusion

In conclusion, the Form 5471 Schedule G-1 is a critical component of the U.S. tax return for corporations that have foreign subsidiaries or interests. It's essential for taxpayers to understand its requirements and significance to ensure compliance with U.S. tax laws and avoid penalties.

By following the IRS instructions and taking the time to accurately complete the schedule, taxpayers can ensure that they are in compliance with U.S. tax laws and avoid common mistakes.

We encourage you to share your experiences and ask questions about the Form 5471 Schedule G-1 in the comments below.

What is the purpose of the Form 5471 Schedule G-1?

+The Form 5471 Schedule G-1 is used to report the income of controlled foreign corporations (CFCs) that are more than 50% owned by U.S. shareholders.

Who must file the Form 5471 Schedule G-1?

+U.S. corporations that have a direct or indirect interest in a CFC must file the Form 5471 Schedule G-1.

What information must be reported on the Form 5471 Schedule G-1?

+The Form 5471 Schedule G-1 requires taxpayers to report the gross income, deductions, and credits of the CFC, as well as the income earned by the CFC that is subject to U.S. taxation.