Form 5471 is a crucial document for U.S. taxpayers who own a controlled foreign corporation (CFC). The form is used to report the income, deductions, and credits of the CFC, as well as to calculate the U.S. taxpayer's share of the CFC's income. Schedule G is a key component of Form 5471, providing detailed information about the CFC's income and deductions.

In this article, we will delve into the world of controlled foreign corporations and explore the intricacies of Form 5471 Schedule G. We will discuss the importance of accurate reporting, the benefits of compliance, and the potential consequences of non-compliance.

What is a Controlled Foreign Corporation (CFC)?

A controlled foreign corporation is a foreign corporation in which U.S. shareholders own more than 50% of the total combined voting power or total value of the corporation's stock. The CFC is considered a separate entity from its U.S. shareholders, but the U.S. taxpayers are required to report their share of the CFC's income on their U.S. tax return.

Why is Form 5471 Important?

Form 5471 is essential for U.S. taxpayers who own a CFC, as it allows them to report their share of the CFC's income and claim any applicable credits or deductions. The form is used to calculate the U.S. taxpayer's tax liability and to ensure compliance with U.S. tax laws.

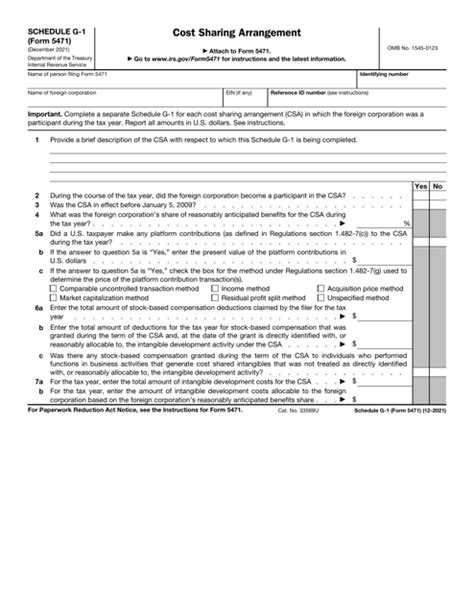

What is Schedule G?

Schedule G is a part of Form 5471, which provides detailed information about the CFC's income and deductions. The schedule is used to report the CFC's gross income, deductions, and credits, as well as to calculate the U.S. taxpayer's share of the CFC's income.

How to Complete Schedule G

Completing Schedule G requires careful attention to detail and a thorough understanding of the CFC's financial statements. The following steps can help guide you through the process:

- Identify the CFC's gross income: Report the CFC's gross income from all sources, including sales, services, and investments.

- Calculate the CFC's deductions: Report the CFC's deductions, including cost of goods sold, operating expenses, and taxes.

- Calculate the CFC's credits: Report the CFC's credits, including foreign tax credits and research and development credits.

- Calculate the U.S. taxpayer's share of the CFC's income: Report the U.S. taxpayer's share of the CFC's income, based on their ownership percentage.

Benefits of Compliance

Compliance with Form 5471 and Schedule G is crucial for U.S. taxpayers who own a CFC. The benefits of compliance include:

- Avoidance of penalties: Failure to file Form 5471 or Schedule G can result in significant penalties and fines.

- Accurate tax reporting: Compliance ensures accurate reporting of the CFC's income and the U.S. taxpayer's share of that income.

- Claiming credits and deductions: Compliance allows U.S. taxpayers to claim applicable credits and deductions, reducing their tax liability.

Consequences of Non-Compliance

Non-compliance with Form 5471 and Schedule G can result in severe consequences, including:

- Penalties and fines: Failure to file Form 5471 or Schedule G can result in penalties and fines of up to $10,000 per year.

- Interest charges: Non-compliance can result in interest charges on any unpaid tax liability.

- Loss of credits and deductions: Failure to comply can result in the loss of applicable credits and deductions.

Conclusion

Form 5471 Schedule G is a critical component of the U.S. tax reporting process for controlled foreign corporations. Accurate completion of the schedule is essential to ensure compliance with U.S. tax laws and to avoid penalties and fines. By understanding the importance of Schedule G and following the steps outlined above, U.S. taxpayers can ensure accurate reporting and claim applicable credits and deductions.

We encourage you to share your thoughts and experiences with Form 5471 Schedule G in the comments below. If you have any questions or concerns, please don't hesitate to reach out to a tax professional.

What is the purpose of Form 5471 Schedule G?

+Form 5471 Schedule G is used to report the income, deductions, and credits of a controlled foreign corporation (CFC), as well as to calculate the U.S. taxpayer's share of the CFC's income.

Who is required to file Form 5471 Schedule G?

+U.S. taxpayers who own a controlled foreign corporation (CFC) are required to file Form 5471 Schedule G.

What are the consequences of non-compliance with Form 5471 Schedule G?

+Non-compliance with Form 5471 Schedule G can result in penalties and fines of up to $10,000 per year, interest charges, and the loss of applicable credits and deductions.