The Form 5471, also known as the Information Return of U.S. Persons with Respect to Certain Foreign Corporations, is a crucial document for U.S. taxpayers with interests in foreign corporations. Specifically, Schedule E (Form 5471) focuses on reporting information related to foreign earned income and foreign taxes paid by U.S. shareholders of controlled foreign corporations (CFCs). In this comprehensive guide, we will delve into the intricacies of Form 5471 Sch E, breaking down the steps to accurately complete and file this complex form.

Understanding the Purpose of Form 5471 Sch E

Form 5471 Sch E is a critical component of the Form 5471 series, serving as a vital reporting tool for U.S. taxpayers with interests in foreign corporations. The primary purpose of Sch E is to report foreign earned income and foreign taxes paid by U.S. shareholders of CFCs. This information is essential for the Internal Revenue Service (IRS) to accurately assess U.S. tax liabilities and prevent tax evasion.

Who Must File Form 5471 Sch E?

U.S. taxpayers with interests in foreign corporations must file Form 5471 Sch E if they meet certain criteria. Specifically, this includes:

- U.S. shareholders of CFCs, including direct and indirect shareholders

- U.S. persons who own 10% or more of the total voting power or value of a foreign corporation

- U.S. persons who own 10% or more of the total voting power or value of a foreign corporation's stock

Step-by-Step Filing Guide for Form 5471 Sch E

Completing and filing Form 5471 Sch E can be a daunting task, especially for those unfamiliar with the complexities of international taxation. To ensure accuracy and compliance, follow these steps:

Step 1: Gather Required Information and Documents

Before starting the filing process, gather all necessary information and documents, including:

- Foreign corporation's financial statements and tax returns

- U.S. shareholder's ownership percentage and voting power

- Foreign earned income and foreign taxes paid by the CFC

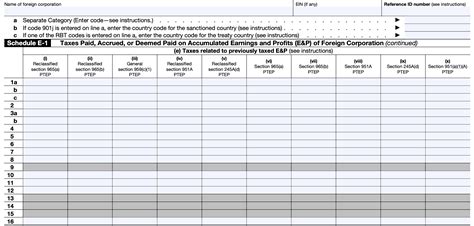

Step 2: Complete Form 5471 Sch E, Part I

Part I of Form 5471 Sch E requires reporting information related to the foreign corporation's income and taxes. This includes:

- Foreign corporation's name, address, and employer identification number (EIN)

- Type of foreign corporation (e.g., CFC, PFIC, etc.)

- U.S. shareholder's ownership percentage and voting power

Step 3: Complete Form 5471 Sch E, Part II

Part II of Form 5471 Sch E requires reporting information related to foreign earned income and foreign taxes paid by the CFC. This includes:

- Foreign earned income (FEI) and its components (e.g., interest, dividends, etc.)

- Foreign taxes paid by the CFC, including withholding taxes and taxes paid on behalf of the U.S. shareholder

Step 4: Complete Form 5471 Sch E, Part III

Part III of Form 5471 Sch E requires reporting information related to the U.S. shareholder's tax liabilities and credits. This includes:

- U.S. shareholder's tax liability, including foreign tax credits and deductions

- U.S. shareholder's foreign tax credit limitation and carryover amounts

Step 5: Review and Sign Form 5471 Sch E

Carefully review Form 5471 Sch E for accuracy and completeness. Ensure all required information is provided and calculations are correct. Sign and date the form, and attach all supporting documentation.

Step 6: File Form 5471 Sch E with the IRS

File Form 5471 Sch E with the IRS by the required deadline, which is typically the 15th day of the 4th month following the end of the foreign corporation's tax year. Ensure timely filing to avoid penalties and interest.

Common Mistakes to Avoid When Filing Form 5471 Sch E

When filing Form 5471 Sch E, it is essential to avoid common mistakes that can lead to penalties and interest. Some common mistakes to avoid include:

- Inaccurate or incomplete reporting of foreign earned income and foreign taxes paid

- Failure to report all required information and documentation

- Incorrect calculations and foreign tax credit limitations

- Late filing or failure to file Form 5471 Sch E

Conclusion

Form 5471 Sch E is a critical component of the Form 5471 series, serving as a vital reporting tool for U.S. taxpayers with interests in foreign corporations. By following the step-by-step guide outlined above, U.S. taxpayers can ensure accurate and compliant filing of Form 5471 Sch E. Remember to gather all required information and documents, complete each part of the form carefully, and review and sign the form before filing with the IRS.

Now that you have a comprehensive understanding of Form 5471 Sch E, we invite you to share your thoughts and experiences with filing this complex form. Have you encountered any challenges or successes when filing Form 5471 Sch E? Share your comments below and help others navigate the intricacies of international taxation.

What is the purpose of Form 5471 Sch E?

+Form 5471 Sch E is used to report foreign earned income and foreign taxes paid by U.S. shareholders of controlled foreign corporations (CFCs).

Who must file Form 5471 Sch E?

+U.S. taxpayers with interests in foreign corporations, including direct and indirect shareholders, must file Form 5471 Sch E if they meet certain criteria.

What is the deadline for filing Form 5471 Sch E?

+The deadline for filing Form 5471 Sch E is typically the 15th day of the 4th month following the end of the foreign corporation's tax year.