The California state income tax return amendment form, Form 540-X, is a crucial document for individuals who need to make corrections or changes to their previously filed state income tax returns. Whether you're a resident or non-resident of California, understanding the intricacies of this form is essential to ensure compliance with state tax regulations. In this article, we'll delve into the world of Form 540-X, exploring its purpose, benefits, and providing 7 valuable tips for filing it accurately.

Understanding Form 540-X

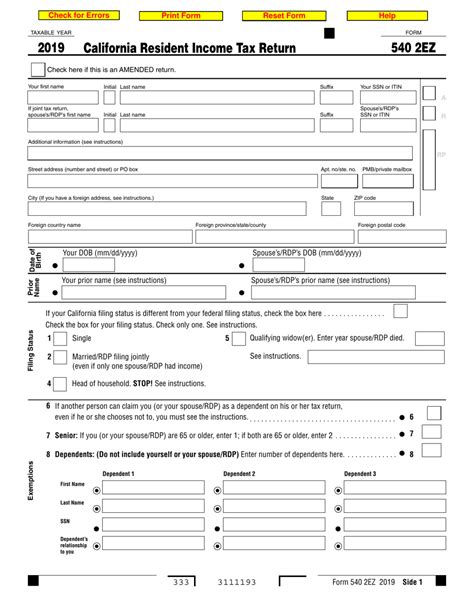

Before we dive into the tips, it's essential to understand the purpose and benefits of Form 540-X. This form is used to amend a previously filed California state income tax return, typically Form 540. You may need to file Form 540-X if you've made errors on your original return, forgotten to report income or claim deductions, or received additional income after filing.

Benefits of Filing Form 540-X

Filing Form 540-X can help you:

- Correct errors or omissions on your original return

- Claim additional deductions or credits

- Report additional income or changes in income

- Reduce your tax liability or increase your refund

7 Tips for Filing Form 540-X

Now that we've covered the basics, let's move on to the 7 tips for filing Form 540-X:

1. Gather Necessary Documents

Before starting the amendment process, gather all necessary documents, including:

- Your original Form 540

- Any supporting schedules or attachments

- Proof of income, deductions, or credits claimed on the original return

- Any additional documentation supporting the changes or corrections

2. Determine the Correct Filing Status

Ensure you're using the correct filing status on Form 540-X. If your filing status has changed since the original return, you may need to file a new return with the updated status.

3. Report Changes to Income

Report any changes to income, including:

- Additional income received after filing the original return

- Changes to self-employment income or business expenses

- Corrections to income reported on the original return

Example:

If you received a corrected W-2 or 1099, you'll need to report the updated income on Form 540-X.

4. Claim Additional Deductions or Credits

Claim any additional deductions or credits you're eligible for, including:

- Charitable donations

- Mortgage interest or property taxes

- Education credits

5. Complete the Correct Schedules

Complete the correct schedules and attachments, including:

- Schedule CA (540) for adjustments to income or deductions

- Schedule D (540) for capital gains or losses

- Schedule E (540) for self-employment income or business expenses

6. Sign and Date the Form

Sign and date Form 540-X, ensuring you've included all required information and documentation.

7. Submit the Form Timely

Submit Form 540-X as soon as possible to avoid penalties and interest. You can file electronically or by mail, but be sure to follow the instructions carefully to avoid delays.

Additional Tips and Reminders

- Keep accurate records of your amended return, including documentation and proof of submission.

- If you're filing electronically, ensure you receive confirmation of receipt from the California Franchise Tax Board.

- If you're filing by mail, use certified mail with return receipt requested to ensure proof of submission.

Final Thoughts

Filing Form 540-X can be a complex process, but with these 7 tips, you'll be well on your way to accurately amending your California state income tax return. Remember to gather necessary documents, determine the correct filing status, report changes to income, claim additional deductions or credits, complete the correct schedules, sign and date the form, and submit it timely.

What is Form 540-X used for?

+Form 540-X is used to amend a previously filed California state income tax return, typically Form 540.

How do I determine the correct filing status on Form 540-X?

+Ensure you're using the correct filing status on Form 540-X. If your filing status has changed since the original return, you may need to file a new return with the updated status.

What is the deadline for submitting Form 540-X?

+Submit Form 540-X as soon as possible to avoid penalties and interest. You can file electronically or by mail, but be sure to follow the instructions carefully to avoid delays.

We hope this comprehensive guide has provided you with valuable insights and tips for filing Form 540-X accurately. If you have any further questions or concerns, please don't hesitate to reach out to a tax professional or the California Franchise Tax Board for assistance.