California is known for its stunning beaches, iconic Hollywood sign, and, of course, its sunny weather. However, when it comes to taxes, California can be a complex and daunting place. As a resident of the Golden State, it's essential to understand how to file your state income tax correctly. In this article, we'll delve into the world of California Form 540, providing you with a comprehensive guide to help you navigate the process with ease.

Living in California comes with a price tag, and that price tag is often reflected in the state's tax laws. California has some of the highest tax rates in the country, with a top marginal tax rate of 13.3%. However, with the right knowledge and preparation, you can ensure you're taking advantage of all the deductions and credits available to you.

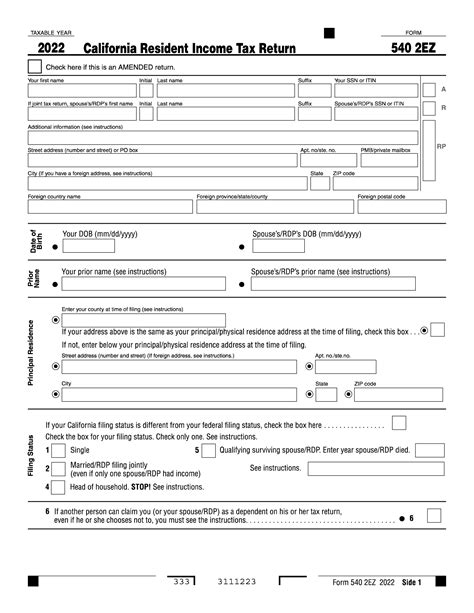

What is California Form 540?

California Form 540 is the state's individual income tax return. It's used to report your income, claim deductions and credits, and calculate your state income tax liability. The form is similar to the federal Form 1040, but with some key differences. If you're a California resident, you'll need to file Form 540 by the tax filing deadline, which is typically April 15th.

Who Needs to File California Form 540?

Not everyone who lives in California needs to file Form 540. You'll need to file a state tax return if:

- You're a California resident and have income that's subject to state taxation.

- You're a non-resident with income from California sources, such as rental income or capital gains from the sale of California property.

- You're a part-year resident, meaning you lived in California for only part of the tax year.

Filing Status and Income Reporting

When filing California Form 540, you'll need to report your income from all sources, including:

- Wages, salaries, and tips

- Interest and dividends

- Capital gains and losses

- Business income

- Rental income

- Unemployment compensation

You'll also need to choose a filing status, which determines your tax rates and deductions. California recognizes the same filing statuses as the federal government:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Deductions and Credits

California offers a range of deductions and credits to help reduce your state income tax liability. Some of the most common deductions include:

- The California standard deduction, which ranges from $4,400 to $13,300, depending on your filing status.

- Itemized deductions, such as mortgage interest, property taxes, and charitable contributions.

- The earned income tax credit (EITC), which provides a refundable credit to low-income working individuals and families.

Other credits available in California include:

- The child and dependent care credit, which provides a credit for childcare expenses.

- The college access tax credit, which provides a credit for education expenses.

- The California motion picture and television production credit, which provides a credit for film and television production expenses.

How to File California Form 540

You can file California Form 540 electronically or by mail. The California Franchise Tax Board (FTB) recommends e-filing, as it's faster and more secure. You can e-file through the FTB's website or through a tax preparation software.

If you prefer to file by mail, you'll need to complete the form and attach any required supporting documentation, such as W-2s and 1099s. Make sure to sign and date the form, and mail it to the address listed in the instructions.

Payment Options

If you owe state income tax, you can pay online, by phone, or by mail. The FTB accepts credit cards, debit cards, and electronic funds transfers. You can also make a payment plan if you're unable to pay your tax bill in full.

Audit and Appeal Process

If you're audited by the FTB, you'll receive a notice explaining the reason for the audit and the information needed to resolve the issue. You can respond to the notice by mail or online.

If you disagree with the FTB's determination, you can appeal the decision. You'll need to file a written appeal within 60 days of the notice date. The appeal process involves a review of your case by an FTB representative, and may include a hearing.

Tips and Reminders

- File on time: The tax filing deadline is typically April 15th, but you can request an automatic six-month extension if needed.

- Keep accurate records: Keep all supporting documentation, such as W-2s and 1099s, in case of an audit.

- Take advantage of deductions and credits: Don't miss out on valuable deductions and credits that can reduce your state income tax liability.

- Seek professional help: If you're unsure about how to file or have complex tax issues, consider hiring a tax professional.

What is the deadline for filing California Form 540?

+The deadline for filing California Form 540 is typically April 15th. However, you can request an automatic six-month extension if needed.

Do I need to file a state tax return if I don't owe any state income tax?

+Yes, even if you don't owe any state income tax, you may still need to file a state tax return if you have income that's subject to state taxation.

How do I report self-employment income on California Form 540?

+You'll need to report self-employment income on Schedule C (Form 540), which is the schedule for business income and expenses.

By following this guide, you'll be well on your way to filing your California state income tax return with confidence. Remember to take advantage of deductions and credits, keep accurate records, and seek professional help if needed. Happy filing!