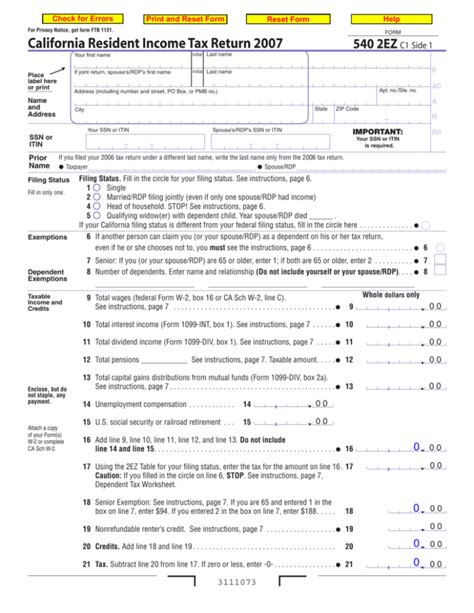

California is known for its stunning coastline, rich cultural diversity, and, of course, its reputation for having some of the highest taxes in the United States. As a California resident, understanding the ins and outs of your state's income tax return is crucial to avoid any last-minute stress or unexpected surprises. In this comprehensive guide, we'll walk you through the process of filing your California income tax return using the Form 540 2EZ, a simplified version of the standard Form 540.

Understanding the Importance of Filing Your California Income Tax Return

As a California resident, you're required to file a state income tax return if your gross income meets or exceeds the state's minimum filing requirement. The state's tax authority, the California Franchise Tax Board (FTB), uses the information reported on your tax return to calculate your tax liability, determine your eligibility for tax credits and deductions, and verify your compliance with state tax laws.

Who Should File the Form 540 2EZ?

The Form 540 2EZ is designed for California residents with simple tax returns, typically those with limited income sources and deductions. You may be eligible to file the Form 540 2EZ if you:

- Have only one source of income (e.g., wages, salaries, or tips)

- Claim the standard deduction

- Don't have any dependents or qualified exemptions

- Don't claim any deductions for mortgage interest, charitable donations, or medical expenses

- Don't have any self-employment income or business expenses

Step-by-Step Guide to Filing the Form 540 2EZ

Before we dive into the nitty-gritty of filing the Form 540 2EZ, make sure you have the following documents and information ready:

- Your W-2 forms from all employers

- Your 1099 forms for any self-employment income or other income

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your California driver's license or state ID number

- Your checking or savings account information for direct deposit (if applicable)

Now, let's walk through the steps to file your Form 540 2EZ:

Step 1: Gather Your Tax Forms and Documents

Collect all the necessary tax forms and documents, including your W-2 forms, 1099 forms, and any other relevant documents. Make sure to review each form carefully for accuracy and completeness.

Step 2: Determine Your Filing Status

Your filing status determines your tax rates and deductions. California recognizes the following filing statuses:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Step 3: Report Your Income

Report all your income from various sources, including wages, salaries, tips, and self-employment income. Make sure to include any income from investments, retirement accounts, or other sources.

Step 4: Claim Your Deductions and Credits

Claim your standard deduction or itemized deductions, whichever is greater. You may also be eligible for various tax credits, such as the Earned Income Tax Credit (EITC) or the California Earned Income Tax Credit (CalEITC).

Step 5: Calculate Your Tax Liability

Use the tax tables or tax calculator to determine your tax liability. Make sure to account for any tax credits or deductions you're eligible for.

Step 6: Sign and Date Your Return

Sign and date your Form 540 2EZ, making sure to include your signature and the date you signed the return.

Step 7: Submit Your Return

You can submit your Form 540 2EZ by mail or electronically through the FTB's website. Make sure to keep a copy of your return for your records.

Benefits of Filing Your California Income Tax Return

Filing your California income tax return on time comes with several benefits, including:

- Avoiding penalties and interest

- Receiving your tax refund faster

- Ensuring compliance with state tax laws

- Eligibility for tax credits and deductions

- Accurate calculation of your tax liability

Common Mistakes to Avoid When Filing Your Form 540 2EZ

When filing your Form 540 2EZ, be sure to avoid the following common mistakes:

- Failing to report all income sources

- Claiming incorrect deductions or credits

- Failing to sign and date your return

- Not submitting your return on time

Tips for Filing Your California Income Tax Return

Here are some additional tips to keep in mind when filing your Form 540 2EZ:

- File electronically to reduce errors and speed up processing

- Use tax software or consult a tax professional if you're unsure about any part of the filing process

- Keep accurate records and supporting documentation

- Take advantage of tax credits and deductions you're eligible for

California Income Tax Return Form 540 2EZ FAQs

Still have questions about filing your Form 540 2EZ? Here are some frequently asked questions and answers to help:

- Q: What is the deadline for filing my Form 540 2EZ? A: The deadline for filing your Form 540 2EZ is typically April 15th of each year.

- Q: Can I file my Form 540 2EZ electronically? A: Yes, you can file your Form 540 2EZ electronically through the FTB's website.

- Q: What if I need help with my Form 540 2EZ? A: You can consult a tax professional or contact the FTB's customer service for assistance.

What is the California Franchise Tax Board (FTB)?

+The California Franchise Tax Board (FTB) is the state's tax authority responsible for administering and enforcing state tax laws.

What is the standard deduction for California state income tax?

+The standard deduction for California state income tax varies depending on your filing status and income level. You can find the current standard deduction amounts on the FTB's website.

Can I claim the Earned Income Tax Credit (EITC) on my Form 540 2EZ?

+Yes, you may be eligible to claim the EITC on your Form 540 2EZ. Consult the FTB's website or a tax professional to determine your eligibility.

By following this comprehensive guide, you'll be well on your way to filing your California income tax return using the Form 540 2EZ with confidence. Remember to take your time, review your return carefully, and don't hesitate to seek help if you need it. Happy filing!