As a business owner in South Carolina, navigating the complexities of sales tax can be a daunting task. The SC Sales Tax Form is a crucial document that helps you report and pay sales tax to the state. In this article, we will delve into the world of SC Sales Tax Form, exploring its importance, benefits, and the steps to ensure compliance.

Understanding the SC Sales Tax Form

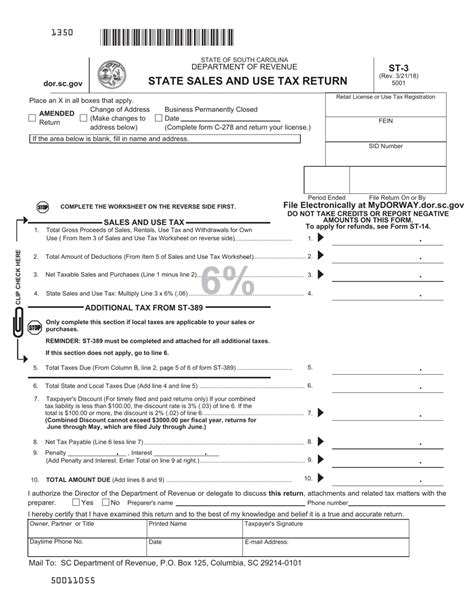

The SC Sales Tax Form, also known as the ST-3 Form, is a quarterly return that must be filed by businesses that collect sales tax in South Carolina. The form is used to report the total amount of sales tax collected during the quarter, as well as any additional taxes or fees owed to the state.

Benefits of Filing the SC Sales Tax Form

Filing the SC Sales Tax Form is essential for businesses that collect sales tax in South Carolina. Some of the benefits of filing the form include:

- Avoiding penalties and fines for non-compliance

- Ensuring accurate reporting of sales tax revenue

- Claiming credits or refunds for overpaid sales tax

- Maintaining a good standing with the state

Who Needs to File the SC Sales Tax Form?

Businesses that collect sales tax in South Carolina are required to file the SC Sales Tax Form. This includes:

- Retailers

- Wholesalers

- Restaurants

- Hotels

- Online sellers

Steps to File the SC Sales Tax Form

Filing the SC Sales Tax Form is a straightforward process that can be completed online or by mail. Here are the steps to follow:

Step 1: Gather Required Documents

Before filing the SC Sales Tax Form, you will need to gather the following documents:

- Sales tax permit number

- Business name and address

- Quarterly sales tax revenue

- Total amount of sales tax collected

- Any additional taxes or fees owed

Step 2: Calculate Sales Tax Revenue

Calculate your quarterly sales tax revenue by multiplying your total sales by the applicable sales tax rate.

Step 3: Complete the SC Sales Tax Form

Complete the SC Sales Tax Form by entering the required information, including your sales tax permit number, business name and address, quarterly sales tax revenue, and total amount of sales tax collected.

Step 4: Submit the Form

Submit the completed SC Sales Tax Form online or by mail to the South Carolina Department of Revenue.

Common Mistakes to Avoid

When filing the SC Sales Tax Form, there are several common mistakes to avoid, including:

- Failing to file the form on time

- Underreporting sales tax revenue

- Overpaying sales tax

- Failing to claim credits or refunds

Consequences of Non-Compliance

Failing to file the SC Sales Tax Form or making errors on the form can result in penalties and fines. Some of the consequences of non-compliance include:

- Late filing fees

- Interest on unpaid sales tax

- Penalties for underreporting sales tax revenue

- Loss of sales tax permit

Best Practices for SC Sales Tax Form Compliance

To ensure compliance with the SC Sales Tax Form, follow these best practices:

- Keep accurate records of sales tax revenue

- File the form on time

- Double-check calculations and information

- Claim credits or refunds for overpaid sales tax

Conclusion

Filing the SC Sales Tax Form is a crucial step in maintaining compliance with sales tax regulations in South Carolina. By understanding the importance of the form, benefits of filing, and steps to ensure compliance, businesses can avoid penalties and fines, and maintain a good standing with the state.

If you have any questions or concerns about the SC Sales Tax Form, we encourage you to comment below or share this article with others who may find it helpful.

What is the deadline for filing the SC Sales Tax Form?

+The deadline for filing the SC Sales Tax Form is the 20th day of the month following the end of the quarter.

Can I file the SC Sales Tax Form online?

+What happens if I fail to file the SC Sales Tax Form?

+If you fail to file the SC Sales Tax Form, you may be subject to penalties and fines, including late filing fees, interest on unpaid sales tax, and penalties for underreporting sales tax revenue.