As a responsible taxpayer, it's essential to understand the importance of filling out tax forms accurately. One such form is Form 5320.1, which is used to report certain foreign financial assets to the Internal Revenue Service (IRS). In this article, we'll guide you through the process of filling out Form 5320.1 correctly, highlighting six key steps to ensure you comply with the IRS regulations.

Understanding Form 5320.1

Form 5320.1 is a document used by the IRS to collect information about certain foreign financial assets, such as foreign accounts, trusts, and investments. The form is used to report the value of these assets and to calculate any taxes owed. It's essential to fill out the form accurately to avoid penalties and fines.

Who Needs to File Form 5320.1?

Not everyone needs to file Form 5320.1. The form is typically required for individuals who have foreign financial assets exceeding certain thresholds. These thresholds vary depending on the type of asset and the individual's tax filing status.

6 Ways to Fill Out Form 5320.1 Correctly

Filling out Form 5320.1 correctly requires attention to detail and a thorough understanding of the form's requirements. Here are six key steps to help you fill out the form accurately:

1. Gather Required Documents

Before starting to fill out Form 5320.1, gather all the necessary documents, including:

- Foreign account statements

- Trust documents

- Investment records

- Any other relevant financial documents

2. Determine the Type of Asset

Form 5320.1 requires you to identify the type of foreign financial asset you're reporting. This can include:

- Foreign bank accounts

- Foreign trusts

- Foreign investments

- Other types of foreign financial assets

3. Calculate the Value of the Asset

You'll need to calculate the value of the foreign financial asset in U.S. dollars. This can be done using the exchange rate on the last day of the tax year.

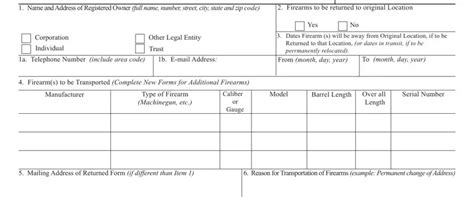

4. Complete Part I - General Information

Part I of Form 5320.1 requires you to provide general information about yourself and the foreign financial asset. This includes:

- Your name and address

- The type of asset

- The value of the asset

5. Complete Part II - Account Information

Part II of Form 5320.1 requires you to provide detailed information about the foreign financial account. This includes:

- The account number

- The name and address of the financial institution

- The type of account

6. Review and Sign the Form

Once you've completed the form, review it carefully to ensure accuracy. Sign and date the form, and keep a copy for your records.

Common Mistakes to Avoid

When filling out Form 5320.1, it's essential to avoid common mistakes that can lead to penalties and fines. Some common mistakes to avoid include:

- Failing to report all foreign financial assets

- Incorrectly calculating the value of the asset

- Failing to sign and date the form

Conclusion

Filling out Form 5320.1 correctly is crucial to avoid penalties and fines. By following the six steps outlined in this article, you can ensure you're complying with the IRS regulations. Remember to gather all necessary documents, determine the type of asset, calculate the value of the asset, complete Part I and Part II, review and sign the form, and avoid common mistakes.

We hope this article has provided you with a comprehensive guide to filling out Form 5320.1 correctly. If you have any questions or concerns, please don't hesitate to reach out to a tax professional or the IRS directly.

What is Form 5320.1 used for?

+Form 5320.1 is used to report certain foreign financial assets to the Internal Revenue Service (IRS).

Who needs to file Form 5320.1?

+Individuals who have foreign financial assets exceeding certain thresholds need to file Form 5320.1.

What are the consequences of not filing Form 5320.1?

+Failing to file Form 5320.1 can result in penalties and fines.