If you've received a lump sum payment, you may be wondering how to handle the tax implications. Form 4972 is used to report the tax on lump sum distributions from qualified retirement plans, such as 401(k) or pension plans. In this article, we'll explore five ways to handle Form 4972 tax on lump sums, so you can make informed decisions about your tax obligations.

Receiving a lump sum payment can be a significant financial event, but it's essential to consider the tax implications to avoid any unexpected surprises. The tax on lump sum distributions can be substantial, and it's crucial to understand your options for reporting and paying the tax. By exploring these five ways to handle Form 4972 tax, you'll be better equipped to manage your tax obligations and make the most of your lump sum payment.

Taxation of Lump Sum Distributions

Before we dive into the five ways to handle Form 4972 tax, it's essential to understand how lump sum distributions are taxed. Lump sum distributions are considered ordinary income and are subject to federal income tax. The tax rate on lump sum distributions depends on your income tax bracket, and the tax is typically withheld at a rate of 20%. However, you may be able to reduce the tax withholding or avoid it altogether by rolling over the lump sum distribution to an IRA or another qualified retirement plan.

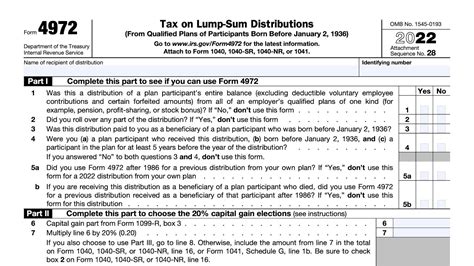

Understanding Form 4972

Form 4972 is used to report the tax on lump sum distributions from qualified retirement plans. The form is used to calculate the tax on the lump sum distribution and to report the tax withheld. If you receive a lump sum distribution, your plan administrator will provide you with a Form 1099-R, which will show the amount of the distribution and the amount of tax withheld. You'll use this information to complete Form 4972 and report the tax on your lump sum distribution.

Five Ways to Handle Form 4972 Tax

Now that we've covered the basics of Form 4972 and the taxation of lump sum distributions, let's explore five ways to handle the tax on your lump sum payment.

- Roll Over the Lump Sum Distribution

One way to handle Form 4972 tax is to roll over the lump sum distribution to an IRA or another qualified retirement plan. By rolling over the distribution, you can avoid the tax withholding and delay the tax payment until you withdraw the funds from the IRA or qualified retirement plan. To roll over the distribution, you'll need to complete Form 8606 and attach it to your tax return.

- Elect to Use the 10-Year Averaging Method

Another way to handle Form 4972 tax is to elect to use the 10-year averaging method. This method allows you to calculate the tax on the lump sum distribution by averaging the income over 10 years. To use this method, you'll need to complete Form 4972 and attach it to your tax return. You'll also need to provide documentation to support the election, such as a copy of the Form 1099-R.

How to Elect the 10-Year Averaging Method

To elect the 10-year averaging method, you'll need to follow these steps:

- Complete Form 4972 and attach it to your tax return.

- Provide documentation to support the election, such as a copy of the Form 1099-R.

- Calculate the tax on the lump sum distribution using the 10-year averaging method.

- Make an Election Under Section 402(e)

A third way to handle Form 4972 tax is to make an election under Section 402(e). This election allows you to calculate the tax on the lump sum distribution by using the minimum distribution requirements. To make this election, you'll need to complete Form 4972 and attach it to your tax return. You'll also need to provide documentation to support the election, such as a copy of the Form 1099-R.

- Claim a Credit for the Tax Withheld

A fourth way to handle Form 4972 tax is to claim a credit for the tax withheld. If you've had tax withheld from the lump sum distribution, you may be able to claim a credit for the tax withheld on your tax return. To claim the credit, you'll need to complete Form 4972 and attach it to your tax return. You'll also need to provide documentation to support the credit, such as a copy of the Form 1099-R.

How to Claim a Credit for the Tax Withheld

To claim a credit for the tax withheld, you'll need to follow these steps:

- Complete Form 4972 and attach it to your tax return.

- Provide documentation to support the credit, such as a copy of the Form 1099-R.

- Calculate the credit for the tax withheld using the instructions on Form 4972.

- Pay the Tax on the Lump Sum Distribution

A fifth way to handle Form 4972 tax is to pay the tax on the lump sum distribution. If you don't roll over the distribution or elect to use the 10-year averaging method or make an election under Section 402(e), you'll need to pay the tax on the lump sum distribution. You can pay the tax by sending a check with your tax return or by using the Electronic Federal Tax Payment System (EFTPS).

Conclusion

Receiving a lump sum payment can be a significant financial event, but it's essential to consider the tax implications to avoid any unexpected surprises. By understanding Form 4972 and the five ways to handle the tax on lump sum distributions, you'll be better equipped to manage your tax obligations and make the most of your lump sum payment. Whether you roll over the distribution, elect to use the 10-year averaging method, make an election under Section 402(e), claim a credit for the tax withheld, or pay the tax on the lump sum distribution, it's essential to follow the correct procedures to avoid any penalties or fines.

We hope this article has provided you with valuable information on handling Form 4972 tax on lump sum distributions. If you have any questions or comments, please feel free to share them below.

What is Form 4972?

+Form 4972 is used to report the tax on lump sum distributions from qualified retirement plans.

How is a lump sum distribution taxed?

+A lump sum distribution is considered ordinary income and is subject to federal income tax.

Can I roll over a lump sum distribution to an IRA?

+Yes, you can roll over a lump sum distribution to an IRA or another qualified retirement plan.