Tax season is upon us, and with it comes the daunting task of navigating complex tax forms. One of these forms is the Form 4972, which can be particularly challenging for those who are not familiar with its intricacies. In this article, we will break down the Form 4972 instructions into simple, easy-to-follow steps, ensuring that you can confidently complete this form and avoid any potential penalties.

What is Form 4972?

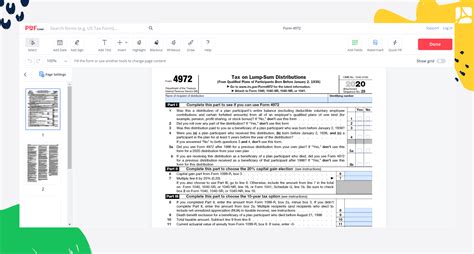

Form 4972 is a tax form used to report lump-sum distributions from qualified retirement plans, such as 401(k) or 403(b) plans. These distributions are subject to income tax, and the form is used to calculate the tax owed on these distributions. The form is typically filed by individuals who have received a lump-sum distribution from a qualified retirement plan.

Who Needs to File Form 4972?

You will need to file Form 4972 if you have received a lump-sum distribution from a qualified retirement plan and you meet one of the following conditions:

- You are under age 59 1/2 and do not qualify for an exception to the 10% penalty for early withdrawals.

- You are required to pay income tax on the distribution.

- You are eligible for the 20% withholding option.

Exceptions to Filing Form 4972

There are certain exceptions to filing Form 4972, including:

- If you rolled over the entire distribution to an IRA or another qualified retirement plan within 60 days of receiving the distribution.

- If you are 59 1/2 or older and do not need to pay the 10% penalty for early withdrawals.

- If you are eligible for an exception to the 10% penalty, such as a first-time home purchase or qualified education expenses.

How to Complete Form 4972

To complete Form 4972, follow these steps:

- Gather necessary information: Collect your tax return, the Form 1099-R from the plan administrator, and any other relevant documents.

- Enter your name, address, and Social Security number: Fill in this information at the top of the form.

- Enter the distribution information: Report the amount of the lump-sum distribution, the date of the distribution, and the plan administrator's name and address.

- Calculate the taxable amount: Use the instructions in the form to calculate the taxable amount of the distribution.

- Calculate the tax owed: Use the tax tables or the worksheet provided in the instructions to calculate the tax owed on the distribution.

- Claim the 20% withholding option: If eligible, claim the 20% withholding option by checking the box on Line 14.

- Sign and date the form: Sign and date the form, and attach it to your tax return.

Tips and Reminders

Here are some tips and reminders to keep in mind when completing Form 4972:

- File Form 4972 with your tax return: Attach Form 4972 to your tax return (Form 1040) and file it by the April 15th deadline.

- Use the correct tax year: Use the correct tax year for the distribution, even if the distribution was made in a prior year.

- Keep accurate records: Keep accurate records of the distribution, including the Form 1099-R and any other relevant documents.

Common Mistakes to Avoid

Here are some common mistakes to avoid when completing Form 4972:

- Failing to report the distribution: Failing to report the lump-sum distribution on Form 4972 can result in penalties and interest.

- Incorrectly calculating the taxable amount: Incorrectly calculating the taxable amount can result in an incorrect tax liability.

- Failing to claim the 20% withholding option: Failing to claim the 20% withholding option can result in a higher tax liability.

Conclusion

Completing Form 4972 can be a daunting task, but by following these simple steps and tips, you can confidently complete this form and avoid any potential penalties. Remember to file Form 4972 with your tax return, use the correct tax year, and keep accurate records of the distribution. If you have any questions or concerns, consult the IRS instructions or seek the advice of a tax professional.

We hope this article has provided you with a clear understanding of Form 4972 and its instructions. If you have any further questions or would like to share your experience with completing Form 4972, please comment below.

What is Form 4972 used for?

+Form 4972 is used to report lump-sum distributions from qualified retirement plans, such as 401(k) or 403(b) plans.

Who needs to file Form 4972?

+You will need to file Form 4972 if you have received a lump-sum distribution from a qualified retirement plan and you meet certain conditions, such as being under age 59 1/2 and not qualifying for an exception to the 10% penalty for early withdrawals.

What is the 20% withholding option?

+The 20% withholding option allows you to have 20% of the distribution withheld for federal income tax purposes.