The world of international taxation can be complex and overwhelming, especially for U.S. citizens and resident aliens with interests in foreign corporations. One of the key forms used to report these interests is Schedule J (Form 5471), also known as the "Information Return of U.S. Persons with Respect to Certain Foreign Corporations." In this article, we will delve into the comprehensive filing requirements of Schedule J, helping you understand the ins and outs of this critical form.

Who Needs to File Schedule J?

Before we dive into the details of Schedule J, it's essential to determine who needs to file this form. Generally, U.S. persons with interests in foreign corporations must file Form 5471. This includes:

- U.S. citizens

- Resident aliens

- Domestic partnerships

- Domestic corporations

- Estates

- Trusts

These individuals and entities must file Schedule J if they meet specific conditions, such as:

- Being a Category 1, 2, 3, 4, or 5 filer (explained below)

- Having an interest in a Controlled Foreign Corporation (CFC)

- Being a U.S. shareholder of a CFC

- Having a 10% or greater interest in a foreign corporation

Categories of Filers

There are five categories of filers for Schedule J:

- Category 1: U.S. shareholders of a CFC

- Category 2: U.S. persons who are officers or directors of a foreign corporation

- Category 3: U.S. persons who have acquired or disposed of stock in a foreign corporation

- Category 4: U.S. persons who have a 10% or greater interest in a foreign corporation

- Category 5: U.S. persons who have control of a foreign corporation

Each category has specific requirements and obligations, which we will discuss in more detail below.

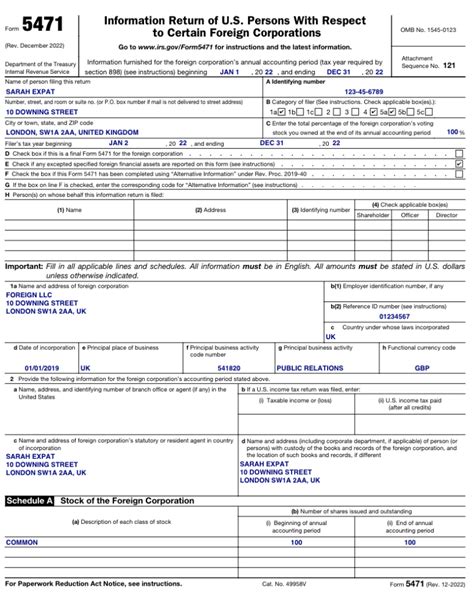

What Information is Required on Schedule J?

Schedule J requires detailed information about the foreign corporation, including:

- Name and address of the foreign corporation

- Country of incorporation

- Type of entity (e.g., corporation, partnership, trust)

- Date of incorporation

- Principal business activity

In addition to this basic information, filers must also provide more detailed data, such as:

- Financial statements (balance sheet, income statement, etc.)

- Ownership structure

- Information about related parties

- Details about transactions with the foreign corporation

Financial Statements

Filers must attach financial statements for the foreign corporation, including:

- Balance sheet

- Income statement

- Statement of changes in equity

- Statement of cash flows

These financial statements must be prepared in accordance with U.S. GAAP (Generally Accepted Accounting Principles) or IFRS (International Financial Reporting Standards).

Penalties for Non-Compliance

Failure to file Schedule J or providing incomplete or inaccurate information can result in significant penalties, including:

- $10,000 penalty for failing to file Form 5471

- Additional penalties for failing to file Schedule J

- Potential loss of deductions or credits

It's essential to ensure accurate and timely filing of Schedule J to avoid these penalties and maintain compliance with U.S. tax laws.

Best Practices for Filing Schedule J

To ensure a smooth filing process, follow these best practices:

- Seek professional advice from a qualified tax professional or attorney

- Maintain accurate and detailed records of foreign corporation activities

- Ensure timely filing of Form 5471 and Schedule J

- Review and understand the specific requirements for your category of filer

By following these best practices, you can minimize the risk of errors and penalties, ensuring compliance with U.S. tax laws.

Conclusion

In conclusion, Schedule J is a critical form for U.S. persons with interests in foreign corporations. Understanding the comprehensive filing requirements is essential to ensure compliance with U.S. tax laws. By following the guidelines and best practices outlined in this article, you can navigate the complexities of Schedule J and maintain accurate and timely filing.

We encourage you to share your experiences and insights about filing Schedule J in the comments below. If you have any specific questions or concerns, please don't hesitate to reach out to our team of tax experts.

What is the purpose of Schedule J?

+Schedule J is used to report information about foreign corporations, including financial statements, ownership structure, and transactions.

Who needs to file Schedule J?

+U.S. persons with interests in foreign corporations, including U.S. citizens, resident aliens, domestic partnerships, domestic corporations, estates, and trusts.

What are the penalties for non-compliance?

+Penalties for non-compliance include a $10,000 penalty for failing to file Form 5471, additional penalties for failing to file Schedule J, and potential loss of deductions or credits.