Tax Reporting for Rental Income: Understanding the Difference between Form 4835 and Schedule E

As a rental property owner, it's essential to understand the tax implications of your investment. The IRS requires you to report your rental income and expenses on your tax return, but the forms you use can be confusing. In this article, we'll delve into the differences between Form 4835 and Schedule E, helping you to navigate the tax reporting process for your rental income.

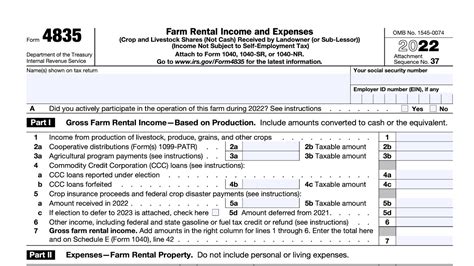

What is Form 4835?

Form 4835, also known as the Farm Rental Income and Expenses form, is used to report rental income and expenses from farmland or other agricultural property. This form is specifically designed for farmers and agricultural property owners who rent out their land to others. If you own a farm or agricultural property and receive rental income, you'll need to file Form 4835 with your tax return.

What is Schedule E?

Schedule E, also known as the Supplemental Income and Loss form, is used to report income and expenses from rental properties, including residential and commercial properties. This schedule is a part of the Form 1040 tax return and is used to report income and expenses from various sources, including rental properties, royalties, and partnerships.

Key Differences between Form 4835 and Schedule E

While both Form 4835 and Schedule E are used to report rental income and expenses, there are key differences between the two:

- Type of Property: Form 4835 is specifically designed for farmland or agricultural property, while Schedule E is used for residential and commercial properties.

- Rental Income: Form 4835 reports rental income from farmland or agricultural property, while Schedule E reports rental income from all types of properties, including residential and commercial.

- Expenses: Both forms allow you to report expenses related to the rental property, but Form 4835 has specific lines for reporting farm-related expenses, such as fertilizers and equipment.

How to Report Rental Income on Form 4835

To report rental income on Form 4835, you'll need to follow these steps:

- Complete Part I: Report your farm rental income and expenses in Part I of the form.

- Report Income: Report your total farm rental income on line 1a.

- Report Expenses: Report your total farm-related expenses on line 2.

- Calculate Net Income: Calculate your net income from farm rentals by subtracting your total expenses from your total income.

How to Report Rental Income on Schedule E

To report rental income on Schedule E, you'll need to follow these steps:

- Complete Part I: Report your rental income and expenses in Part I of the schedule.

- Report Income: Report your total rental income on line 3.

- Report Expenses: Report your total rental expenses on line 4.

- Calculate Net Income: Calculate your net income from rentals by subtracting your total expenses from your total income.

Tips for Reporting Rental Income on Form 4835 and Schedule E

- Keep Accurate Records: Keep accurate records of your rental income and expenses, including receipts, invoices, and bank statements.

- Consult a Tax Professional: Consult a tax professional if you're unsure about how to report your rental income or expenses.

- File on Time: File your tax return on time to avoid penalties and interest.

Conclusion

Reporting rental income on Form 4835 and Schedule E can be complex, but understanding the differences between the two forms can help you navigate the tax reporting process. By following the steps outlined in this article, you can ensure that you're reporting your rental income and expenses accurately and taking advantage of the tax deductions available to you.

What is the difference between Form 4835 and Schedule E?

+Form 4835 is used to report rental income and expenses from farmland or agricultural property, while Schedule E is used to report rental income and expenses from all types of properties, including residential and commercial.

Do I need to file both Form 4835 and Schedule E?

+No, you only need to file one or the other, depending on the type of property you own. If you own farmland or agricultural property, you'll file Form 4835. If you own residential or commercial property, you'll file Schedule E.

What expenses can I deduct on Form 4835 and Schedule E?

+You can deduct expenses related to the rental property, including mortgage interest, property taxes, insurance, and maintenance. On Form 4835, you can also deduct farm-related expenses, such as fertilizers and equipment.