Employee stock transactions can be a complex and sensitive topic, especially when it comes to reporting and compliance. As an employer, it's essential to understand the differences between Form 3922 and Form 3921, two crucial documents used to report employee stock transactions to the Internal Revenue Service (IRS). In this article, we'll delve into the world of employee stock transactions, exploring the purposes, requirements, and differences between these two forms.

The Importance of Accurate Reporting

Before we dive into the specifics of Form 3922 and Form 3921, it's crucial to understand the importance of accurate reporting. The IRS requires employers to report certain employee stock transactions to ensure compliance with tax laws and regulations. Failure to report these transactions accurately can result in penalties, fines, and even audits. As an employer, it's your responsibility to ensure that you're meeting the necessary reporting requirements.

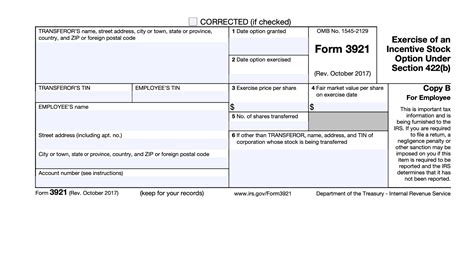

Form 3921: Exercise of an Incentive Stock Option Under Section 422(b)

Form 3921 is used to report the exercise of an incentive stock option (ISO) under Section 422(b) of the Internal Revenue Code. An ISO is a type of stock option that allows employees to purchase company stock at a discounted price. When an employee exercises an ISO, the employer must report the transaction to the IRS using Form 3921.

The form requires employers to report the following information:

- The name, address, and taxpayer identification number (TIN) of the employee

- The name, address, and TIN of the employer

- The date the ISO was granted

- The date the ISO was exercised

- The number of shares acquired

- The exercise price per share

- The fair market value (FMV) of the shares on the exercise date

Form 3922: Transfer of Stock Acquired Through an Employee Stock Purchase Plan Under Section 423(c)

Form 3922 is used to report the transfer of stock acquired through an employee stock purchase plan (ESPP) under Section 423(c) of the Internal Revenue Code. An ESPP allows employees to purchase company stock at a discounted price through payroll deductions. When an employee transfers stock acquired through an ESPP, the employer must report the transaction to the IRS using Form 3922.

The form requires employers to report the following information:

- The name, address, and TIN of the employee

- The name, address, and TIN of the employer

- The date the ESPP was established

- The date the stock was transferred

- The number of shares transferred

- The FMV of the shares on the transfer date

Key Differences Between Form 3922 and Form 3921

While both forms are used to report employee stock transactions, there are key differences between them:

- Type of transaction: Form 3921 reports the exercise of an ISO, while Form 3922 reports the transfer of stock acquired through an ESPP.

- Reporting requirements: Form 3921 requires employers to report the exercise price per share, while Form 3922 requires employers to report the FMV of the shares on the transfer date.

- Tax implications: The tax implications of an ISO exercise are different from those of an ESPP transfer. ISO exercises are generally not subject to taxation, while ESPP transfers may be subject to capital gains tax.

Best Practices for Employers

To ensure accurate reporting and compliance with tax laws and regulations, employers should follow these best practices:

- Maintain accurate records: Keep accurate records of employee stock transactions, including the date, number of shares, and FMV of the shares.

- Use the correct form: Use Form 3921 to report ISO exercises and Form 3922 to report ESPP transfers.

- Report transactions timely: Report employee stock transactions to the IRS by January 31st of each year.

- Provide employee statements: Provide employees with statements showing the details of their stock transactions.

Conclusion

In conclusion, Form 3922 and Form 3921 are two critical documents used to report employee stock transactions to the IRS. Understanding the differences between these forms is essential for employers to ensure accurate reporting and compliance with tax laws and regulations. By following best practices and using the correct form, employers can avoid penalties and fines, and ensure that their employees receive accurate and timely reporting.

Frequently Asked Questions

What is the difference between an ISO and an ESPP?

+An ISO is a type of stock option that allows employees to purchase company stock at a discounted price, while an ESPP is a plan that allows employees to purchase company stock at a discounted price through payroll deductions.

What is the deadline for reporting employee stock transactions to the IRS?

+The deadline for reporting employee stock transactions to the IRS is January 31st of each year.

What are the tax implications of an ISO exercise?

+ISO exercises are generally not subject to taxation, but may be subject to alternative minimum tax (AMT).