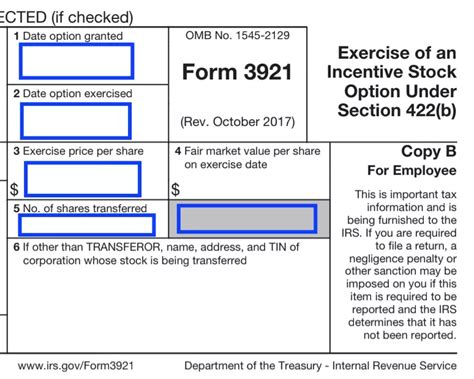

The IRS Form 3921, also known as the Carta, is a tax document that employers must file with the Internal Revenue Service (IRS) to report certain equity transactions made by employees. The form is used to report the exercise of incentive stock options (ISOs) and the transfer of stock acquired through employee stock purchase plans (ESPPs).

The IRS requires employers to file Form 3921 by January 31st of each year, and it's essential to understand the filing requirements to avoid any penalties or fines.

Why is Form 3921 important?

Form 3921 is crucial because it helps the IRS track the tax implications of equity transactions made by employees. The form provides the IRS with the necessary information to determine the tax liability of employees who exercise ISOs or transfer stock acquired through ESPPs.

What information is reported on Form 3921?

Form 3921 requires employers to report the following information:

- The name, address, and employer identification number (EIN) of the employer

- The name, address, and taxpayer identification number (TIN) of the employee

- The date of the exercise or transfer

- The number of shares exercised or transferred

- The fair market value of the shares on the date of exercise or transfer

- The exercise price or purchase price of the shares

Who is required to file Form 3921?

Employers who offer ISOs or ESPPs to their employees are required to file Form 3921. This includes:

- Corporations that offer ISOs or ESPPs to their employees

- Limited liability companies (LLCs) that offer ISOs or ESPPs to their employees

- Partnerships that offer ISOs or ESPPs to their employees

What are the filing requirements for Form 3921?

Employers must file Form 3921 with the IRS by January 31st of each year. The form must be filed electronically or on paper, depending on the number of forms being filed.

- Employers who file 250 or more Forms 3921 must file electronically using the IRS's Filing Information Returns Electronically (FIRE) system.

- Employers who file fewer than 250 Forms 3921 can file on paper or electronically.

What are the penalties for failing to file Form 3921?

Employers who fail to file Form 3921 or file late may be subject to penalties and fines. The penalty for failing to file Form 3921 can range from $30 to $100 per form, depending on the number of forms and the timing of the filing.

How to file Form 3921

Employers can file Form 3921 electronically or on paper. To file electronically, employers must use the IRS's FIRE system. To file on paper, employers can use the IRS's website to download and print the form.

Tips for accurate filing

To ensure accurate filing, employers should:

- Verify the accuracy of the information reported on Form 3921

- Use the correct form and instructions

- File on time to avoid penalties and fines

- Keep accurate records of the forms filed and the information reported

Common mistakes to avoid

Common mistakes to avoid when filing Form 3921 include:

- Filing late or failing to file

- Reporting incorrect information

- Using the wrong form or instructions

- Failing to verify the accuracy of the information reported

Conclusion

Form 3921 is an essential tax document that employers must file with the IRS to report certain equity transactions made by employees. It's crucial to understand the filing requirements to avoid any penalties or fines. By following the tips and guidelines outlined in this article, employers can ensure accurate and timely filing of Form 3921.

FAQ Section

What is Form 3921 used for?

+Form 3921 is used to report the exercise of incentive stock options (ISOs) and the transfer of stock acquired through employee stock purchase plans (ESPPs).

Who is required to file Form 3921?

+Employers who offer ISOs or ESPPs to their employees are required to file Form 3921.

What are the filing requirements for Form 3921?

+Employers must file Form 3921 with the IRS by January 31st of each year. The form must be filed electronically or on paper, depending on the number of forms being filed.