Filing taxes can be a daunting task, especially when dealing with specific forms like Form 3804. Fortunately, TurboTax is here to make the process easier. In this article, we will explore five ways to fill out Form 3804 with TurboTax, making tax season less stressful for you.

As a taxpayer, you may be wondering what Form 3804 is and why you need to fill it out. Form 3804 is used to report the General Business Credit, which can help reduce your tax liability. With TurboTax, you can easily navigate the form and take advantage of the credits you're eligible for.

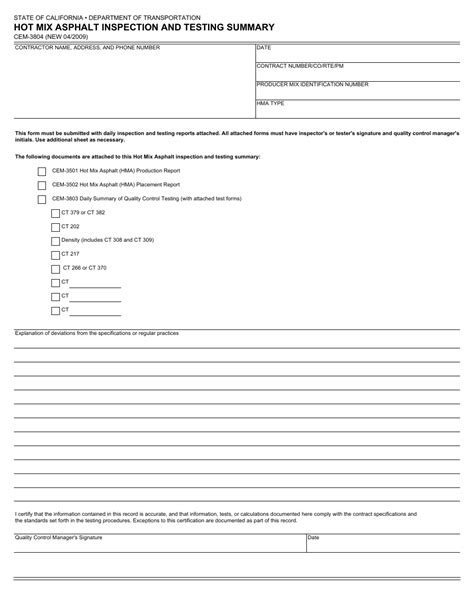

Understanding Form 3804

Before we dive into the five ways to fill out Form 3804 with TurboTax, let's take a closer look at what the form entails. Form 3804 is used to calculate the General Business Credit, which can be claimed by businesses and individuals who have incurred certain expenses. These expenses can include things like research and development costs, low-income housing credits, and renewable energy credits.

What You Need to Know About Form 3804

To fill out Form 3804 with TurboTax, you'll need to have some information ready. This includes:

- Your business income and expenses

- The type and amount of credits you're claiming

- Any carryover credits from previous years

Having this information readily available will make the process of filling out Form 3804 much smoother.

5 Ways to Fill Out Form 3804 with TurboTax

Now that we've covered the basics of Form 3804, let's explore the five ways to fill it out with TurboTax.

1. Use the TurboTax Interview Process

One of the easiest ways to fill out Form 3804 with TurboTax is to use the interview process. This involves answering a series of questions about your business and the credits you're claiming. TurboTax will then use this information to fill out the form for you.

2. Import Your Business Expenses

If you have a large number of business expenses to report, you can import them directly into TurboTax. This can save you time and reduce the risk of errors.

3. Use the TurboTax Form 3804 Template

TurboTax provides a template for Form 3804 that you can use to fill out the form. This template includes all the necessary fields and calculations, making it easy to fill out the form accurately.

4. Get Help from a TurboTax Expert

If you're unsure about how to fill out Form 3804 or need help with a specific section, you can get assistance from a TurboTax expert. These experts are available to answer your questions and provide guidance on how to fill out the form.

5. Use the TurboTax Audit Support

Finally, if you're audited by the IRS, TurboTax offers audit support to help you navigate the process. This includes access to a team of experts who can help you understand the audit process and provide guidance on how to respond to the IRS.

Conclusion

Filling out Form 3804 with TurboTax is easier than you think. By using the interview process, importing your business expenses, using the TurboTax template, getting help from an expert, and using the audit support, you can ensure that your form is filled out accurately and efficiently. Don't let tax season stress you out – let TurboTax help you navigate the process with ease.

Now it's your turn! Share your experiences with filling out Form 3804 with TurboTax in the comments below. Have you used any of the methods mentioned in this article? Do you have any tips or tricks to share?

What is Form 3804 used for?

+Form 3804 is used to report the General Business Credit, which can help reduce your tax liability.

Can I import my business expenses into TurboTax?

+Yes, you can import your business expenses directly into TurboTax to save time and reduce the risk of errors.

Does TurboTax offer audit support?

+Yes, TurboTax offers audit support to help you navigate the audit process and provide guidance on how to respond to the IRS.