Filing the Form 3520-A can be a daunting task, especially for those who are new to the world of foreign trusts and reporting requirements. As a U.S. taxpayer with interests in foreign trusts, it's essential to understand the Form 3520-A instructions to avoid penalties and ensure compliance with the IRS. In this article, we will provide a step-by-step guide to help you navigate the Form 3520-A filing process.

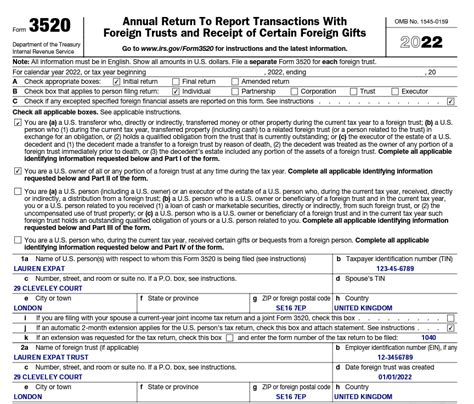

The Form 3520-A, also known as the Annual Information Return of Foreign Trust With a U.S. Owner, is used to report information about foreign trusts with U.S. owners. The form is required to be filed by the trust's owner, and it's essential to understand the instructions to ensure accurate and complete reporting.

Understanding the Form 3520-A Purpose

Before we dive into the instructions, it's crucial to understand the purpose of the Form 3520-A. The form is designed to provide the IRS with information about foreign trusts with U.S. owners, including the trust's income, deductions, and credits. The form also requires the reporting of certain transactions, such as distributions and contributions.

Who Needs to File Form 3520-A?

Not everyone needs to file the Form 3520-A. The form is required to be filed by U.S. taxpayers who have an interest in a foreign trust, including:

- U.S. owners of foreign trusts

- Grantors of foreign trusts

- Beneficiaries of foreign trusts

- Trustees of foreign trusts

If you're unsure whether you need to file the Form 3520-A, it's recommended that you consult with a tax professional or the IRS.

Gathering Required Documents

Before you start filling out the Form 3520-A, you'll need to gather certain documents, including:

- The trust's income statement

- The trust's balance sheet

- Records of distributions and contributions

- Records of transactions with the trust

It's essential to have all the required documents before starting the filing process to ensure accuracy and completeness.

Form 3520-A Instructions: A Step-by-Step Guide

Now that we've covered the basics, let's move on to the step-by-step guide to filing the Form 3520-A.

Step 1: Identify the Trust's Tax Year

The first step is to identify the trust's tax year. The trust's tax year is the calendar year, unless the trust has a different tax year. If the trust has a different tax year, you'll need to indicate this on the form.

Step 2: Complete Part I - General Information

Part I of the Form 3520-A requires general information about the trust, including:

- The trust's name and address

- The trust's employer identification number (EIN)

- The trust's tax year

- The name and address of the U.S. owner

Section A - Trust Information

Section A requires information about the trust, including:

- The trust's name and address

- The trust's EIN

- The trust's tax year

Section B - U.S. Owner Information

Section B requires information about the U.S. owner, including:

- The U.S. owner's name and address

- The U.S. owner's Social Security number or EIN

Step 3: Complete Part II - Income and Deductions

Part II of the Form 3520-A requires information about the trust's income and deductions.

Section A - Income

Section A requires information about the trust's income, including:

- Gross income

- Deductions

- Net income

Section B - Deductions

Section B requires information about the trust's deductions, including:

- Deductions for expenses

- Deductions for depreciation

Step 4: Complete Part III - Transactions with the Trust

Part III of the Form 3520-A requires information about transactions with the trust.

Section A - Distributions

Section A requires information about distributions from the trust, including:

- The amount of the distribution

- The date of the distribution

Section B - Contributions

Section B requires information about contributions to the trust, including:

- The amount of the contribution

- The date of the contribution

Conclusion

Filing the Form 3520-A can be a complex process, but by following these steps, you'll be able to ensure accurate and complete reporting. Remember to gather all required documents, identify the trust's tax year, complete Part I - General Information, Part II - Income and Deductions, and Part III - Transactions with the Trust. If you're unsure about any part of the process, it's recommended that you consult with a tax professional or the IRS.

What's Next?

Now that you've completed the Form 3520-A, it's essential to submit it to the IRS by the deadline. The deadline for filing the Form 3520-A is the 15th day of the 3rd month after the end of the trust's tax year. If you're unable to meet the deadline, you can request an extension by filing Form 7004.

Additional Resources

For more information about the Form 3520-A, you can visit the IRS website or consult with a tax professional. Additionally, you can use tax software to help with the filing process.

Frequently Asked Questions

What is the purpose of the Form 3520-A?

+The Form 3520-A is used to report information about foreign trusts with U.S. owners, including the trust's income, deductions, and credits.

Who needs to file the Form 3520-A?

+U.S. taxpayers with an interest in a foreign trust, including U.S. owners, grantors, beneficiaries, and trustees, need to file the Form 3520-A.

What is the deadline for filing the Form 3520-A?

+The deadline for filing the Form 3520-A is the 15th day of the 3rd month after the end of the trust's tax year.