As a contractor, managing your finances efficiently is crucial to the success of your business. One way to minimize expenses is by taking advantage of tax exemptions on purchases related to your contracting work. Home Depot, one of the largest home improvement retailers in the United States, offers a tax exemption program for eligible contractors. In this article, we will guide you through the process of obtaining a Home Depot tax exemption form, understanding the benefits, and providing tips on how to make the most out of this program.

What is the Home Depot Tax Exemption Program?

The Home Depot tax exemption program is designed for contractors who purchase materials and supplies for resale or use in their business. This program allows eligible contractors to exempt their purchases from sales tax, reducing their overall expenses. The program is available in most states, but the specific requirements and benefits may vary.

Benefits of the Home Depot Tax Exemption Program

The Home Depot tax exemption program offers several benefits to eligible contractors, including:

- Reduced expenses: By exempting purchases from sales tax, contractors can minimize their expenses and increase their profit margins.

- Simplified tax compliance: The program streamlines the tax exemption process, reducing the administrative burden on contractors.

- Increased competitiveness: Contractors who participate in the program can offer more competitive pricing to their customers, making them more attractive in the market.

Who is Eligible for the Home Depot Tax Exemption Program?

To be eligible for the Home Depot tax exemption program, contractors must meet specific requirements, which may vary by state. Generally, eligible contractors include:

- Licensed contractors who purchase materials and supplies for resale or use in their business.

- Businesses that are registered with the state and have a valid tax ID number.

- Contractors who provide documentation, such as a resale certificate or exemption certificate, to support their tax exemption claim.

How to Apply for the Home Depot Tax Exemption Program

To apply for the Home Depot tax exemption program, contractors can follow these steps:

- Check eligibility: Verify that your business meets the eligibility requirements for the program.

- Gather documentation: Collect the necessary documentation, such as a resale certificate or exemption certificate, to support your tax exemption claim.

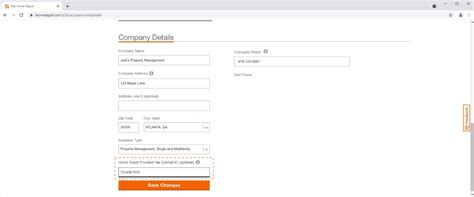

- Create a Home Depot account: Establish a business account with Home Depot, either online or in-store.

- Apply for tax exemption: Submit your application and supporting documentation to Home Depot's tax exemption department.

- Receive approval: Once approved, you will receive a tax exemption certificate, which must be presented at the time of purchase.

Home Depot Tax Exemption Form Requirements

The Home Depot tax exemption form requires contractors to provide specific information and documentation, including:

- Business name and address

- Tax ID number

- Resale certificate or exemption certificate

- Description of the business and the type of purchases being made

- Signature of the business owner or authorized representative

Tips for Using the Home Depot Tax Exemption Form

To make the most out of the Home Depot tax exemption program, contractors should:

- Keep accurate records: Maintain detailed records of purchases and tax exemptions to ensure compliance with state regulations.

- Use the correct documentation: Ensure that all documentation, including the resale certificate or exemption certificate, is accurate and up-to-date.

- Monitor program changes: Stay informed about changes to the program, including eligibility requirements and documentation needs.

Common Mistakes to Avoid with the Home Depot Tax Exemption Form

To avoid common mistakes when using the Home Depot tax exemption form, contractors should:

- Verify eligibility: Ensure that your business meets the eligibility requirements for the program.

- Provide accurate documentation: Submit accurate and complete documentation to support your tax exemption claim.

- Keep records up-to-date: Maintain current records of purchases and tax exemptions to ensure compliance with state regulations.

Conclusion

The Home Depot tax exemption program is a valuable resource for contractors who want to minimize their expenses and increase their competitiveness. By understanding the program's benefits, eligibility requirements, and documentation needs, contractors can make the most out of this program. Remember to keep accurate records, use the correct documentation, and monitor program changes to ensure compliance and maximize benefits.

What is the Home Depot tax exemption program?

+The Home Depot tax exemption program is designed for contractors who purchase materials and supplies for resale or use in their business. This program allows eligible contractors to exempt their purchases from sales tax, reducing their overall expenses.

Who is eligible for the Home Depot tax exemption program?

+To be eligible for the Home Depot tax exemption program, contractors must meet specific requirements, which may vary by state. Generally, eligible contractors include licensed contractors who purchase materials and supplies for resale or use in their business.

How do I apply for the Home Depot tax exemption program?

+To apply for the Home Depot tax exemption program, contractors can follow these steps: check eligibility, gather documentation, create a Home Depot account, apply for tax exemption, and receive approval.