Missouri taxpayers have a unique set of tax obligations and forms to navigate, and one of the most important is Form 2827, also known as the Missouri Tax Preparer Registration Form. This form is a crucial part of the tax preparation process for many taxpayers in the state, and understanding its purpose, requirements, and implications is essential for individuals and tax professionals alike.

In this article, we will delve into the world of Form 2827, exploring its history, requirements, benefits, and potential challenges. We will also examine the steps involved in completing the form, provide practical examples, and discuss the importance of accuracy and compliance. By the end of this article, you will have a comprehensive understanding of Form 2827 and be better equipped to navigate the complexities of Missouri tax preparation.

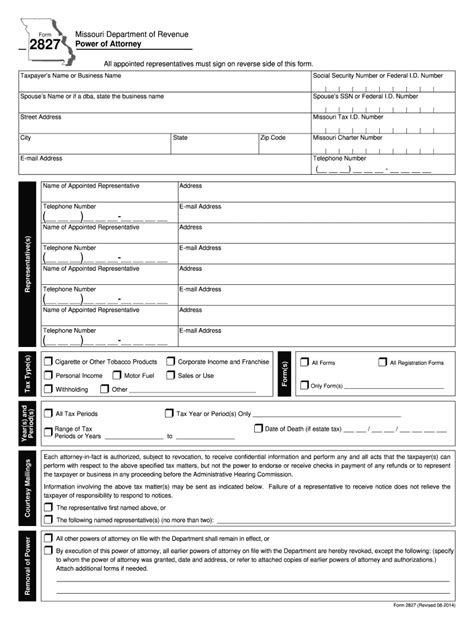

What is Form 2827?

Form 2827 is a registration form required by the Missouri Department of Revenue for tax preparers who prepare Missouri individual income tax returns. The form is designed to ensure that tax preparers meet certain standards and guidelines, providing an added layer of protection for taxpayers and promoting compliance with state tax laws.

History of Form 2827

In 2011, the Missouri Department of Revenue introduced Form 2827 as part of its efforts to regulate tax preparation services and prevent identity theft. The form requires tax preparers to register with the state and obtain a unique registration number, which must be included on all Missouri individual income tax returns prepared by the tax preparer.

Requirements for Form 2827

To complete Form 2827, tax preparers must meet certain requirements, including:

- Obtaining a valid Preparer Tax Identification Number (PTIN) from the Internal Revenue Service (IRS)

- Registering with the Missouri Department of Revenue as a tax preparer

- Passing a background check and tax compliance check

- Completing a state-approved tax preparation course

- Obtaining professional liability insurance

Benefits of Form 2827

The implementation of Form 2827 has several benefits for taxpayers and tax professionals:

- Increased security: By requiring tax preparers to register with the state, Form 2827 helps prevent identity theft and protects taxpayer information.

- Improved accuracy: The form promotes compliance with state tax laws and regulations, reducing errors and inconsistencies on tax returns.

- Enhanced professionalism: Form 2827 promotes a higher level of professionalism among tax preparers, ensuring that they meet certain standards and guidelines.

Steps to Complete Form 2827

Completing Form 2827 involves several steps:

- Obtain a PTIN: Tax preparers must obtain a valid PTIN from the IRS before registering with the Missouri Department of Revenue.

- Register with the Missouri Department of Revenue: Tax preparers must register with the state and obtain a unique registration number.

- Complete the registration form: Tax preparers must complete Form 2827, providing required information, including their PTIN, business name, and address.

- Submit the form: The completed form must be submitted to the Missouri Department of Revenue.

Practical Examples

Let's consider a few practical examples of how Form 2827 affects tax preparers and taxpayers:

- Example 1: John, a tax preparer, prepares individual income tax returns for clients in Missouri. To comply with state regulations, John must register with the Missouri Department of Revenue and obtain a unique registration number. He must also complete Form 2827 and submit it to the state.

- Example 2: Sarah, a taxpayer, hires a tax preparer to prepare her individual income tax return. The tax preparer must include their registration number on Sarah's tax return, ensuring compliance with state regulations.

Challenges and Controversies

While Form 2827 has several benefits, it also presents challenges and controversies:

- Increased costs: Tax preparers may incur additional costs to comply with state regulations, including the cost of registration and liability insurance.

- Regulatory burden: Some tax preparers may argue that the requirements for Form 2827 create an undue regulatory burden, limiting their ability to provide services to taxpayers.

Best Practices

To ensure compliance with state regulations and avoid potential challenges, tax preparers and taxpayers should follow these best practices:

- Understand state regulations: Familiarize yourself with Missouri tax laws and regulations, including the requirements for Form 2827.

- Register promptly: Tax preparers should register with the state and obtain a unique registration number in a timely manner.

- Maintain accuracy: Ensure that all information on Form 2827 is accurate and complete.

Conclusion

Form 2827 is a critical component of Missouri tax preparation, promoting compliance with state tax laws and regulations. By understanding the history, requirements, benefits, and potential challenges of Form 2827, tax preparers and taxpayers can navigate the complexities of Missouri tax preparation with confidence. Remember to follow best practices, including registering promptly and maintaining accuracy, to ensure a smooth and compliant tax preparation process.

Frequently Asked Questions

What is the purpose of Form 2827?

+Form 2827 is a registration form required by the Missouri Department of Revenue for tax preparers who prepare Missouri individual income tax returns. The form ensures that tax preparers meet certain standards and guidelines, providing an added layer of protection for taxpayers and promoting compliance with state tax laws.

Who must complete Form 2827?

+Tax preparers who prepare Missouri individual income tax returns must complete Form 2827. This includes individuals and businesses that provide tax preparation services to taxpayers in Missouri.

What are the benefits of Form 2827?

+The implementation of Form 2827 has several benefits, including increased security, improved accuracy, and enhanced professionalism among tax preparers.