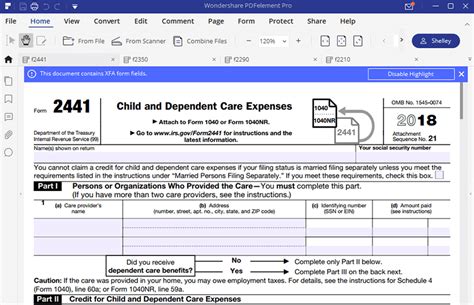

Filling out tax forms can be a daunting task, but with the right guidance, it can be a breeze. In this article, we will walk you through three easy ways to fill out Form 2441, also known as the Child and Dependent Care Expenses form. Specifically, we will focus on providing the provider's Social Security Number (SSN) or Employer Identification Number (EIN).

Form 2441 is used to claim the Child and Dependent Care Credit, which is a tax credit that helps working individuals and couples offset the cost of childcare or adult care while they work or look for work. One of the required pieces of information on this form is the provider's SSN or EIN.

Understanding the Importance of the Provider's SSN or EIN

Before we dive into the three easy ways to fill out Form 2441, it's essential to understand why the provider's SSN or EIN is necessary. The IRS requires this information to verify the identity of the care provider and ensure that the credit is being claimed correctly. Providing the correct SSN or EIN also helps prevent errors and delays in processing your tax return.

Method 1: Gather Information from Your Care Provider

The first and most straightforward way to fill out Form 2441 is to gather the necessary information from your care provider. This can be done by:

- Asking your care provider for their SSN or EIN

- Checking your payment receipts or invoices for the provider's SSN or EIN

- Contacting your care provider's administrative office to obtain the required information

Make sure to verify the accuracy of the SSN or EIN with your care provider to avoid errors on your tax return.

Tips for Gathering Information from Your Care Provider

- Be clear and direct when asking your care provider for their SSN or EIN

- Provide your care provider with a sample of Form 2441 to help them understand what information is required

- Follow up with your care provider to ensure you receive the necessary information in a timely manner

Method 2: Use Last Year's Tax Return

If you claimed the Child and Dependent Care Credit on your previous year's tax return, you can use that information to fill out Form 2441 for the current year. Simply:

- Review your previous year's tax return to find the provider's SSN or EIN

- Verify that the provider's information has not changed

- Use the same SSN or EIN on your current year's tax return

Tips for Using Last Year's Tax Return

- Make sure to review your previous year's tax return carefully to ensure accuracy

- Verify that the provider's information has not changed to avoid errors on your current year's tax return

- Use this method only if you are certain that the provider's information has not changed

Method 3: Contact the IRS

If you are unable to obtain the provider's SSN or EIN using the first two methods, you can contact the IRS for assistance. You can:

- Call the IRS at 1-800-829-1040 (individuals) or 1-800-829-4933 (businesses)

- Visit the IRS website at irs.gov to find information on how to obtain the provider's SSN or EIN

- Contact your local IRS office for in-person assistance

Tips for Contacting the IRS

- Be prepared to provide your tax identification number and other required information

- Have your care provider's information readily available to provide to the IRS

- Follow the IRS's instructions carefully to ensure that you receive the necessary information

Conclusion: Take Control of Your Taxes

Filling out Form 2441 can be a straightforward process if you have the right information. By gathering information from your care provider, using last year's tax return, or contacting the IRS, you can easily provide the required SSN or EIN and claim the Child and Dependent Care Credit. Remember to take your time, be accurate, and seek help when needed. With these three easy methods, you'll be on your way to completing your tax return with confidence.

We hope this article has been informative and helpful in guiding you through the process of filling out Form 2441. If you have any questions or comments, please feel free to share them below.

What is Form 2441 used for?

+Form 2441 is used to claim the Child and Dependent Care Credit, which is a tax credit that helps working individuals and couples offset the cost of childcare or adult care while they work or look for work.

Why is the provider's SSN or EIN required on Form 2441?

+The provider's SSN or EIN is required to verify the identity of the care provider and ensure that the credit is being claimed correctly.

What if I am unable to obtain the provider's SSN or EIN?

+If you are unable to obtain the provider's SSN or EIN, you can contact the IRS for assistance.