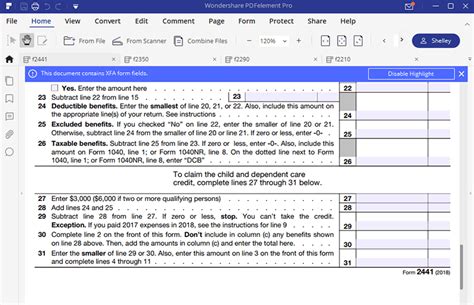

Completing Form 2441, also known as the Child and Dependent Care Expenses form, is a crucial step for taxpayers who claim childcare expenses on their tax return. Line 26 of this form is particularly important, as it requires taxpayers to report the amount of dependent care benefits they received from their employer. In this article, we will provide five tips to help you complete Form 2441 Line 26 correctly.

Understanding Form 2441 and Line 26

Before we dive into the tips, let's take a brief look at what Form 2441 is and what Line 26 represents. Form 2441 is used by taxpayers to claim childcare expenses related to their work or education. Line 26 specifically asks for the amount of dependent care benefits received from an employer. This can include benefits received through a flexible spending account (FSA) or other reimbursement programs.

Tips for Completing Form 2441 Line 26

Now that we have a basic understanding of Form 2441 and Line 26, let's move on to the tips.

Tip 1: Review Your W-2 Form

The first step in completing Form 2441 Line 26 is to review your W-2 form. Your employer should report the amount of dependent care benefits you received in box 10 of your W-2 form. Make sure to check this box carefully, as the amount reported here will be the amount you enter on Line 26 of Form 2441.

Tip 2: Check Your FSA Account

If you have a flexible spending account (FSA) through your employer, you may have received dependent care benefits through this account. Check your FSA account statement to determine the amount of benefits you received. This amount should be reported on Line 26 of Form 2441.

FSA Account Benefits and Line 26

It's essential to note that FSA account benefits are subject to certain limits and rules. For example, the maximum amount of FSA benefits you can receive for dependent care expenses is $5,000 per year. Additionally, FSA benefits are subject to income tax, so you may need to report these benefits on your tax return.

Tip 3: Consider Other Dependent Care Benefits

In addition to FSA benefits, you may have received other dependent care benefits from your employer. These benefits can include reimbursement programs or other types of assistance. Make sure to consider all dependent care benefits you received when completing Line 26 of Form 2441.

Tip 4: Report Benefits on Line 26

Once you have determined the amount of dependent care benefits you received, report this amount on Line 26 of Form 2441. Make sure to follow the instructions provided with the form carefully, as the reporting requirements may vary depending on your specific situation.

Tip 5: Keep Accurate Records

Finally, it's essential to keep accurate records of your dependent care benefits and expenses. This includes receipts, invoices, and other documentation related to your childcare expenses. Having these records will help you complete Form 2441 Line 26 accurately and ensure you are taking advantage of the dependent care credit.

Common Mistakes to Avoid

When completing Form 2441 Line 26, there are several common mistakes to avoid. These include:

- Failing to report dependent care benefits received from an employer

- Reporting incorrect amounts on Line 26

- Failing to keep accurate records of dependent care benefits and expenses

Conclusion

Completing Form 2441 Line 26 requires careful attention to detail and accurate reporting of dependent care benefits. By following these five tips, you can ensure you complete this line correctly and take advantage of the dependent care credit. Remember to review your W-2 form, check your FSA account, consider other dependent care benefits, report benefits on Line 26, and keep accurate records.

Get Help with Form 2441 Line 26

If you need help with Form 2441 Line 26 or have questions about dependent care benefits, consider consulting a tax professional. They can provide guidance and ensure you are taking advantage of the dependent care credit.

Stay Informed

Stay informed about changes to Form 2441 and the dependent care credit by visiting the IRS website or consulting with a tax professional. By staying informed, you can ensure you are taking advantage of the credits and deductions available to you.

What is Form 2441?

+Form 2441 is a tax form used to claim childcare expenses related to work or education.

What is Line 26 on Form 2441?

+Line 26 on Form 2441 is used to report the amount of dependent care benefits received from an employer.

What is a flexible spending account (FSA)?

+A flexible spending account (FSA) is a type of employee benefit that allows you to set aside pre-tax dollars for certain expenses, including dependent care expenses.