The IRS Form 2439 is a crucial document for mutual fund investors, particularly those who receive undistributed long-term capital gains from their investments. As a taxpayer, understanding the purpose and significance of this form can help you navigate the complexities of tax reporting and ensure compliance with the IRS regulations.

Undistributed long-term capital gains refer to the profits earned by a mutual fund from the sale of securities, such as stocks or bonds, that have been held for more than one year. These gains are typically passed on to the fund's shareholders, who then report them on their individual tax returns. The IRS Form 2439 is used by mutual funds to report these undistributed long-term capital gains to the IRS and to provide shareholders with the necessary information to report these gains on their tax returns.

In this article, we will delve into the details of the IRS Form 2439, including its purpose, who needs to file it, and how to report undistributed long-term capital gains on your tax return.

Understanding the IRS Form 2439

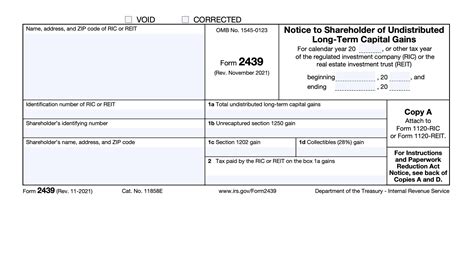

The IRS Form 2439 is a report filed by mutual funds with the IRS to disclose undistributed long-term capital gains to shareholders. The form provides essential information about the fund's capital gains, including the type of gains, the amount of gains, and the shareholder's allocation of these gains.

The IRS Form 2439 is typically filed by mutual funds that have undistributed long-term capital gains exceeding $100. The form is usually filed with the IRS by the end of January following the tax year in which the gains were earned.

Who Needs to File the IRS Form 2439?

Mutual funds that earn undistributed long-term capital gains exceeding $100 are required to file the IRS Form 2439. This includes:

- Mutual funds that are registered with the Securities and Exchange Commission (SEC)

- Mutual funds that are exempt from SEC registration

- Unit investment trusts (UITs)

- Real estate investment trusts (REITs)

Reporting Undistributed Long-Term Capital Gains on Your Tax Return

As a shareholder, you will receive a copy of the IRS Form 2439 from the mutual fund, which will provide you with the necessary information to report the undistributed long-term capital gains on your tax return.

To report undistributed long-term capital gains on your tax return, follow these steps:

- Gather the necessary information: Collect the IRS Form 2439 and your mutual fund statements to determine the amount of undistributed long-term capital gains you received.

- Complete Form 8949: Report the undistributed long-term capital gains on Form 8949, Sales and Other Dispositions of Capital Assets. You will need to complete a separate Form 8949 for each mutual fund that provided you with undistributed long-term capital gains.

- Complete Schedule D: Report the total amount of undistributed long-term capital gains on Schedule D, Capital Gains and Losses. You will need to complete a separate Schedule D for each mutual fund that provided you with undistributed long-term capital gains.

Calculating the Tax on Undistributed Long-Term Capital Gains

The tax on undistributed long-term capital gains is calculated based on the shareholder's tax rate. The tax rate on long-term capital gains is typically lower than the tax rate on ordinary income.

For the 2022 tax year, the tax rates on long-term capital gains are as follows:

- 0% for taxpayers in the 10% and 12% tax brackets

- 15% for taxpayers in the 22%, 24%, 32%, and 35% tax brackets

- 20% for taxpayers in the 37% tax bracket

Benefits of Reporting Undistributed Long-Term Capital Gains

Reporting undistributed long-term capital gains on your tax return can provide several benefits, including:

- Reduced tax liability: By reporting undistributed long-term capital gains, you may be eligible for a lower tax rate, which can reduce your overall tax liability.

- Increased accuracy: Reporting undistributed long-term capital gains ensures that your tax return is accurate and complete, which can help you avoid penalties and interest charges.

- Compliance with IRS regulations: Reporting undistributed long-term capital gains demonstrates your compliance with IRS regulations, which can help you avoid audits and other tax-related issues.

Common Mistakes to Avoid When Reporting Undistributed Long-Term Capital Gains

When reporting undistributed long-term capital gains on your tax return, it is essential to avoid common mistakes, including:

- Failure to report undistributed long-term capital gains: Failing to report undistributed long-term capital gains can result in penalties and interest charges.

- Incorrect calculation of tax: Incorrectly calculating the tax on undistributed long-term capital gains can result in an incorrect tax liability.

- Failure to complete Form 8949 and Schedule D: Failing to complete Form 8949 and Schedule D can result in an incomplete tax return, which can lead to delays and other tax-related issues.

Best Practices for Reporting Undistributed Long-Term Capital Gains

To ensure accurate and compliant reporting of undistributed long-term capital gains, follow these best practices:

- Gather all necessary information: Collect the IRS Form 2439 and your mutual fund statements to determine the amount of undistributed long-term capital gains you received.

- Use tax preparation software: Utilize tax preparation software to ensure accurate calculation of tax and completion of Form 8949 and Schedule D.

- Consult a tax professional: Consult a tax professional if you are unsure about reporting undistributed long-term capital gains on your tax return.

In conclusion, the IRS Form 2439 is a critical document for mutual fund investors who receive undistributed long-term capital gains. By understanding the purpose and significance of this form, you can ensure accurate and compliant reporting of these gains on your tax return. Remember to gather all necessary information, use tax preparation software, and consult a tax professional if needed.

We hope this article has provided you with valuable insights into the IRS Form 2439 and the reporting of undistributed long-term capital gains. If you have any questions or comments, please feel free to share them below.

What is the IRS Form 2439?

+The IRS Form 2439 is a report filed by mutual funds with the IRS to disclose undistributed long-term capital gains to shareholders.

Who needs to file the IRS Form 2439?

+Mutual funds that earn undistributed long-term capital gains exceeding $100 are required to file the IRS Form 2439.

How do I report undistributed long-term capital gains on my tax return?

+Report the undistributed long-term capital gains on Form 8949 and Schedule D, using the information provided on the IRS Form 2439.