Filing taxes can be a daunting task, especially when dealing with specific state forms like the Michigan Form 163. This form is used for the Michigan Homestead Property Tax Credit, which provides relief to eligible homeowners and renters. To ensure you receive the credit you're eligible for, it's essential to complete Form 163 accurately. In this article, we'll guide you through the process with a step-by-step approach.

Understanding the Michigan Homestead Property Tax Credit

The Michigan Homestead Property Tax Credit is designed to help homeowners and renters who meet certain income and property tax requirements. The credit is calculated based on the amount of property taxes paid and the applicant's total household income. To qualify, you must have been a Michigan resident for the entire tax year and have paid property taxes or rent on your primary residence.

Step 1: Determine Your Eligibility

Before starting the application process, it's crucial to determine if you're eligible for the credit. Review the eligibility criteria, which includes:

- Being a Michigan resident for the entire tax year

- Paying property taxes or rent on your primary residence

- Meeting the income requirements, which vary based on the number of dependents claimed

- Not being a full-time student or a dependent of someone else

Income Requirements

The income requirements for the Michigan Homestead Property Tax Credit vary based on the number of dependents claimed. For the 2022 tax year, the maximum household income limits are:

- $60,000 for households with no dependents

- $75,000 for households with one dependent

- $90,000 for households with two or more dependents

Step 2: Gather Required Documents

To complete Form 163, you'll need to gather several documents, including:

- Your property tax statement or rent receipts

- Proof of income, such as W-2 forms and 1099 statements

- Social Security numbers for all household members

- Information about any dependents claimed

Property Tax Statement

Your property tax statement should include the following information:

- The address of your primary residence

- The amount of property taxes paid

- The tax year for which the taxes were paid

Step 3: Complete Form 163

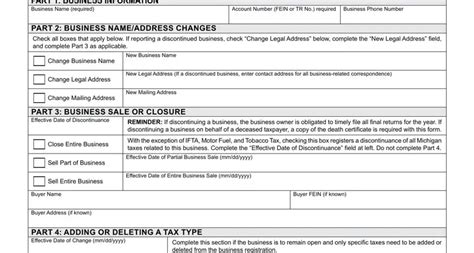

Form 163 is a two-page document that requires you to provide personal and financial information. The form is divided into several sections, including:

- Section 1: Household Information

- Section 2: Income Information

- Section 3: Property Tax Information

- Section 4: Rent Information (if applicable)

- Section 5: Dependents and Credits

Section 1: Household Information

In this section, you'll provide information about your household, including:

- Your name and Social Security number

- Your spouse's name and Social Security number (if applicable)

- The number of dependents claimed

Step 4: Calculate Your Credit

Once you've completed Form 163, you'll need to calculate your credit. The credit is calculated based on the amount of property taxes paid and your total household income. You can use the Michigan Department of Treasury's online calculator or consult with a tax professional to ensure accuracy.

Example Calculation

Let's say you paid $2,000 in property taxes and have a total household income of $50,000. Using the Michigan Department of Treasury's online calculator, you determine that your credit is $800.

Step 5: Submit Your Application

After completing Form 163 and calculating your credit, you'll need to submit your application to the Michigan Department of Treasury. You can file online or by mail.

Filing Online

To file online, visit the Michigan Department of Treasury's website and follow the prompts. You'll need to create an account and upload your completed Form 163.

Filing by Mail

To file by mail, send your completed Form 163 to the Michigan Department of Treasury at the following address:

Michigan Department of Treasury Lansing, MI 48922

What to Expect Next

After submitting your application, you can expect to receive a confirmation email or letter from the Michigan Department of Treasury. If your application is approved, you'll receive a refund or credit towards your state income tax.

What is the deadline for filing Form 163?

+The deadline for filing Form 163 is typically April 15th of each year.

Can I file Form 163 online?

+Yes, you can file Form 163 online through the Michigan Department of Treasury's website.

How long does it take to process Form 163?

+The processing time for Form 163 typically takes 4-6 weeks.

We hope this article has provided you with a comprehensive guide to completing Form 163 Michigan correctly. If you have any further questions or concerns, please don't hesitate to reach out. Remember to share this article with friends and family who may be eligible for the Michigan Homestead Property Tax Credit.