As the world of insurance continues to evolve, it's essential to stay informed about the various types of coverage available. One lesser-known but crucial type of insurance is Vern Fonk Broad Form Insurance. In this article, we'll delve into the world of Vern Fonk Broad Form Insurance, exploring its benefits, working mechanisms, and key aspects to consider.

What is Vern Fonk Broad Form Insurance?

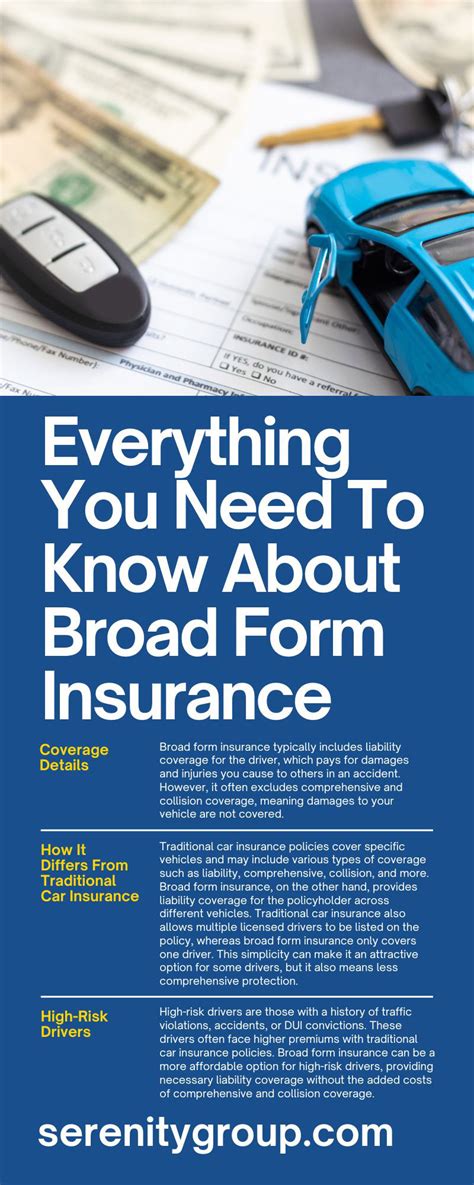

Vern Fonk Broad Form Insurance is a type of insurance that provides coverage for drivers who have been unable to obtain a standard auto insurance policy due to various reasons, such as a poor driving record or a history of accidents. This type of insurance is often referred to as "high-risk" insurance, as it caters to individuals who are considered a higher risk to insure.

Benefits of Vern Fonk Broad Form Insurance

While Vern Fonk Broad Form Insurance may be more expensive than standard auto insurance, it offers several benefits to policyholders. Some of the advantages of this type of insurance include:

- SR-22 filing: Vern Fonk Broad Form Insurance can help drivers who need to file an SR-22 form, which is required by the state for drivers who have been convicted of certain traffic offenses or have had their license suspended.

- High-risk coverage: This type of insurance provides coverage for drivers who are considered high-risk, making it an excellent option for those who have been unable to obtain standard auto insurance.

- Flexible payment options: Many insurance companies that offer Vern Fonk Broad Form Insurance provide flexible payment options, making it easier for policyholders to manage their premiums.

How Does Vern Fonk Broad Form Insurance Work?

Vern Fonk Broad Form Insurance works similarly to standard auto insurance, with a few key differences. Here's a breakdown of how it works:

- Application process: To apply for Vern Fonk Broad Form Insurance, drivers typically need to provide personal and driving history information, as well as proof of income and residency.

- Premium calculation: Insurance companies calculate premiums based on a variety of factors, including driving history, age, and location.

- Policy issuance: Once the application is approved, the insurance company issues a policy that outlines the terms and conditions of the coverage.

Things to Consider When Choosing a Vern Fonk Broad Form Insurance Provider

When selecting a Vern Fonk Broad Form Insurance provider, there are several factors to consider. Here are some key aspects to keep in mind:

- Reputation: Research the insurance company's reputation by reading reviews and checking their ratings with the Better Business Bureau.

- Coverage options: Compare the coverage options offered by different insurance companies to ensure you're getting the best policy for your needs.

- Premium costs: Compare premiums from different insurance companies to ensure you're getting the best rate.

Alternatives to Vern Fonk Broad Form Insurance

While Vern Fonk Broad Form Insurance can provide essential coverage for high-risk drivers, there are alternative options available. Some of these alternatives include:

- Non-standard auto insurance: This type of insurance is designed for drivers who don't qualify for standard auto insurance due to a poor driving record or other factors.

- Specialty auto insurance: This type of insurance is designed for drivers who require specialized coverage, such as coverage for classic cars or high-performance vehicles.

Conclusion and Next Steps

Vern Fonk Broad Form Insurance can provide essential coverage for high-risk drivers, offering benefits such as SR-22 filing and flexible payment options. When choosing a Vern Fonk Broad Form Insurance provider, it's crucial to consider factors such as reputation, coverage options, and premium costs. By doing your research and comparing different insurance companies, you can find the best policy for your needs.

We encourage you to share your thoughts and experiences with Vern Fonk Broad Form Insurance in the comments below. If you have any questions or would like to learn more about this type of insurance, please don't hesitate to ask.

What is Vern Fonk Broad Form Insurance?

+Vern Fonk Broad Form Insurance is a type of insurance that provides coverage for drivers who have been unable to obtain a standard auto insurance policy due to various reasons, such as a poor driving record or a history of accidents.

What are the benefits of Vern Fonk Broad Form Insurance?

+The benefits of Vern Fonk Broad Form Insurance include SR-22 filing, high-risk coverage, and flexible payment options.

How does Vern Fonk Broad Form Insurance work?

+Vern Fonk Broad Form Insurance works similarly to standard auto insurance, with a few key differences. The application process typically involves providing personal and driving history information, as well as proof of income and residency.