As a business owner, you're likely no stranger to the complexities of tax season. One crucial form that requires attention to detail is Form 1125-A, the Cost of Goods Sold section of the corporate income tax return. In this article, we'll delve into the essential instructions for completing Form 1125-A accurately, ensuring you're well-prepared for tax season.

The importance of accurate Form 1125-A instructions cannot be overstated. The Cost of Goods Sold (COGS) is a critical component of a company's tax return, as it directly affects the business's taxable income. Incorrect calculations or omissions can lead to costly errors, penalties, and even audits. By understanding the essential Form 1125-A instructions, you'll be able to navigate the process with confidence and ensure your business is in compliance with tax regulations.

In this article, we'll explore the five essential Form 1125-A instructions to know, including the basics of COGS, calculating costs, and completing the form accurately.

Understanding the Basics of Cost of Goods Sold (COGS)

Before diving into the Form 1125-A instructions, it's essential to understand the basics of COGS. COGS represents the direct costs associated with producing and selling a company's products or services. This includes the cost of materials, labor, and overhead expenses. Accurately calculating COGS is crucial, as it directly affects a company's taxable income.

What Expenses Are Included in COGS?

COGS includes a range of expenses, such as:

- Direct materials and labor costs

- Factory overhead expenses, such as rent, utilities, and equipment depreciation

- Packaging and shipping costs

- Costs of goods purchased for resale

It's essential to note that COGS does not include indirect expenses, such as marketing, administrative, and general expenses. These costs are typically reported separately on the income statement.

Calculating COGS: A Step-by-Step Guide

Calculating COGS involves several steps:

- Determine the beginning inventory: Start by calculating the beginning inventory balance, which includes the cost of goods on hand at the beginning of the accounting period.

- Calculate the cost of goods purchased: Add the cost of goods purchased during the accounting period to the beginning inventory balance.

- Calculate the cost of goods manufactured: If your business manufactures products, calculate the cost of goods manufactured during the accounting period.

- Calculate the ending inventory: Determine the ending inventory balance, which includes the cost of goods on hand at the end of the accounting period.

- Calculate COGS: Subtract the ending inventory balance from the sum of the beginning inventory balance, cost of goods purchased, and cost of goods manufactured.

Example: Calculating COGS

Suppose your business has the following COGS components:

- Beginning inventory: $100,000

- Cost of goods purchased: $500,000

- Cost of goods manufactured: $200,000

- Ending inventory: $150,000

COGS would be calculated as follows:

COGS = Beginning inventory + Cost of goods purchased + Cost of goods manufactured - Ending inventory = $100,000 + $500,000 + $200,000 - $150,000 = $650,000

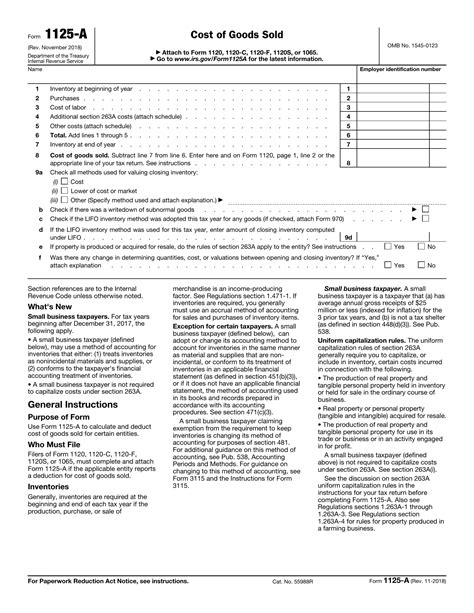

Completing Form 1125-A: A Line-by-Line Guide

Form 1125-A is divided into several sections, each requiring specific information. Here's a line-by-line guide to completing the form:

- Section 1: Beginning Inventory: Report the beginning inventory balance, including the cost of goods on hand at the beginning of the accounting period.

- Section 2: Cost of Goods Purchased: Report the cost of goods purchased during the accounting period.

- Section 3: Cost of Goods Manufactured: If your business manufactures products, report the cost of goods manufactured during the accounting period.

- Section 4: Ending Inventory: Report the ending inventory balance, including the cost of goods on hand at the end of the accounting period.

- Section 5: COGS: Calculate and report the COGS, using the formula outlined above.

Additional Tips for Completing Form 1125-A

- Ensure accuracy: Double-check calculations and ensure that all required information is included.

- Maintain records: Keep detailed records of COGS calculations, including supporting documentation, in case of an audit.

- Consult a tax professional: If you're unsure about any aspect of Form 1125-A, consult a tax professional to ensure compliance with tax regulations.

Common Mistakes to Avoid When Completing Form 1125-A

When completing Form 1125-A, it's essential to avoid common mistakes that can lead to costly errors and penalties. Some common mistakes to avoid include:

- Inaccurate calculations: Double-check calculations to ensure accuracy.

- Omitting required information: Ensure that all required information is included on the form.

- Incorrect classification: Ensure that COGS expenses are properly classified and reported.

Conclusion: Mastering Form 1125-A Instructions for Accurate Tax Compliance

Mastering Form 1125-A instructions is crucial for accurate tax compliance and minimizing the risk of costly errors and penalties. By understanding the basics of COGS, calculating costs accurately, and completing the form correctly, you'll be well-prepared for tax season. Remember to maintain detailed records, consult a tax professional if needed, and avoid common mistakes to ensure a smooth tax filing process.

What is the purpose of Form 1125-A?

+Form 1125-A is used to calculate the Cost of Goods Sold (COGS) for businesses, which is a critical component of the corporate income tax return.

What expenses are included in COGS?

+COGS includes direct materials and labor costs, factory overhead expenses, packaging and shipping costs, and costs of goods purchased for resale.

How do I calculate COGS?

+COGS is calculated by adding the beginning inventory balance, cost of goods purchased, and cost of goods manufactured, and then subtracting the ending inventory balance.