Abusive tax schemes have been a persistent issue in the United States, costing the government billions of dollars in lost revenue each year. These schemes often involve complex financial arrangements and misrepresentations, making it difficult for the Internal Revenue Service (IRS) to detect and prevent them. However, with the help of whistleblowers and federal reporting requirements, the IRS has been able to identify and shut down many of these schemes.

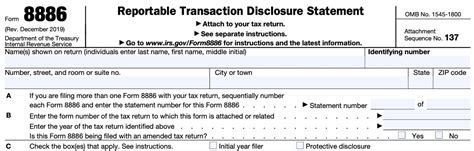

One of the key tools in the fight against abusive tax schemes is Federal Form 8886, also known as the Reportable Transaction Disclosure Statement. This form is used by taxpayers to disclose certain transactions that may be considered abusive or reportable. In this article, we will explore the purpose and requirements of Federal Form 8886, as well as the benefits of reporting abusive tax schemes.

What is Federal Form 8886?

Federal Form 8886 is a disclosure statement used by taxpayers to report certain transactions that may be considered abusive or reportable. The form is used to provide information about the transaction, including the type of transaction, the parties involved, and the tax benefits claimed. The IRS uses this information to identify and evaluate potential abusive tax schemes.

Who is required to file Federal Form 8886?

Taxpayers who engage in certain transactions are required to file Federal Form 8886. These transactions include:

- Listed transactions: These are transactions that the IRS has specifically identified as potentially abusive or reportable.

- Reportable transactions: These are transactions that have certain characteristics, such as a significant tax benefit or a complex financial arrangement.

- Transactions with contractual protection: These are transactions that involve a contractual arrangement, such as a guarantee or an indemnification agreement, that protects the taxpayer from potential losses.

Benefits of Reporting Abusive Tax Schemes

Reporting abusive tax schemes can have several benefits, including:

- Reduced risk of penalties: Taxpayers who report abusive tax schemes may be eligible for reduced penalties or even immunity from prosecution.

- Increased transparency: Reporting abusive tax schemes can help to increase transparency and accountability in the tax system.

- Protection of taxpayers' rights: Reporting abusive tax schemes can help to protect taxpayers' rights by ensuring that they are not unfairly penalized or prosecuted.

How to Report Abusive Tax Schemes

Taxpayers who wish to report abusive tax schemes can do so by filing Federal Form 8886. The form should be filed with the taxpayer's annual tax return, and it should include all required information about the transaction.

In addition to filing Federal Form 8886, taxpayers can also report abusive tax schemes to the IRS Whistleblower Office. The Whistleblower Office is responsible for investigating and prosecuting abusive tax schemes, and it offers rewards to whistleblowers who provide information that leads to the recovery of taxes owed.

Consequences of Not Reporting Abusive Tax Schemes

Taxpayers who fail to report abusive tax schemes may face significant consequences, including:

- Penalties: Taxpayers who fail to report abusive tax schemes may be subject to penalties, including fines and interest.

- Prosecution: In some cases, taxpayers who fail to report abusive tax schemes may be prosecuted for tax evasion or other crimes.

- Loss of credibility: Taxpayers who fail to report abusive tax schemes may lose credibility with the IRS and other government agencies.

Examples of Abusive Tax Schemes

Abusive tax schemes can take many forms, but some common examples include:

- Offshore tax evasion: This involves hiding assets or income in offshore accounts or entities to avoid paying taxes.

- Tax shelter schemes: This involves using complex financial arrangements to reduce or eliminate tax liability.

- False or inflated deductions: This involves claiming false or inflated deductions to reduce tax liability.

Conclusion

Reporting abusive tax schemes is an important step in maintaining the integrity of the tax system. By filing Federal Form 8886 and reporting abusive tax schemes to the IRS Whistleblower Office, taxpayers can help to reduce the risk of penalties, increase transparency, and protect taxpayers' rights. Remember, honesty is always the best policy when it comes to taxes.

What is Federal Form 8886?

+Federal Form 8886 is a disclosure statement used by taxpayers to report certain transactions that may be considered abusive or reportable.

Who is required to file Federal Form 8886?

+Taxpayers who engage in certain transactions, including listed transactions, reportable transactions, and transactions with contractual protection, are required to file Federal Form 8886.

What are the benefits of reporting abusive tax schemes?

+Reporting abusive tax schemes can reduce the risk of penalties, increase transparency, and protect taxpayers' rights.