As the tax season approaches, many business owners and shareholders are preparing to file their taxes. One crucial document that plays a significant role in this process is the Form 1120S K-1. In this article, we will delve into the world of Form 1120S K-1, exploring its purpose, benefits, and essential facts that you need to know.

What is Form 1120S K-1?

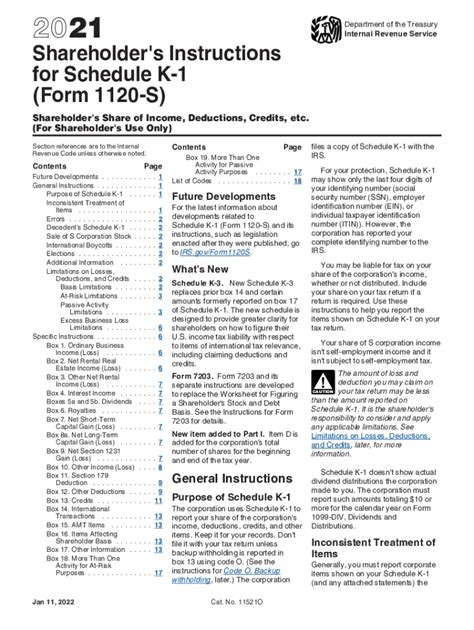

Form 1120S K-1 is a tax document that is used by S corporations to report the income, deductions, and credits of the corporation to its shareholders. The form is a schedules K-1 attachment to the S corporation's tax return, Form 1120S. The K-1 statement provides each shareholder with their share of the corporation's income, deductions, and credits, which they must report on their individual tax return.

Why is Form 1120S K-1 Important?

The Form 1120S K-1 is a critical document for S corporations and their shareholders. It provides the necessary information for shareholders to complete their individual tax returns accurately. Without the K-1 statement, shareholders would not be able to report their share of the corporation's income, deductions, and credits, which could lead to errors and potential tax penalties.

Beyond the Basics: Essential Facts About Form 1120S K-1

Now that we have covered the basics, let's dive deeper into the world of Form 1120S K-1. Here are five essential facts that you need to know:

1. Deadline for Filing

The deadline for filing Form 1120S K-1 is typically March 15th of each year, unless the S corporation files for an automatic six-month extension. This deadline applies to the corporation's tax return, Form 1120S, and the attached K-1 statements. Shareholders should receive their K-1 statements by January 31st of each year to ensure timely filing of their individual tax returns.

2. What Information is Reported on Form 1120S K-1?

The Form 1120S K-1 reports various types of income, deductions, and credits, including:

- Ordinary business income

- Capital gains and losses

- Dividend income

- Interest income

- Depreciation and amortization

- Charitable contributions

- Taxes

This information is crucial for shareholders to accurately report their share of the corporation's income, deductions, and credits on their individual tax return.

How to Complete Form 1120S K-1

To complete Form 1120S K-1, the S corporation must gather various information, including:

- Shareholder information, such as name, address, and Social Security number

- Shareholder percentage of ownership

- Corporation's income, deductions, and credits

- Taxes paid or accrued

The corporation must then attach the K-1 statements to the Form 1120S tax return and provide a copy to each shareholder.

Tax Benefits of Form 1120S K-1

The Form 1120S K-1 provides several tax benefits to S corporations and their shareholders. Some of the key benefits include:

- Pass-through taxation: The corporation's income, deductions, and credits pass through to the shareholders, who report them on their individual tax return.

- Reduced self-employment taxes: Shareholders are not subject to self-employment taxes on their share of the corporation's income.

- Deductibility of business losses: Shareholders can deduct their share of the corporation's business losses on their individual tax return.

5. Common Errors and Penalties

When completing Form 1120S K-1, it's essential to avoid common errors that can result in penalties and fines. Some of the most common errors include:

- Incorrect shareholder information: Inaccurate or missing shareholder information can lead to delayed or incorrect processing of the K-1 statement.

- Math errors: Mathematical errors can result in incorrect reporting of income, deductions, and credits.

- Failure to file: Failure to file the K-1 statement or Form 1120S tax return can result in penalties and fines.

To avoid these errors, it's crucial to carefully review the Form 1120S K-1 and seek professional advice if necessary.

Conclusion

In conclusion, Form 1120S K-1 is a critical document for S corporations and their shareholders. It provides the necessary information for shareholders to complete their individual tax returns accurately and take advantage of the tax benefits associated with S corporation ownership. By understanding the essential facts about Form 1120S K-1, you can ensure timely and accurate filing of your tax returns and avoid potential penalties and fines.

We hope this article has provided you with a comprehensive understanding of Form 1120S K-1. If you have any questions or concerns, please don't hesitate to comment below. Share this article with your friends and colleagues who may find it helpful.

What is the deadline for filing Form 1120S K-1?

+The deadline for filing Form 1120S K-1 is typically March 15th of each year, unless the S corporation files for an automatic six-month extension.

What information is reported on Form 1120S K-1?

+The Form 1120S K-1 reports various types of income, deductions, and credits, including ordinary business income, capital gains and losses, dividend income, interest income, depreciation and amortization, charitable contributions, and taxes.

What are the tax benefits of Form 1120S K-1?

+The Form 1120S K-1 provides several tax benefits, including pass-through taxation, reduced self-employment taxes, and deductibility of business losses.