Understanding the Importance of Form 1120a

As a business owner, you're likely familiar with the various tax forms required by the Internal Revenue Service (IRS). One such form is Form 1120a, also known as the U.S. Corporation Income Tax Return. This form is used by corporations to report their income, deductions, and credits, and to calculate their tax liability. In this article, we'll guide you through the essential steps to complete Form 1120a, ensuring you're in compliance with the IRS regulations.

Step 1: Determine If You Need to File Form 1120a

Before diving into the details, it's crucial to determine if your corporation needs to file Form 1120a. Generally, all domestic corporations, including S corporations, must file this form annually. However, there are some exceptions, such as:

- Corporations with a gross income of $250,000 or less

- Corporations that have been dissolved or have ceased operations

- Corporations that are exempt from taxation, such as non-profit organizations

If you're unsure about your corporation's filing requirements, consult with a tax professional or the IRS directly.

Step 2: Gather Necessary Documents and Information

To complete Form 1120a, you'll need to gather various documents and information, including:

- Your corporation's financial statements, such as the balance sheet and income statement

- Records of income, including sales, interest, and dividends

- Records of deductions, such as operating expenses, salaries, and depreciation

- Information about your corporation's tax credits, such as research and development credits

- Your corporation's Employer Identification Number (EIN)

- The names and addresses of your corporation's officers, directors, and shareholders

Having all the necessary documents and information readily available will make the filing process much smoother.

Step 3: Complete the Identification Section

The identification section of Form 1120a requires you to provide basic information about your corporation, including:

- Corporation name and address

- EIN

- Date of incorporation

- State of incorporation

- Business activity code

This information is used to identify your corporation and ensure that the IRS can process your return correctly.

Step 4: Report Income and Deductions

The next step is to report your corporation's income and deductions on Form 1120a. This includes:

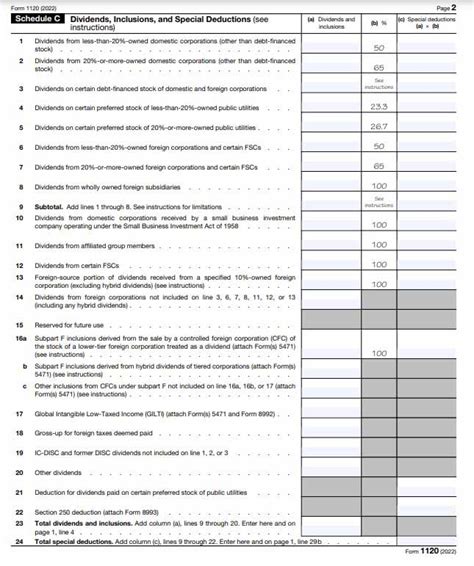

- Reporting income from various sources, such as sales, interest, and dividends

- Claiming deductions for operating expenses, salaries, and depreciation

- Reporting any tax credits, such as research and development credits

Accurately reporting income and deductions is crucial to ensure that your corporation is paying the correct amount of taxes.

Step 5: Calculate Tax Liability

After reporting income and deductions, you'll need to calculate your corporation's tax liability. This involves:

- Applying the corporate tax rate to your corporation's taxable income

- Claiming any tax credits or deductions that may reduce your tax liability

- Calculating any penalties or interest due

Ensuring that your corporation is paying the correct amount of taxes is essential to avoid any penalties or fines.

Step 6: Sign and Date the Return

Once you've completed Form 1120a, you'll need to sign and date the return. This is a critical step, as it confirms that the information provided is accurate and true.

Step 7: File the Return and Pay Any Taxes Due

Finally, you'll need to file Form 1120a with the IRS and pay any taxes due. The filing deadline is typically March 15th for corporations that operate on a calendar year basis. You can file electronically or by mail, and pay any taxes due online, by phone, or by mail.

By following these 7 essential steps, you'll be able to complete Form 1120a accurately and ensure that your corporation is in compliance with the IRS regulations.

Additional Tips and Reminders

- Make sure to keep accurate records and supporting documentation for your corporation's income and deductions.

- Consult with a tax professional if you're unsure about any aspect of the filing process.

- Take advantage of any tax credits or deductions that your corporation may be eligible for.

- File Form 1120a on time to avoid any penalties or fines.

By following these tips and reminders, you'll be able to navigate the Form 1120a filing process with confidence and ensure that your corporation is in good standing with the IRS.

What is the deadline for filing Form 1120a?

+The filing deadline for Form 1120a is typically March 15th for corporations that operate on a calendar year basis.

Can I file Form 1120a electronically?

+Yes, you can file Form 1120a electronically through the IRS website or through a tax preparation software.

What happens if I fail to file Form 1120a?

+If you fail to file Form 1120a, you may be subject to penalties and fines, including interest on any taxes due.

We hope this article has provided you with a comprehensive guide to completing Form 1120a. If you have any further questions or concerns, please don't hesitate to reach out to a tax professional or the IRS directly.