Filing taxes can be a daunting task, especially for those who are new to the process. One crucial step in this process is obtaining an Electronic Filing Identification Number (EFIN). An EFIN is a unique number assigned to tax professionals who are authorized to e-file tax returns on behalf of their clients. If you're a tax professional or an individual looking to e-file your tax returns, you'll need to fill out the EFIN application form. In this article, we'll break down the process into 5 easy steps to help you navigate the EFIN application form with ease.

Understanding the Importance of EFIN

Before we dive into the steps, it's essential to understand the importance of EFIN. An EFIN is required for tax professionals who want to e-file tax returns on behalf of their clients. This number ensures that the tax professional is authorized to transmit tax returns electronically to the IRS. Without an EFIN, you won't be able to e-file tax returns, which can lead to delays and penalties.

Step 1: Determine Your Eligibility

To fill out the EFIN application form, you need to determine your eligibility. The IRS requires that you meet specific requirements to obtain an EFIN. These requirements include:

- You must be a tax professional, such as a Certified Public Accountant (CPA), Enrolled Agent (EA), or Annual Filing Season Program (AFSP) participant.

- You must have a valid Preparer Tax Identification Number (PTIN).

- You must have a registered Electronic Filing Identification Number (EFIN) for your business.

- You must meet the IRS's suitability standards.

If you meet these requirements, you can proceed to the next step.

Step 2: Gather Required Documents

To complete the EFIN application form, you'll need to gather the required documents. These documents include:

- Your PTIN certificate

- Your business registration documents (e.g., articles of incorporation, business license)

- Proof of identity (e.g., driver's license, passport)

- Proof of business address (e.g., utility bill, lease agreement)

Make sure you have all the necessary documents before proceeding to the next step.

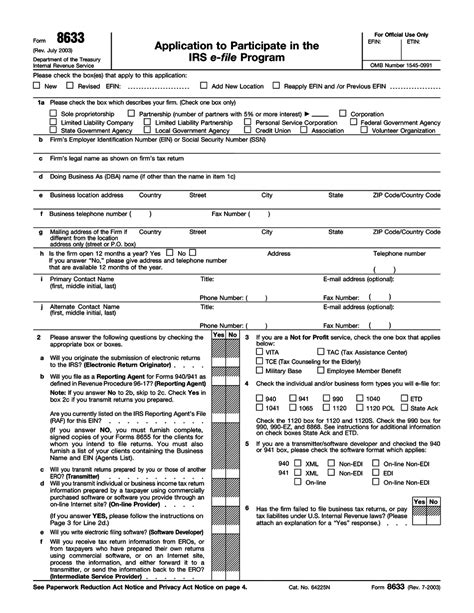

Step 3: Fill Out the EFIN Application Form

Now it's time to fill out the EFIN application form. The form will ask for your personal and business information, including:

- Your name and address

- Your business name and address

- Your PTIN and EFIN (if you have one)

- Your business type and structure

- Your tax preparation experience and qualifications

Make sure to answer all questions accurately and thoroughly. Incomplete or inaccurate information may delay the processing of your application.

Step 4: Submit Your Application

Once you've completed the EFIN application form, you can submit it to the IRS. You can submit your application online or by mail. If you submit your application online, you'll receive an immediate confirmation. If you submit your application by mail, you'll receive a confirmation within 2-3 weeks.

Step 5: Receive Your EFIN

After submitting your application, you'll receive your EFIN within 2-3 weeks. Your EFIN will be sent to you via email or mail, depending on your preference. Once you receive your EFIN, you can start e-filing tax returns on behalf of your clients.

Common Mistakes to Avoid

When filling out the EFIN application form, there are common mistakes to avoid. These include:

- Incomplete or inaccurate information

- Failure to submit required documents

- Incorrect business information

- Failure to pay the required fee

Avoiding these mistakes will ensure that your application is processed quickly and efficiently.

Benefits of Having an EFIN

Having an EFIN comes with several benefits, including:

- Increased efficiency and productivity

- Improved accuracy and reduced errors

- Enhanced client satisfaction

- Increased revenue and business growth

By following these 5 easy steps, you can obtain an EFIN and start e-filing tax returns on behalf of your clients. Remember to avoid common mistakes and ensure that you have all the required documents before submitting your application.

What is an EFIN?

+An Electronic Filing Identification Number (EFIN) is a unique number assigned to tax professionals who are authorized to e-file tax returns on behalf of their clients.

Who needs an EFIN?

+Tax professionals, such as Certified Public Accountants (CPAs), Enrolled Agents (EAs), and Annual Filing Season Program (AFSP) participants, need an EFIN to e-file tax returns on behalf of their clients.

How do I obtain an EFIN?

+To obtain an EFIN, you need to fill out the EFIN application form, gather required documents, and submit your application to the IRS. You can submit your application online or by mail.

We hope this article has provided you with a comprehensive guide on how to fill out the EFIN application form. If you have any further questions or concerns, please don't hesitate to reach out. Remember to share this article with your colleagues and friends who may benefit from this information.