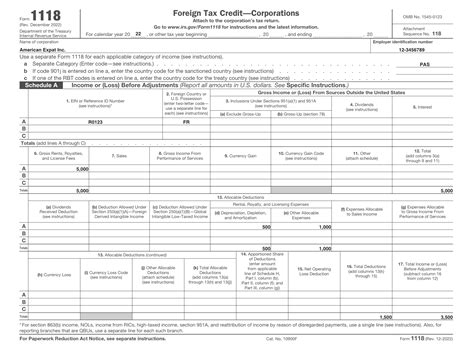

Form 1118 Schedule L is a crucial part of the Form 1118, Foreign Tax Credit - Corporations, which is used by corporations to claim foreign tax credits. The foreign tax credit is a valuable tax benefit that allows U.S. taxpayers to reduce their U.S. tax liability by the amount of foreign taxes paid or accrued on foreign-source income. In this article, we will delve into the details of Form 1118 Schedule L, its purpose, and the steps to complete it.

Understanding Form 1118 Schedule L

Form 1118 Schedule L is used to calculate the foreign tax credit limitation for each separate category of foreign-source income. The schedule is divided into several parts, each dealing with a specific type of foreign-source income, such as foreign branch income, passive category income, and general category income. By completing Schedule L, taxpayers can determine the maximum amount of foreign tax credits they can claim for each category of income.

Purpose of Form 1118 Schedule L

The primary purpose of Form 1118 Schedule L is to ensure that taxpayers claim the correct amount of foreign tax credits for each category of foreign-source income. This is crucial because the foreign tax credit is limited to the amount of U.S. tax liability that is attributable to foreign-source income. By completing Schedule L, taxpayers can avoid claiming excessive foreign tax credits, which can result in penalties and interest.

Steps to Complete Form 1118 Schedule L

To complete Form 1118 Schedule L, taxpayers must follow these steps:

- Identify the separate categories of foreign-source income: Taxpayers must identify the different categories of foreign-source income they have earned, such as foreign branch income, passive category income, and general category income.

- Calculate the foreign tax credit limitation for each category: Taxpayers must calculate the foreign tax credit limitation for each category of foreign-source income using the formulas provided in the instructions to Form 1118.

- Complete the schedule: Taxpayers must complete Schedule L by entering the required information, including the category of foreign-source income, the foreign tax credit limitation, and the foreign tax credits claimed.

Special Considerations

When completing Form 1118 Schedule L, taxpayers must be aware of the following special considerations:

- Foreign tax credit carrybacks and carryforwards: Taxpayers can carry back or carry forward excess foreign tax credits to other tax years.

- Foreign tax credit limitations: The foreign tax credit is limited to the amount of U.S. tax liability that is attributable to foreign-source income.

- Documentation requirements: Taxpayers must maintain adequate documentation to support their foreign tax credit claims.

Benefits of Claiming Foreign Tax Credits

Claiming foreign tax credits can provide significant tax benefits to U.S. taxpayers. Some of the benefits include:

- Reduced U.S. tax liability: Foreign tax credits can reduce a taxpayer's U.S. tax liability, resulting in a lower tax bill.

- Increased cash flow: By reducing U.S. tax liability, taxpayers can increase their cash flow and improve their financial position.

- Competitive advantage: Claiming foreign tax credits can provide a competitive advantage to U.S. taxpayers operating in foreign markets.

Common Mistakes to Avoid

When claiming foreign tax credits, taxpayers must avoid the following common mistakes:

- Incorrect categorization of foreign-source income: Taxpayers must ensure that they correctly categorize their foreign-source income to avoid claiming excessive foreign tax credits.

- Failure to maintain adequate documentation: Taxpayers must maintain adequate documentation to support their foreign tax credit claims.

- Inaccurate calculation of foreign tax credit limitations: Taxpayers must accurately calculate the foreign tax credit limitation for each category of foreign-source income.

Conclusion

Form 1118 Schedule L is a critical component of the Form 1118, Foreign Tax Credit - Corporations. By completing Schedule L, taxpayers can ensure that they claim the correct amount of foreign tax credits for each category of foreign-source income. By understanding the purpose and steps to complete Schedule L, taxpayers can avoid common mistakes and ensure that they receive the maximum foreign tax credit benefits.

What is Form 1118 Schedule L?

+Form 1118 Schedule L is used to calculate the foreign tax credit limitation for each separate category of foreign-source income.

What are the benefits of claiming foreign tax credits?

+Claiming foreign tax credits can provide significant tax benefits, including reduced U.S. tax liability, increased cash flow, and a competitive advantage.

What are some common mistakes to avoid when claiming foreign tax credits?

+Common mistakes to avoid include incorrect categorization of foreign-source income, failure to maintain adequate documentation, and inaccurate calculation of foreign tax credit limitations.

We hope this article has provided valuable insights into Form 1118 Schedule L and the benefits of claiming foreign tax credits. If you have any further questions or would like to share your experiences, please leave a comment below.