As a taxpayer with international investments or business operations, understanding Form 1118 Schedule K is crucial for claiming foreign tax credits. This form is used by corporations to report foreign taxes paid or accrued, and it plays a significant role in reducing the amount of taxes owed to the US government. In this article, we will delve into the intricacies of Form 1118 Schedule K, its importance, and how to navigate the complexities of foreign tax credit reporting.

Understanding Foreign Tax Credits

Foreign tax credits are a vital component of the US tax system, allowing taxpayers to reduce their tax liability by claiming credits for taxes paid or accrued on foreign income. This mechanism is designed to prevent double taxation, ensuring that taxpayers are not taxed twice on the same income. The foreign tax credit is calculated based on the amount of foreign taxes paid or accrued, and it can be claimed against US taxes owed.

Who Needs to File Form 1118 Schedule K?

Form 1118 Schedule K is required for corporations that have paid or accrued foreign taxes on income earned outside the US. This includes:

- Domestic corporations with foreign subsidiaries or branches

- Foreign corporations with US-sourced income

- Corporations with foreign investments or assets

The form is used to report foreign taxes paid or accrued, and it must be filed with the corporation's annual tax return (Form 1120).

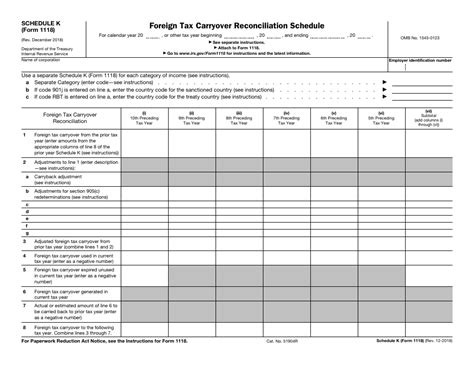

Breaking Down Form 1118 Schedule K

Form 1118 Schedule K is a complex document, and it requires careful attention to detail. The form is divided into several sections, each with its own set of requirements and calculations.

Section 1: Foreign Taxes Paid or Accrued

This section requires the taxpayer to report foreign taxes paid or accrued during the tax year. The taxpayer must provide the name of the foreign country, the type of tax paid or accrued, and the amount of tax.

- Country-by-Country Reporting: The taxpayer must report foreign taxes paid or accrued on a country-by-country basis.

- Type of Tax: The taxpayer must identify the type of tax paid or accrued, such as income tax, withholding tax, or value-added tax.

Section 2: Foreign Tax Credit Limitation

This section requires the taxpayer to calculate the foreign tax credit limitation. The limitation is calculated based on the taxpayer's foreign source income and the amount of foreign taxes paid or accrued.

- Foreign Source Income: The taxpayer must calculate foreign source income, which includes income earned from foreign sources, such as dividends, interest, and royalties.

- Foreign Tax Credit Limitation: The taxpayer must calculate the foreign tax credit limitation, which is the amount of foreign taxes paid or accrued that can be claimed as a credit against US taxes.

Section 3: Foreign Tax Credit Carryover

This section requires the taxpayer to calculate the foreign tax credit carryover. The carryover is the amount of foreign tax credit that exceeds the limitation and can be carried over to future tax years.

- Foreign Tax Credit Carryover: The taxpayer must calculate the foreign tax credit carryover, which is the amount of foreign tax credit that exceeds the limitation.

Benefits of Filing Form 1118 Schedule K

Filing Form 1118 Schedule K can provide significant tax benefits for corporations with foreign operations. Some of the benefits include:

- Reduced Tax Liability: Filing Form 1118 Schedule K can help reduce the corporation's tax liability by claiming foreign tax credits.

- Avoiding Double Taxation: The foreign tax credit mechanism helps avoid double taxation by allowing taxpayers to claim credits for taxes paid or accrued on foreign income.

- Increased Cash Flow: By reducing the corporation's tax liability, filing Form 1118 Schedule K can help increase cash flow and improve financial performance.

Common Challenges and Pitfalls

Filing Form 1118 Schedule K can be complex, and taxpayers often face challenges and pitfalls. Some of the common challenges include:

- Complexity of Foreign Tax Laws: Foreign tax laws can be complex, and taxpayers must navigate these laws to ensure compliance.

- Calculating Foreign Tax Credits: Calculating foreign tax credits can be challenging, and taxpayers must ensure accuracy to avoid errors.

- Documentation Requirements: Taxpayers must maintain accurate documentation to support foreign tax credit claims.

Best Practices for Filing Form 1118 Schedule K

To ensure accurate and compliant filing, taxpayers should follow best practices, including:

- Consulting with Tax Professionals: Taxpayers should consult with tax professionals to ensure accurate and compliant filing.

- Maintaining Accurate Documentation: Taxpayers must maintain accurate documentation to support foreign tax credit claims.

- Staying Up-to-Date with Tax Laws: Taxpayers must stay up-to-date with changing tax laws and regulations to ensure compliance.

Conclusion

Filing Form 1118 Schedule K is a critical step in claiming foreign tax credits and reducing tax liability. By understanding the complexities of foreign tax credit reporting, taxpayers can ensure accurate and compliant filing. It is essential to consult with tax professionals and maintain accurate documentation to support foreign tax credit claims. By following best practices and staying up-to-date with tax laws and regulations, taxpayers can navigate the complexities of foreign tax credit reporting and achieve significant tax benefits.

We hope this article has provided valuable insights into Form 1118 Schedule K and foreign tax credit reporting. If you have any questions or concerns, please share them in the comments section below. We would be happy to help you navigate the complexities of foreign tax credit reporting.

What is Form 1118 Schedule K?

+Form 1118 Schedule K is a form used by corporations to report foreign taxes paid or accrued, and it is used to claim foreign tax credits.

Who needs to file Form 1118 Schedule K?

+Form 1118 Schedule K is required for corporations that have paid or accrued foreign taxes on income earned outside the US.

What are the benefits of filing Form 1118 Schedule K?

+Filing Form 1118 Schedule K can provide significant tax benefits, including reduced tax liability, avoiding double taxation, and increased cash flow.