The complex world of tax forms and schedules can be overwhelming, especially for those dealing with foreign earned income and taxes. Form 1118, the Foreign Tax Credit - Corporations, and its accompanying Schedule J, are no exception. These forms are crucial for corporations and certain other entities to calculate and claim foreign tax credits, which can significantly impact their tax liability. In this article, we will delve into the intricacies of Form 1118 and Schedule J, explaining their importance, benefits, and the steps to accurately complete them.

What is Form 1118 and Schedule J?

Form 1118 is used by corporations (including S corporations), trusts, and estates to compute the foreign tax credit. This credit is allowed for certain taxes paid to foreign governments on income earned from sources outside the United States. The foreign tax credit is designed to reduce or eliminate the double taxation of income that is taxed both by the United States and a foreign country.

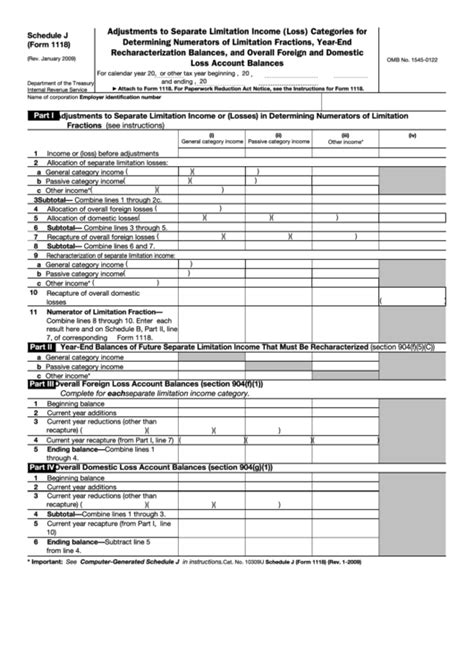

Schedule J, Accumulated Earnings and Profits (E&P) of Controlled Foreign Corporation (CFC), is a part of Form 1118. It is specifically used to compute the accumulated earnings and profits of a controlled foreign corporation, which are essential in determining certain types of foreign tax credits.

Why is Form 1118 and Schedule J Important?

Accurately completing Form 1118 and Schedule J is crucial for several reasons:

-

Foreign Tax Credits: These forms help in calculating the foreign tax credits that can significantly reduce the U.S. tax liability on foreign earned income. Proper calculation and claim of these credits can lead to substantial tax savings.

-

Compliance with IRS Regulations: Failure to accurately complete these forms or missing deadlines can lead to penalties and fines. Compliance with IRS regulations is essential to avoid any legal issues.

-

Financial Planning: Understanding the implications of foreign taxes and credits is crucial for financial planning. These forms provide insights into the financial implications of foreign operations, which can inform business decisions.

Benefits of Accurately Completing Form 1118 and Schedule J

Accurately completing Form 1118 and Schedule J can have several benefits:

-

Tax Savings: The most direct benefit is the potential for significant tax savings through the foreign tax credit. By accurately calculating these credits, corporations can reduce their U.S. tax liability.

-

Avoid Penalties: Compliance with IRS regulations avoids any penalties or fines associated with incorrect filing or late submissions.

-

Informed Business Decisions: The process of completing these forms provides valuable insights into the financial implications of foreign operations. This information can be used to make informed business decisions regarding foreign investments and operations.

Steps to Complete Form 1118 and Schedule J

Completing Form 1118 and Schedule J involves several steps:

-

Determine the Type of Foreign Tax Credit: Decide whether you are claiming a direct foreign tax credit or an indirect credit through a foreign corporation.

-

Gather Necessary Documents: Collect all relevant documents including foreign tax returns, receipts for taxes paid, and financial statements of foreign corporations.

-

Calculate Foreign Tax Credits: Use Form 1118 to calculate the foreign tax credits. This involves determining the foreign taxes paid, the limitation on foreign tax credits, and the amount of credit allowed.

-

Complete Schedule J: For controlled foreign corporations, use Schedule J to compute the accumulated earnings and profits, which are necessary for certain types of foreign tax credits.

-

Attach to Tax Return: Once completed, Form 1118 and Schedule J should be attached to the corporate tax return, Form 1120.

Common Challenges and Solutions

Completing Form 1118 and Schedule J can pose several challenges:

-

Complexity of Tax Laws: The U.S. tax code, especially regarding foreign taxes, is complex and constantly evolving. Staying updated on the latest regulations and seeking professional advice can help navigate these complexities.

-

Accurate Calculation: Ensuring accurate calculations is crucial. Using tax software and consulting with a tax professional can minimize errors.

-

Documentation: Ensuring all necessary documents are in order can be challenging. Maintaining detailed records and having a system for tracking foreign taxes paid can simplify the process.

Conclusion and Next Steps

Understanding and accurately completing Form 1118 and Schedule J are critical for corporations and certain entities dealing with foreign earned income. The process, while complex, offers significant benefits in terms of tax savings and compliance with IRS regulations. By following the steps outlined and seeking professional advice when needed, entities can ensure they are making the most of the foreign tax credit and maintaining good tax health.

Now that you have a better understanding of Form 1118 and Schedule J, we encourage you to share your experiences or ask questions in the comments section below. Your insights can help others navigate the complexities of foreign tax credits. Don't forget to share this article with anyone who might find it useful and stay tuned for more in-depth guides on tax-related topics.

What is the purpose of Form 1118?

+Form 1118 is used to compute the foreign tax credit, which is allowed for certain taxes paid to foreign governments on income earned from sources outside the United States.

Why is Schedule J necessary?

+Schedule J is necessary to compute the accumulated earnings and profits of a controlled foreign corporation, which are essential in determining certain types of foreign tax credits.

What are the benefits of accurately completing Form 1118 and Schedule J?

+Accurately completing these forms can lead to tax savings through foreign tax credits, compliance with IRS regulations, and informed business decisions regarding foreign operations.