The Foreign Tax Credit (FTC) is a vital tax benefit for individuals and businesses operating internationally. Form 1118 is a crucial document in claiming this credit, and understanding its instructions is essential for accurate and successful filing. In this comprehensive guide, we will delve into the Form 1118 instructions, providing a step-by-step walkthrough to help you navigate the process.

Understanding the Foreign Tax Credit

The Foreign Tax Credit is a non-refundable tax credit that allows taxpayers to offset their U.S. tax liability by the amount of foreign income taxes paid or accrued. This credit is designed to prevent double taxation on foreign-sourced income, ensuring that taxpayers are not taxed twice on the same income.

Who Needs to File Form 1118?

Form 1118 is required for taxpayers who:

- Have foreign source income

- Have paid or accrued foreign income taxes

- Want to claim the Foreign Tax Credit

This includes individuals, corporations, and pass-through entities, such as partnerships and S corporations.

What is Form 1118?

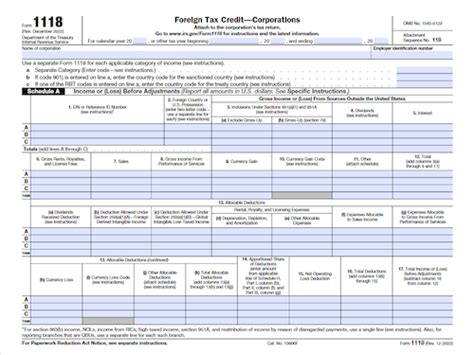

Form 1118 is a supporting statement that must be attached to Form 1120 (Corporate Income Tax Return) or Form 1040 (Individual Income Tax Return). It provides detailed information about the foreign taxes paid or accrued, including the type of tax, the country of origin, and the amount of tax paid.

Step-by-Step Guide to Form 1118 Instructions

To accurately complete Form 1118, follow these steps:

Step 1: Identify the Type of Foreign Tax

Determine the type of foreign tax you paid or accrued. This can include income taxes, withholding taxes, or other types of taxes.

Step 2: Determine the Country of Origin

Identify the country where the foreign tax was paid or accrued.

Step 3: Calculate the Foreign Tax Paid or Accrued

Calculate the total amount of foreign tax paid or accrued for the tax year.

Step 4: Complete Part I of Form 1118

Complete Part I of Form 1118, which requires information about the type of foreign tax, the country of origin, and the amount of tax paid.

Step 5: Complete Part II of Form 1118

Complete Part II of Form 1118, which requires information about the foreign tax credit limitation.

Step 6: Complete Part III of Form 1118

Complete Part III of Form 1118, which requires information about the foreign tax credit carryback and carryforward.

Additional Requirements and Considerations

When completing Form 1118, keep in mind the following:

- Attach all supporting documentation, including foreign tax returns and receipts.

- Ensure accurate translation of foreign language documents.

- Consider the impact of foreign tax credits on other tax benefits, such as the foreign earned income exclusion.

Frequently Asked Questions

Here are some frequently asked questions about Form 1118 and the Foreign Tax Credit:

Q: What is the deadline for filing Form 1118?

A: The deadline for filing Form 1118 is the same as the deadline for filing the taxpayer's income tax return.

Q: Can I claim the Foreign Tax Credit without filing Form 1118?

A: No, Form 1118 is required to claim the Foreign Tax Credit.

Q: Can I amend my return to claim the Foreign Tax Credit?

A: Yes, you can amend your return to claim the Foreign Tax Credit, but you must file the amended return within the applicable statute of limitations.

What is the Foreign Tax Credit limitation?

+The Foreign Tax Credit limitation is the amount of foreign tax that can be claimed as a credit against U.S. tax liability.

Can I claim the Foreign Tax Credit for foreign taxes paid on investment income?

+No, the Foreign Tax Credit is generally not available for foreign taxes paid on investment income.

How do I report foreign tax credits on my tax return?

+Foreign tax credits are reported on Form 1118 and attached to the taxpayer's income tax return.

By following these steps and considering the additional requirements and considerations, you can accurately complete Form 1118 and claim the Foreign Tax Credit.